Grab Accelerates Financial Services Roadmap with Acquisition of Digital Investing Platform, Stash Financial, Inc.

Singapore and New York City, February 12, 2026 – Grab Holdings Limited (“Grab”) announced that it had signed definitive agreements to acquire 100% of the equity interest in Stash Financial, Inc., (“Stash”), a U.S. digital financial services company, with the payment for 50.1% equity interest to be made at Closing at an enterprise value of US$425 million and payments for the remaining interest to be made at the fair market value over three years post-Closing. The transaction is subject to regulatory approvals and other customary closing conditions and is expected to close in the third quarter of 2026 (“Closing”). The payment at Closing will be made in a combination of cash and stock, and subsequent payments will be made in cash and/or stock at Grab’s discretion.

Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab, said: “This is a milestone in Grab’s evolution as a trusted international provider of financial services. This acquisition brings more than just recurring, high-margin subscription revenue; we will strengthen Grab’s fintech knowhow with Stash’s AI-powered investing app, designed with existing U.S. regulatory requirements at its core. While we remain operationally focused on Southeast Asia and scaling our regional loanbook, this move reinforces our mission of democratizing financial services for everyone.”

Brandon Krieg, Co-Founder and Co-CEO of Stash, said: “Ed and I founded Stash because we believe the tools and advice to build long-term wealth should be accessible to everyone, not just the top 1%. Joining the Grab ecosystem is a validation of that mission. Grab has a track record of ecosystem-building through harnessing user data and a culture of entrepreneurship that will serve our growth ambitions. This acquisition gives us the best of both worlds: the capabilities to double down on growth in the U.S., and the resources of a technology powerhouse to accelerate our vision of personalized, AI-driven financial guidance for millions of people across all parts of their financial lives.”

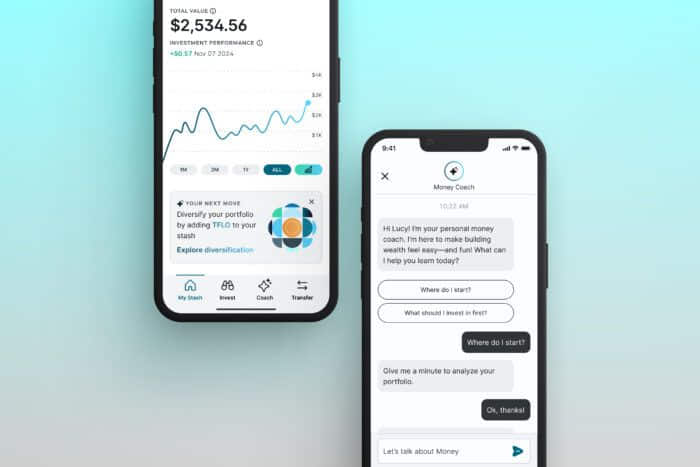

Left: Stash app home screen. Right: AI Money Coach, the Stash app’s integrated AI-driven financial companion.

Regulated by the SEC, Stash is a U.S. registered investment advisor with more than $5 billion in assets under management. Through its subscription-based app, Stash serves over one million consumers with accessible investing, banking, and financial education tools designed to support long-term financial decision-making. Stash also offers StashWorks, a financial wellness solution for U.S. employers that helps employees build healthier financial habits through education and guided tools.

A core part of Stash’s platform is its use of technology to deliver personalized financial guidance at scale. This includes AI Money Coach, which serves as a financial companion offering guidance and execution tailored and adaptable to users’ life goals and financial circumstances. It is built for regulated financial services and combines expert knowledge, deep financial integrations, compliance-by-design, and direct actionability across Stash’s investing, banking, and saving products. Interactions with AI Money Coach are auditable and configurable through defined policies and controls. This enables Stash to deploy AI responsibly at scale while maintaining high standards of consumer protection and regulatory integrity. AI Money Coach has driven strong engagement since its launch in late 2024, with approximately one in two users taking a positive financial action on the same day, up nearly 40% in 2025. Following the acquisition, Grab plans to support Stash’s continued growth in the U.S. consumer market, while exploring opportunities to introduce Stash’s investing solutions, including AI Money Coach, in Southeast Asia longer-term. Based on current business momentum and the execution of the company’s strategic plan, Stash is expected to generate more than $60 million in Adjusted EBITDA in the 2028 calendar year.

Post-Closing, Stash will remain a standalone entity as part of Grab’s business, retaining its current recurring revenue model, services, and brand. Stash will continue being led by a highly experienced team committed to the mission of democratizing financial services, including Co-Founders and Co-CEOs Brandon Krieg and Ed Robinson, who have steered the company towards profitable growth on an Adjusted EBITDA basis since its latest Series H fundraising round in 2025.

Grab offers Mobility, Delivery, and Financial Services to over 50 million monthly transacting users across eight Southeast Asian countries, where many individuals participate in the informal economy and are not served by traditional financial institutions. The company has a track record of serving those who lack access to banking and personal finance products by harnessing ecosystem data to offer lending, insurance, and payment solutions suited for millions of otherwise underserved consumers and small businesses. Grab also operates digital banking services in Singapore, Malaysia, and through an associate in Indonesia.