Over five million merchants and GrabKios agents are linked up with Grab’s (NASDAQ:GRAB) platform in Southeast Asia. There are big chain restaurants, like Jollibee. But most are small, single-outlet F&B businesses. They’re part of Southeast Asia’s vast, informal economy and often family-run.

To manage incoming food delivery orders, these restaurants install the Grab Merchant app. Small tweaks to this app can go a long way.

For example, Grab’s merchant services team recently updated the incoming order notification sound, making it more consistent and distinctive.

Restaurant kitchens tend to be noisy, crowded, and cluttered. Workers multitask; nobody has time to pay close attention. If an incoming order sound easily drowns out among other noises, or doesn’t play at all, it can lead to missed orders and chaos in the kitchen.

Now, the sound notification improvement was just one recent change to an app that has evolved into a versatile digital tool kit for small businesses.

Through the GrabMerchant app, micro, small, and medium enterprises (MSMEs) manage orders, but can also reach new customers, grow their business, and even take out loans.

Covid was the tipping point for many small businesses to come online, said Xin Wei Ngiam, Head of Deliveries at Grab. It was also the inflection point for Grab, when it realised it could do much more to invest in and improve the merchant experience tailored to them.

“We grew about 2.5 times in terms of the number of merchants that we signed onto our platform during that time,” said Ngiam.

Help for every step of the journey

The pandemic is now in the past, but work on the GrabMerchant app has continued to thrive.

A guiding principle, from a product perspective, is to offer digital self-help tools for every chapter of the growth of a small business once it joins the app.

For instance, Grab improved the merchant onboarding process, said Monika Maheshwari, Senior Manager of Strategy and Merchant Services at Grab.

Many of the signing up processes are fully automated, so that merchants can download the app and get started right away, without having to contact a Grab manager.

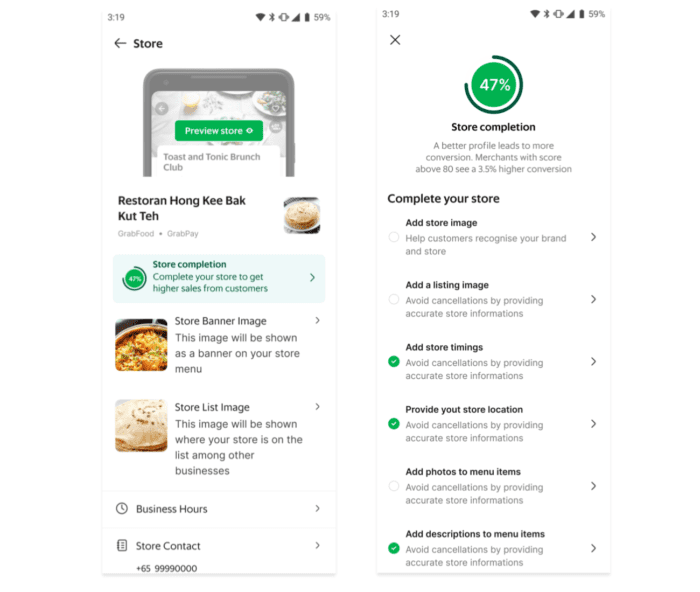

The app nudges merchants to fill out their profile by giving helpful cues, such as showing a progress bar for profile completion and the number of photos added.

“Our data tells us that adding more photos of dishes can help merchants improve their sales. For example, their average order increases up to 35 per cent when 75 per cent of the menu includes photos,” said Maheshwari. The app shares these insights with merchants as they complete their profiles, encouraging them to upload photos to make their profile more attractive to consumers.

A new layer of business insight

After starting sales through the app, merchants gain a much deeper level of insight into their business processes compared to when they were still working mostly offline.

For instance, Maheshwari explained, merchants get to see a quality score that measures how well a merchant can keep up an appropriate preparation time. Achieving consistent preparation times helps delivery-partners plan their trip, and consumers like the certainty of an accurate delivery time. With this quality score in sight, merchants can organise their workflows to hit the right time.

The GrabMerchant app will in future offer even more business insights that can help restaurant owners plan ahead.

“For example, they could see a heat map of where the most orders are coming from; and what the most commonly ordered food types are, at what time of the day,” said Ashwin Irappa, Product Head of Business Platforms, Core Transaction Platform and Grab for Business. “With the advancement of generative AI and predictive analytics, we are working on ways to predict––with high accuracy––how many orders a restaurant will get at any given time in the future. This gives restaurants a much better way to plan inventory, cashflow, and manpower accordingly.”

The predictive feature is still in beta testing, which means that Grab’s Merchant product team is testing it with a panel of merchants, who can work with and review new features before they are rolled out.

Another area where Grab’s merchant app has undergone major upgrades is the suite of tools for advertising available to merchants. They’ve become more sophisticated and merchant-friendly, so that even small, digitally less savvy businesses can make use of them.

The scale of Grab’s platform means merchants can potentially reach more than 36 million monthly transacting users (MTUs) with their ad campaigns.

(Read more: GrabAds is one of Southeast Asia’s fastest growing advertising platforms)

Growing up

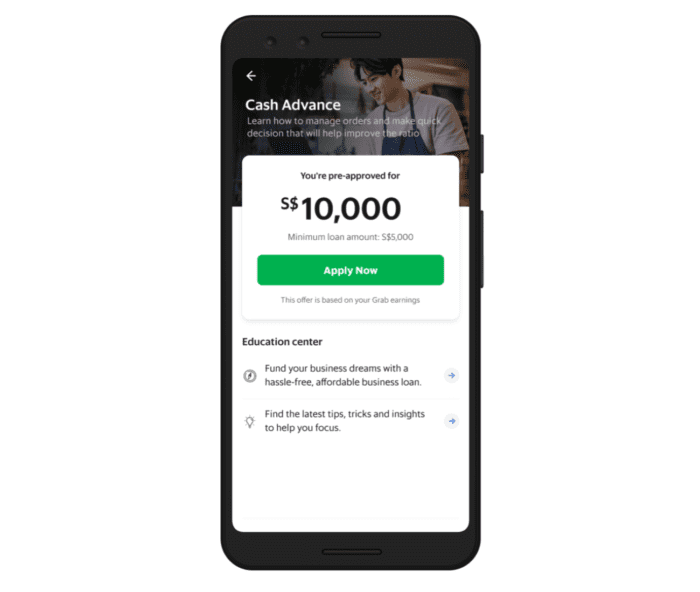

F&B merchants ready to take the next step and grow their business can now also find cash loans on the merchant app.

The unique capability Grab can offer is that it deducts loan repayments from the merchant’s Grab earnings in small increments, explained Maheshwari.

Loans typically have a six-month tenure, and reach up to “a few thousand dollars,” according to Ngiam. “Many of these merchants would not be able to walk into a bank and get a loan, because their business is too small. This can be the only access to capital for them, outside of going to loan sharks.”

“In the Philippines, we had this particular merchant, a young guy, who grew his number of outlets one by one with the help of a cash advance from Grab. At this point, they’re looking to franchise their brand out, because it became so popular,” said Maheshwari.

Grab can predict which merchants are likely to make use of and be able to repay the loan, based on previous transaction volumes and other merchant data.

Usually, the proposed loan size is based on the volume of online orders, and doesn’t take into account the size of the offline business of the particular merchant. But for merchants who want to take on a bigger loan, they can provide Grab with their bank account statements for additional data that can be fed into the model, Maheshwari explained.

Growing beyond Grab

There’s been a push in the direction to make the GrabMerchant app useful to restaurants even beyond online orders.

Already, the merchant app helps support in-store management via its Point of Sale (PoS) solution. It also lets merchants take digital payments via a QR code from customers.

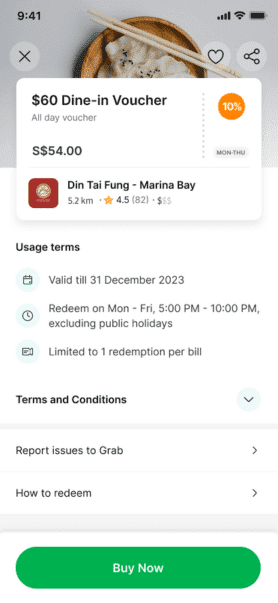

One of the newer developments is that merchants can now also use the app to drive footfall to their offline location. Especially now that the pandemic is over, they may be more interested in growing their offline presence than the number of online deliveries.

“The delivery business might only make up 10 to 20 per cent of a merchant’s business,” said Ngiam. With Grab’s new dine-in feature, restaurants can now use the Grab merchant app to issue discount vouchers to attract new customers. There’s also a loyalty stamp card feature, with which restaurants can offer returning customers perks for revisiting multiple times.

The Grab Merchant Services team’s big challenge now is to make sure the features are suited for the diverse conditions in the Southeast Asian markets, and to devise strategic rollout plans.

Building out the GrabMerchant app toolkit remains a focus for Grab as it’s a means to create value for merchants on the platform.

And that will have a flywheel effect: businesses that grow with Grab are more likely to stay loyal to the app, and invest more into the platform. Lastly, thriving merchants who up their game with new products and offers are attractive to consumers who’ll return to the app to make purchases, which in turn creates more jobs for Grab’s driver-partners.

3 Media Close,

Singapore 138498

Komsan Chiyadis

GrabFood delivery-partner, Thailand

COVID-19 has dealt an unprecedented blow to the tourism industry, affecting the livelihoods of millions of workers. One of them was Komsan, an assistant chef in a luxury hotel based in the Srinakarin area.

As the number of tourists at the hotel plunged, he decided to sign up as a GrabFood delivery-partner to earn an alternative income. Soon after, the hotel ceased operations.

Komsan has viewed this change through an optimistic lens, calling it the perfect opportunity for him to embark on a fresh journey after his previous job. Aside from GrabFood deliveries, he now also picks up GrabExpress jobs. It can get tiring, having to shuttle between different locations, but Komsan finds it exciting. And mostly, he’s glad to get his income back on track.