In the food delivery business, order density (the more orders there are within a window of time, in the same area) is an important factor in allowing platforms like Grab’s (NASDAQ:GRAB) to offer the services at lower cost, and still make a profit.

That’s why population density is key. That raises the potential for order density to go up, giving delivery platforms a better chance to benefit from the economies of scale—and flourish.

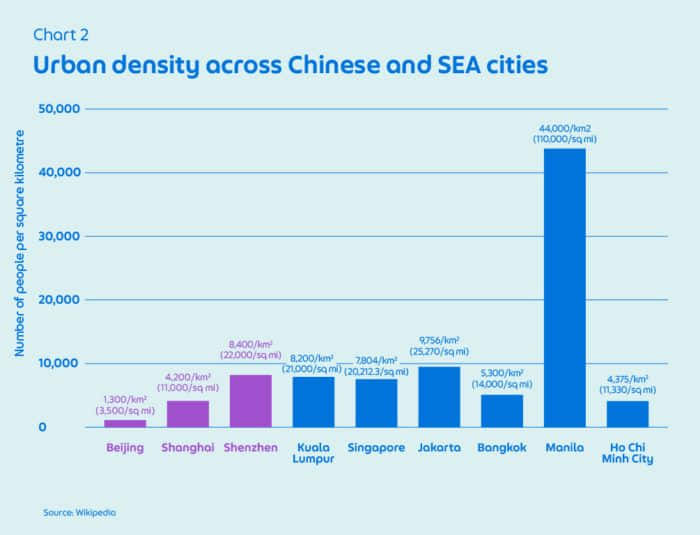

Take for example a city like Jakarta, where more than 16,000 people live per square kilometre. Lots of people living close to each other and ordering food delivery means that with smart allocation systems, riders don’t have to travel very far to either a merchant or customer to make a delivery. Even better, the system has a chance to combine multiple orders within a trip, saving the rider time per order.

This increases utilisation of the overall fleet, lowering the average cost per delivery. It’s good for the delivery platform, but also good for the riders because they can earn more by completing more jobs in a day.

Meituan’s success in China

Meituan is a good case study of this. The company achieved operating profitability in 2019 by harnessing China’s urban population density, their leading market share and a focus on squeezing efficiency out of operations.

Their 2019 annual report cited an improvement in unit economics for their food delivery business due to “increasing economies of scale”. Their report the previous year included the following excerpt:

“Our delivery rider cost per order further declined attributable to the continuous expansion of our delivery network, improvement of order density and enhancement of our AI-powered intelligent dispatch system.”

In other words, order density and an allocation system that tapped the benefits of the urban population.

Southeast Asia’s under-penetration and potential

Southeast Asia has the groundwork set for similar success.

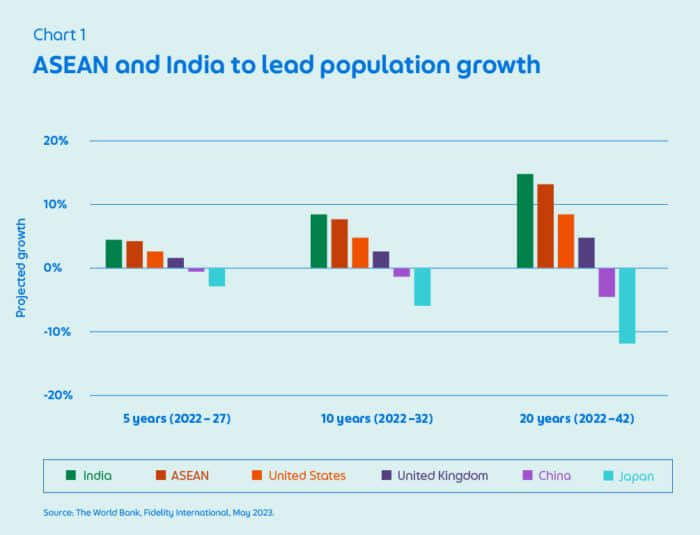

According to Euromonitor, online food delivery penetration in Southeast Asia stands at 17 per cent, trailing behind China’s 28 per cent penetration rate. For Grab, this signals potential for growth. Southeast Asia’s development tends to be a few semesters behind China, but it will catch up. The International Monetary Authority forecasts ASEAN’s growth in 2024 and 2025 to be ahead of China’s.

Importantly, Southeast Asia has in place all the ingredients for increasing adoption of digital services. The population here is young and smartphone penetration is high. The region has a growing middle class, and internet accessibility and speeds have been improving significantly.

Its cities also have the density needed for growth to translate into profit.

Drawing parallels with China:

- Urban population: There are 10 cities in Southeast Asia with an urban population of more than 5 million, amongst which four have more than 10 million inhabitants. The combined population of these 10 cities reach 137 million, or six times that of Beijing. In addition, while China’s population has tipped into a decline, Southeast Asia is young and growing with a median age of 30 compared with China’s 39.

Density: Are these cities dense enough for food delivery to operate effectively? Shanghai has an urban population density of about 4,000 inhabitants per square kilometer; in Southeast Asia’s key economic hubs, the number varies between 5,300 (in Bangkok) and over 8,000 (in Jakarta, Kuala Lumpur, and Manila). Southeast Asia’s famous street food culture also means that in many neighbourhoods, there is a high concentration of food stalls or hawkers to serve the communities that live there, fuelling activity and variety on the platform.

- Average disposable income: A rise in spending power helped propel the growth of services like food delivery in China. Today, China has a higher gross domestic product (GDP) per capita than most Southeast Asian countries, with the exception of Singapore and Malaysia. However, Southeast Asia is forecast to grow by 3 to 4 per cent annually through 2030. That, together with a fast growing middle class, is set to boost consumption and spending power.

- Infrastructure: China made investments into payments, roads, electric bikes and others that helped accelerate the deliveries industry. In Southeast Asia, many of these investments are still nascent, and the region will need to catch up. But efforts are already underway, with investments into road-building, internet connectivity, digital payments, and electric two-wheelers to provide greener and more efficient urban transportation. Grab has also made investments into building our own map tech, built with details for Southeast Asia to fill in the gaps that third-party maps miss.

In a nutshell, Southeast Asia has the economic fundamentals, geographic density, and improving infrastructure to support further growth in food delivery.

Harnessing a city’s order density for an efficient delivery network

At Grab, we’re thinking up new ideas to tap into each city’s density, leaning into tech efficiencies to unlock growth in a sustainable way.

One benefit we have over other platforms is our shared fleet. Since our driver-partners can cross between our services, they have both ride-hailing and delivery bookings in front of them. This means that across both peak and non-peak times, our drivers stay busy and their utilisation is higher. This lowers our cost to serve. Our category leadership in our markets gives us an added scale advantage.

We’ve invested in making our own maps and location-based technology, to batch more effectively, navigate our drivers more efficiently and reduce idle time. In Q3 2023, batched orders—which now account for over a third of deliveries orders—provided average delivery fees for users that were 8 per cent lower than unbatched orders and resulted in 5 per cent higher driver earnings per transit hour compared to unbatched orders. Wait time for drivers also reduced by 72 per cent.

We’re convinced that Southeast Asia has a long runway for growth ahead. By building the right technology for the region and leveraging our deep understanding of local dynamics, we look forward to being a part of shaping Southeast Asia’s digital future.

3 Media Close,

Singapore 138498

Komsan Chiyadis

GrabFood delivery-partner, Thailand

COVID-19 has dealt an unprecedented blow to the tourism industry, affecting the livelihoods of millions of workers. One of them was Komsan, an assistant chef in a luxury hotel based in the Srinakarin area.

As the number of tourists at the hotel plunged, he decided to sign up as a GrabFood delivery-partner to earn an alternative income. Soon after, the hotel ceased operations.

Komsan has viewed this change through an optimistic lens, calling it the perfect opportunity for him to embark on a fresh journey after his previous job. Aside from GrabFood deliveries, he now also picks up GrabExpress jobs. It can get tiring, having to shuttle between different locations, but Komsan finds it exciting. And mostly, he’s glad to get his income back on track.