Free Your Money

Transfer funds easily and instantly with GrabPay.

Transfer money in & out of your GrabPay Wallet more easily.

Starting 8 Feb 2021, we’re launching GrabPay Wallet transfers and PayNow VPA top ups – new features that will make transfers in and out of your GrabPay Wallet more seamless and convenient.

These features will be rolled out progressively to GrabPay users. For more information on top-ups via PayNow, please visit our PayNow page.

You can transfer funds to the following destinations

No minimum transfer amounts. No transaction fees.

You’ll be able to make up to 2 transfers a day from your Transferable balance (does not include top ups made via credit cards or foreign debit cards.)

Before you can transfer your funds...

You’ll need to:![]() i) fully verify your identity^ to upgrade to a Premium GrabPay Wallet.

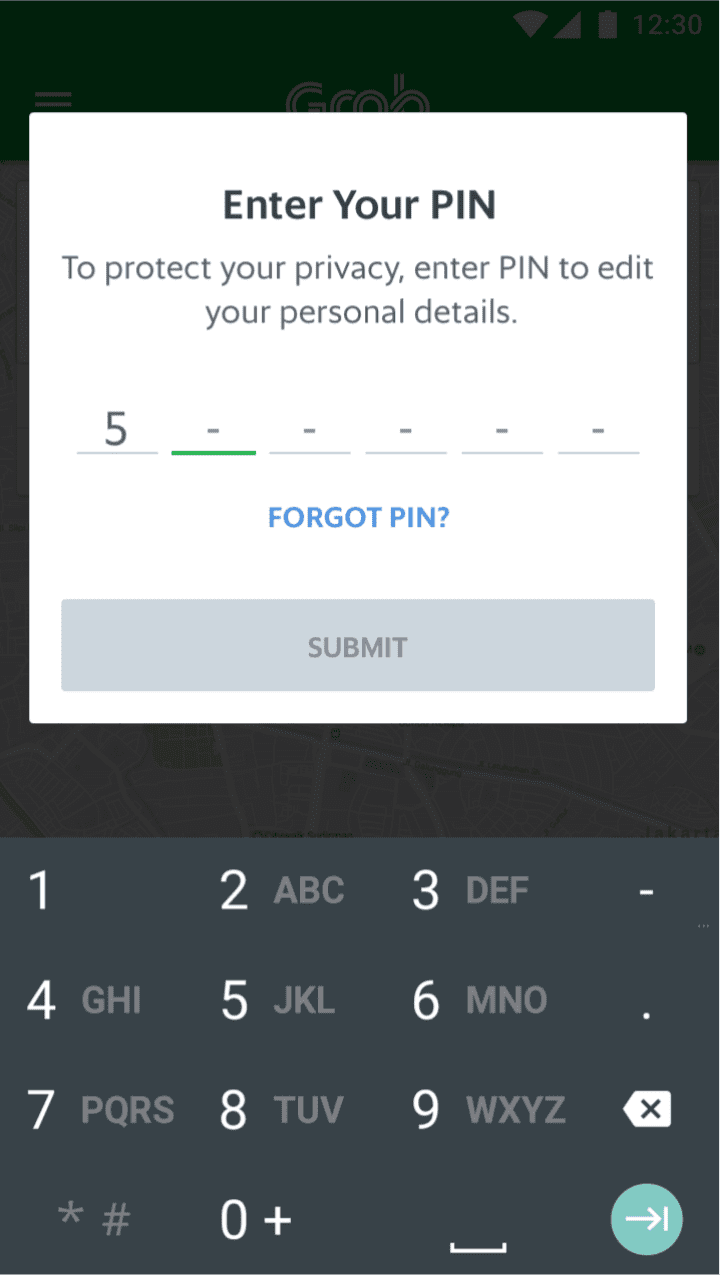

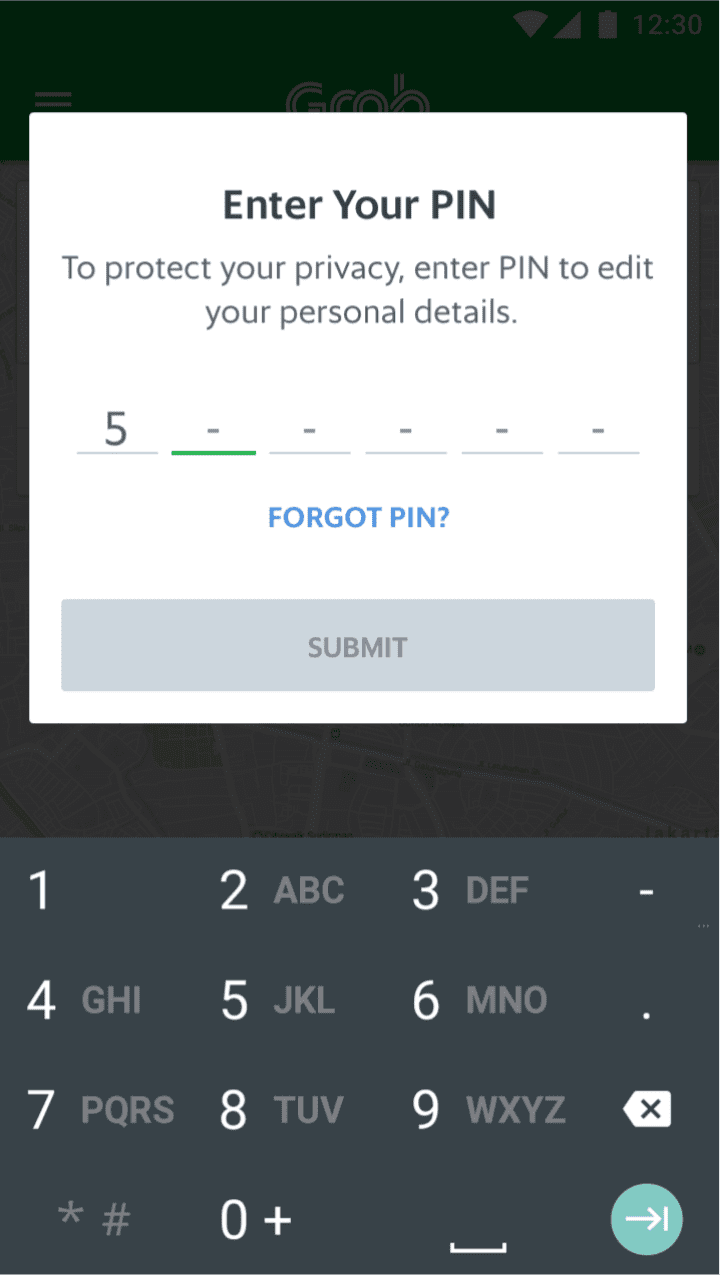

i) fully verify your identity^ to upgrade to a Premium GrabPay Wallet.![]() ii) AND set up your GrabPIN before you can transfer funds from your GrabPay Wallet.

ii) AND set up your GrabPIN before you can transfer funds from your GrabPay Wallet.

It’s simple and easy, we’ll guide you step-by-step in the Grab app!

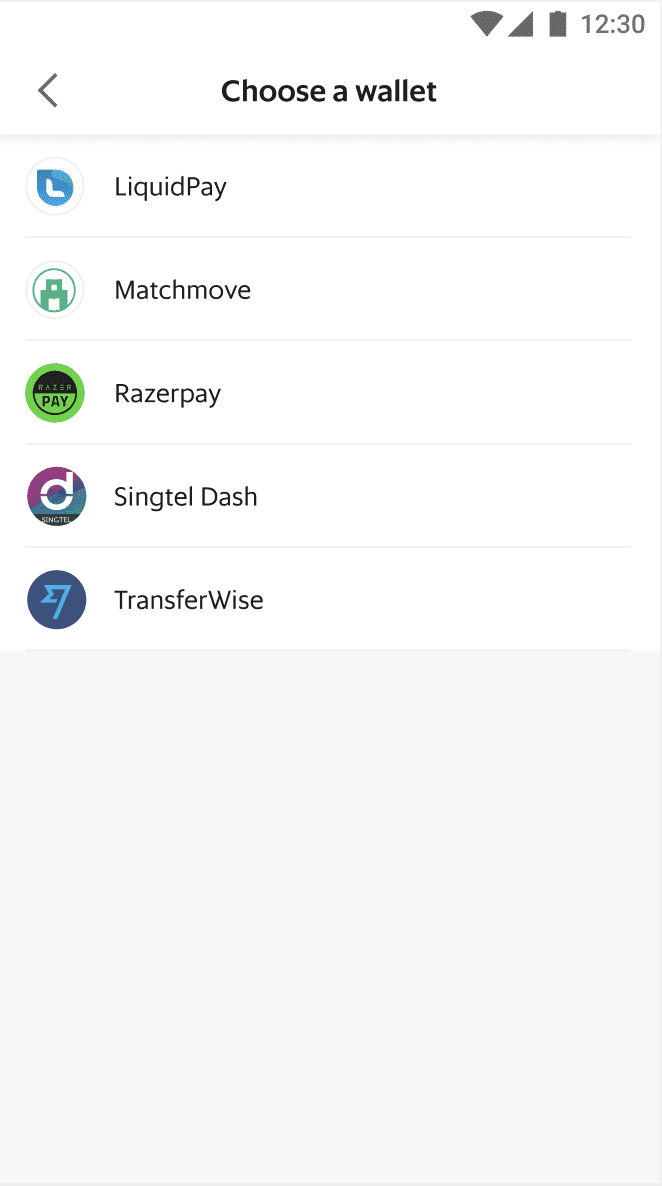

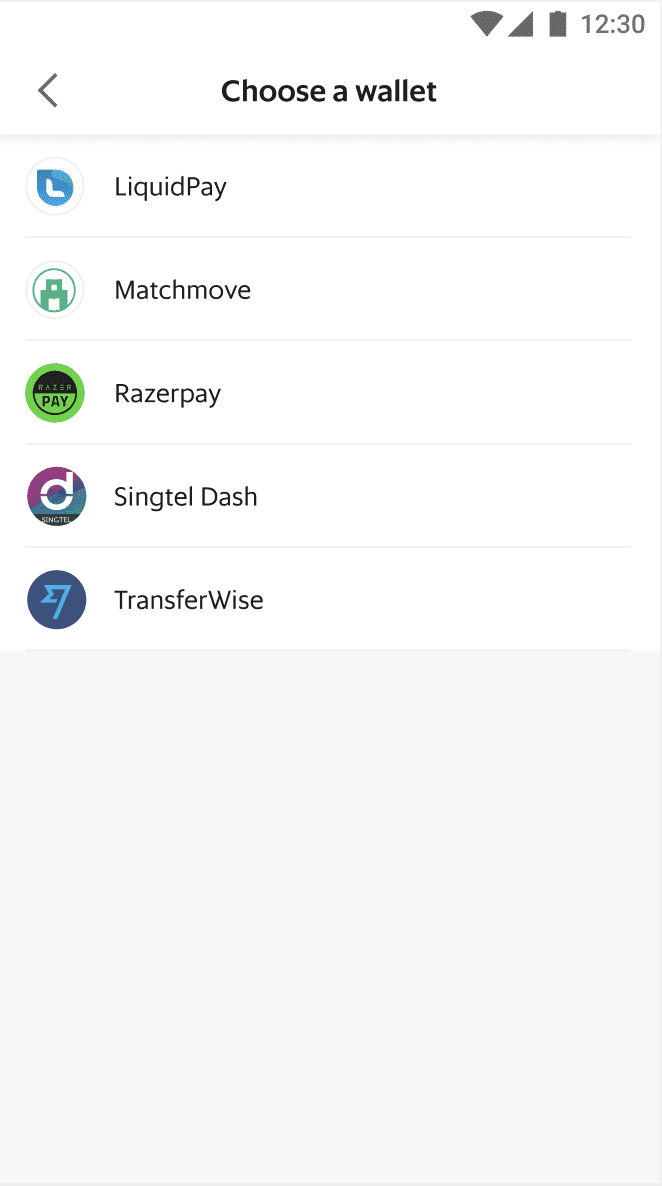

*Supported e-wallets: Singtel Dash, TransferWise, LiquidPay, MatchMove.

^If you have never verified your identity on the Grab app before, you’re holding a basic GrabPay Wallet.

How do I transfer funds from my GrabPay Wallet?

Please note: You can make up to 2 transfers per day, maximum transfer amount is $5,000, and ONLY transfers to your own account do not count to your annual spending limit.

- View transferable and non-transferable balances

- Transfer to your own PayNow account

- Transfer to another bank account via PayNow

- Transfer to another account via bank account details

- Transfer to another e-wallet (for Singtel Dash and Liquid Pay)

- Transfer to another e-wallet (for TransferWise and MatchMove)

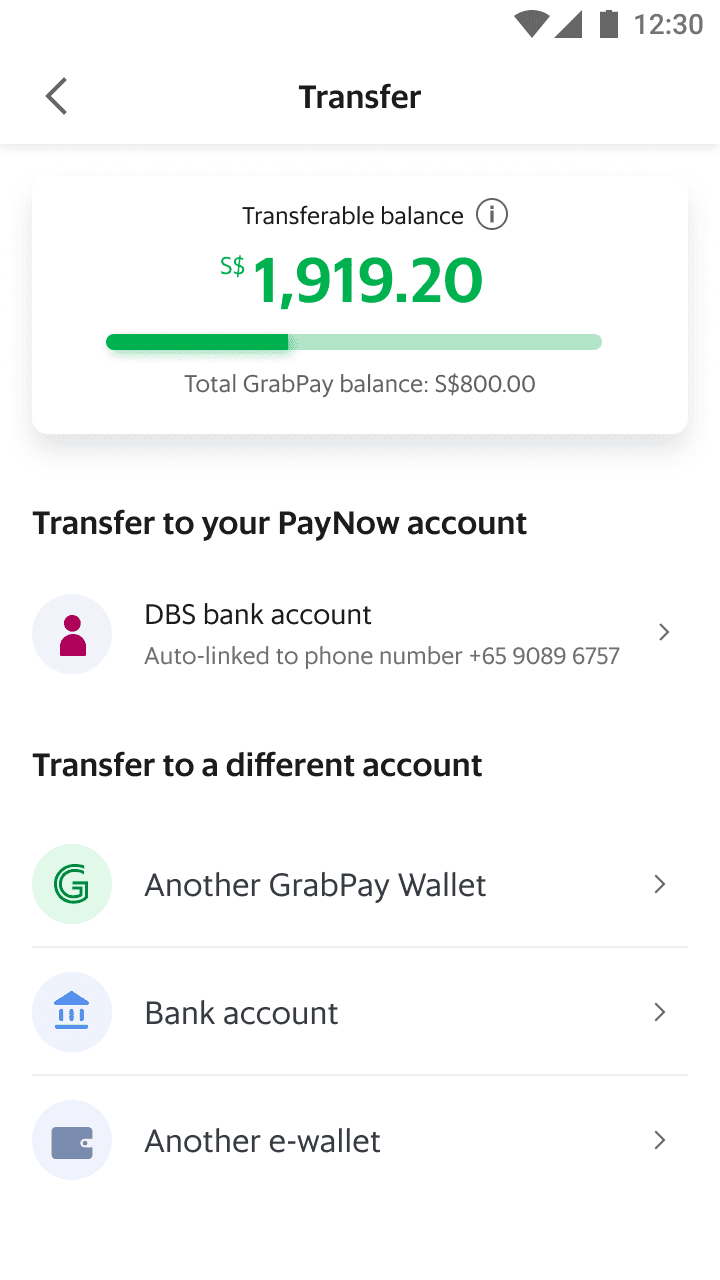

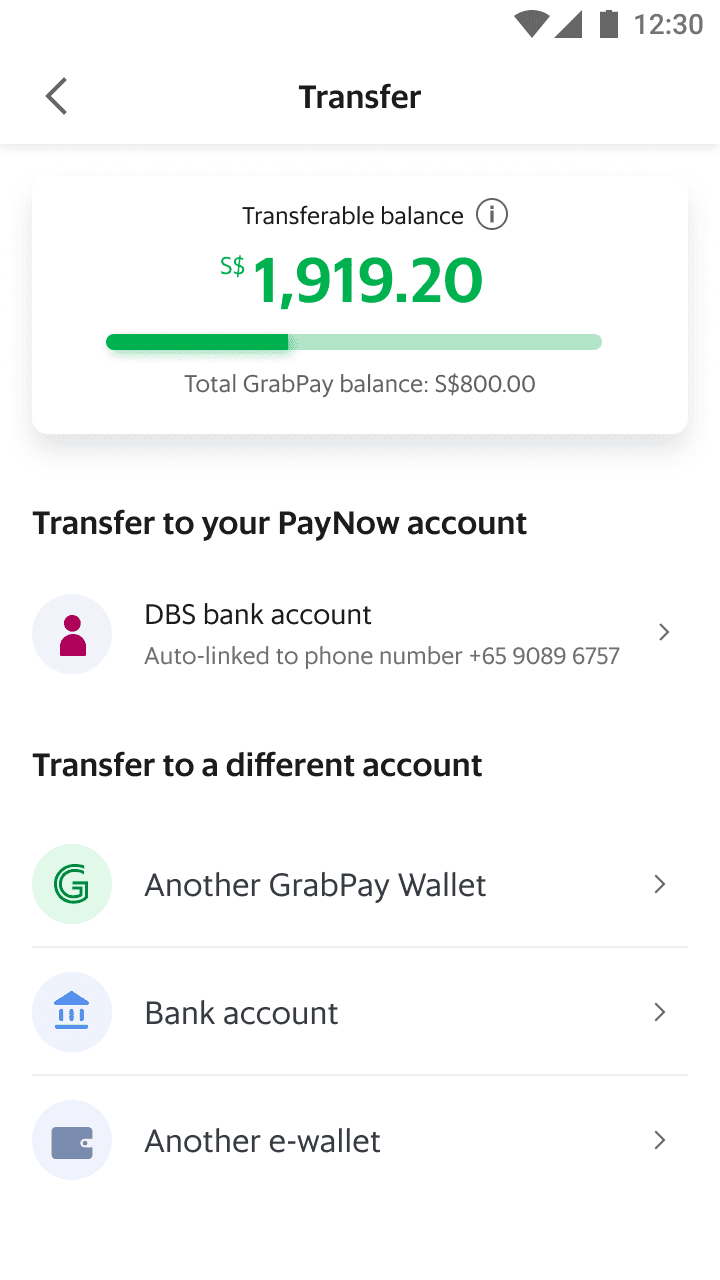

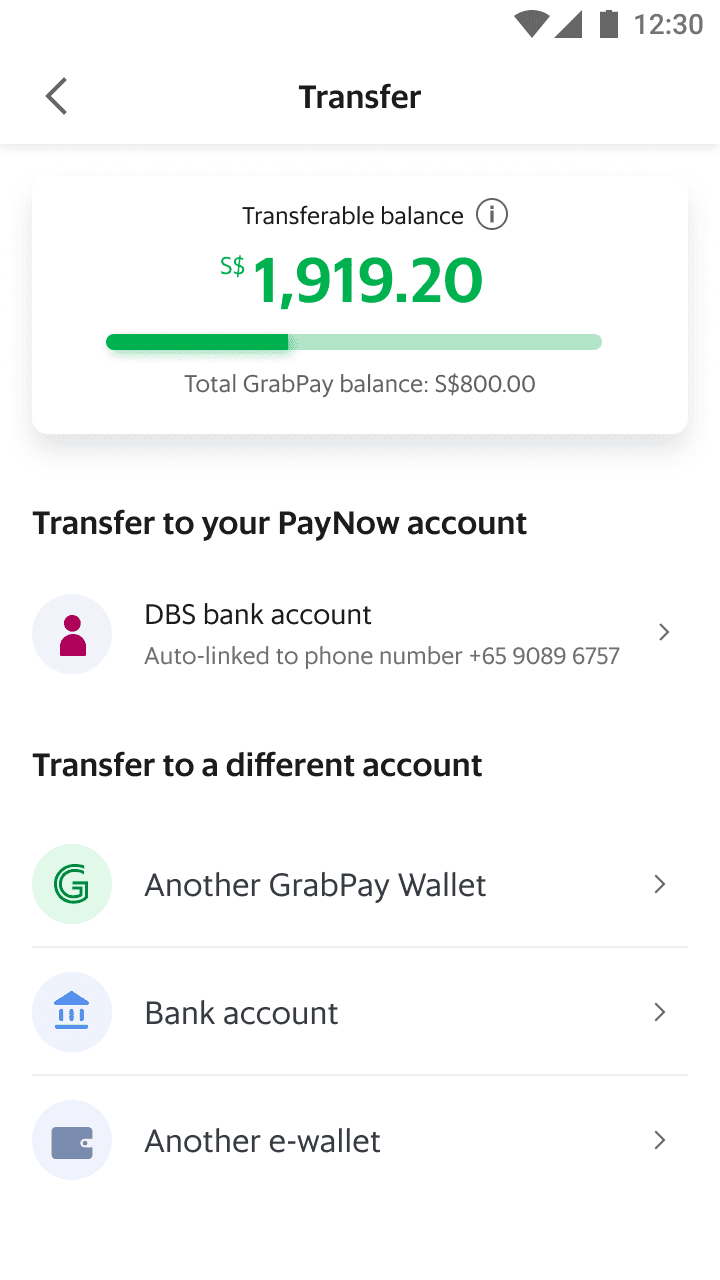

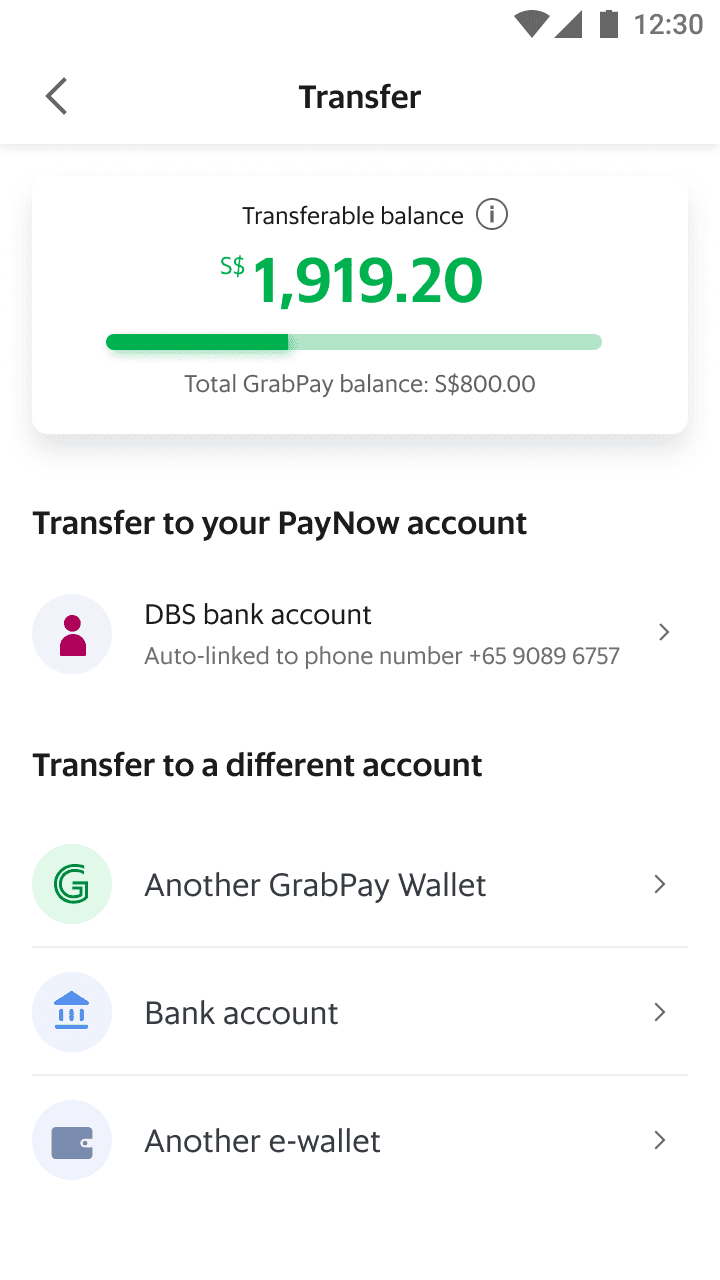

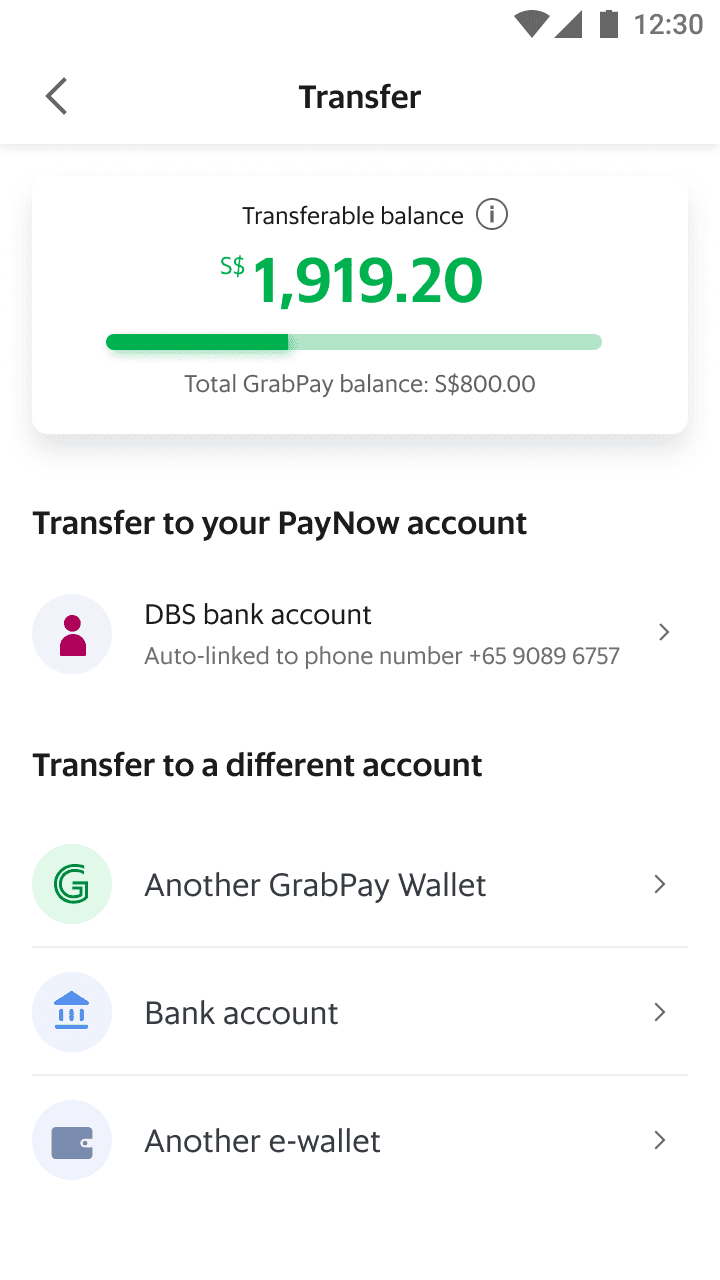

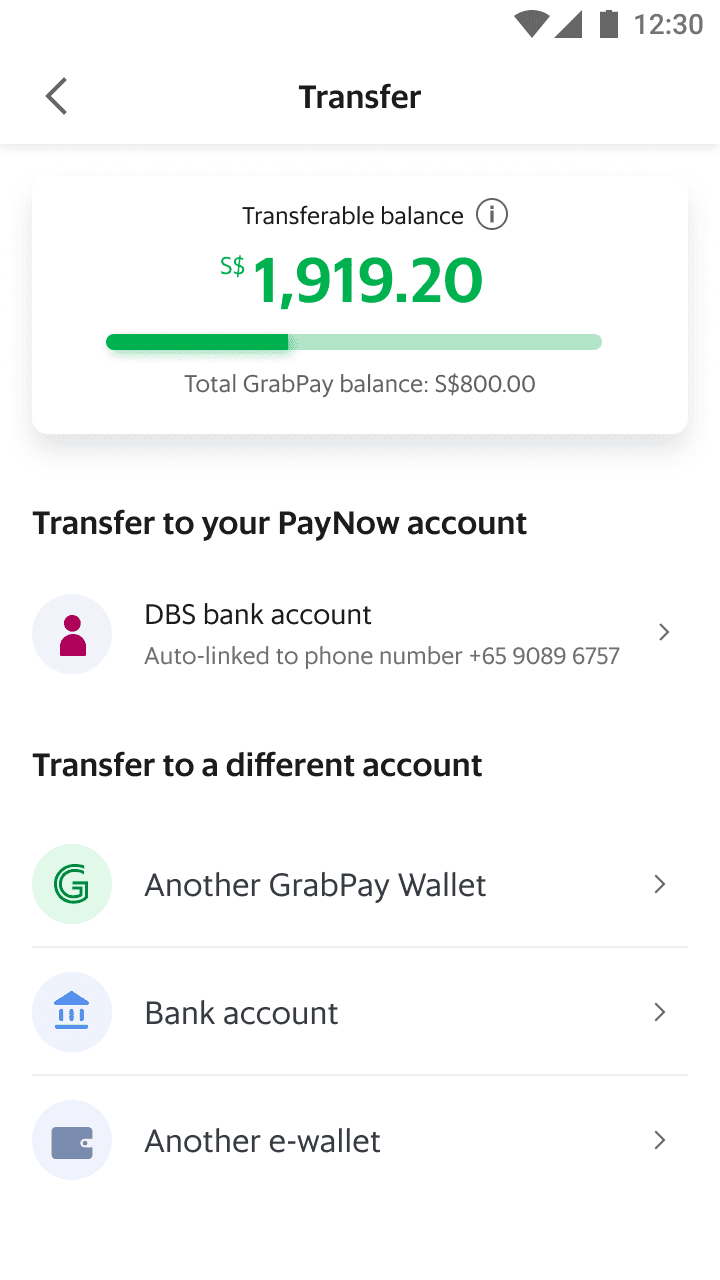

View transferable and non-transferable balances

-

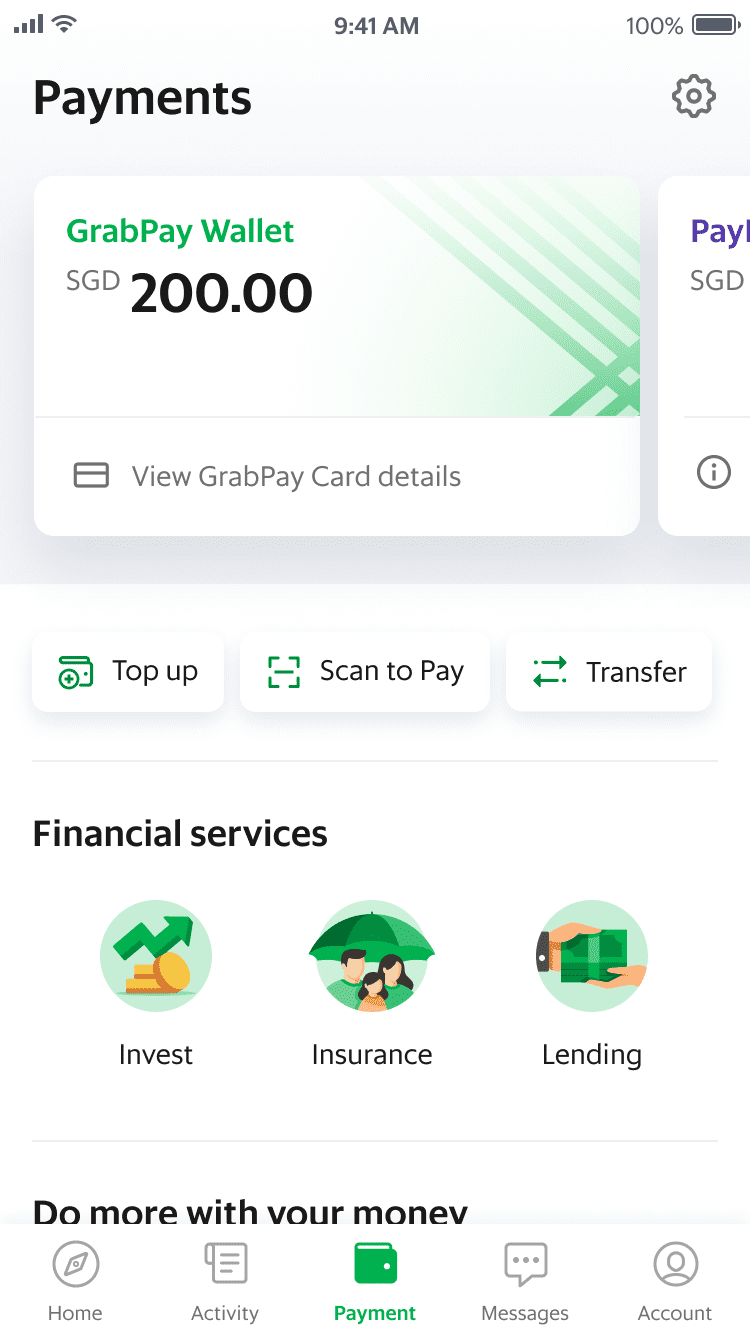

When you've verified your identity and set up your GrabPIN, you'll be able to access the 'Transfer' feature.

-

Tap on 'Transfer' and you'll see the transferable and non-transferable balance, and the different options to transfer to.

-

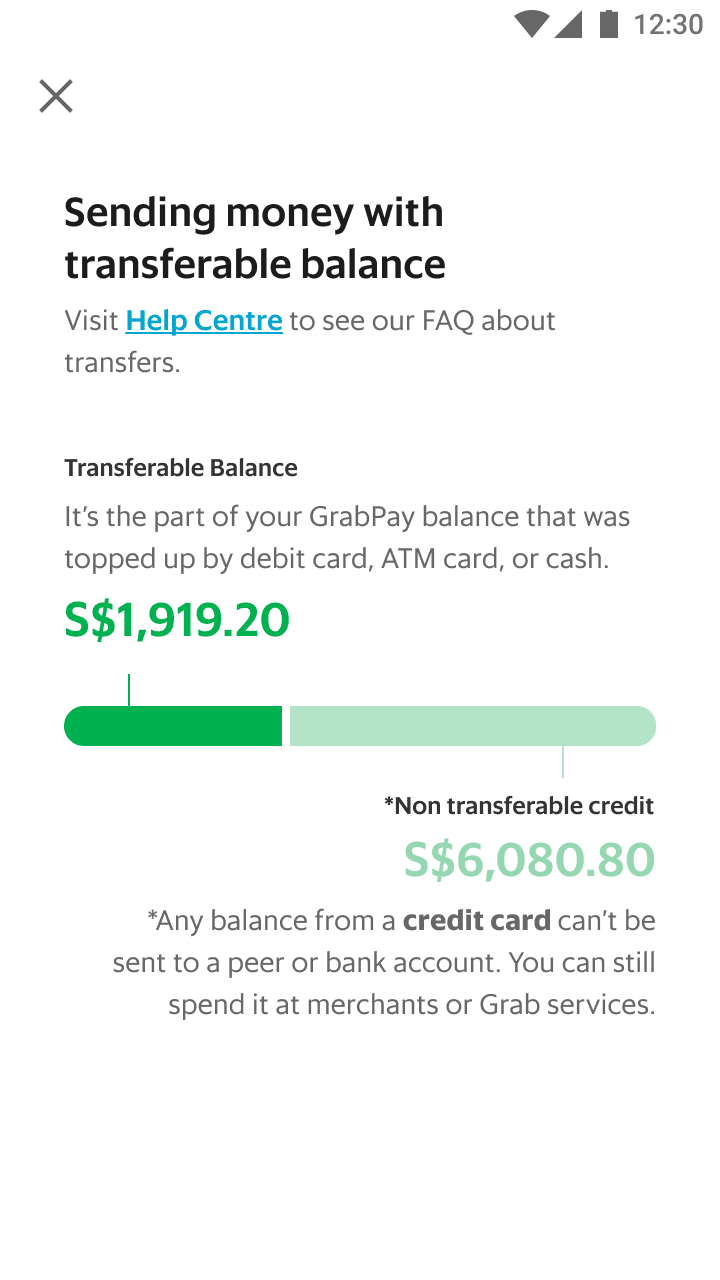

Tap on (i), to access definitions of each balance.

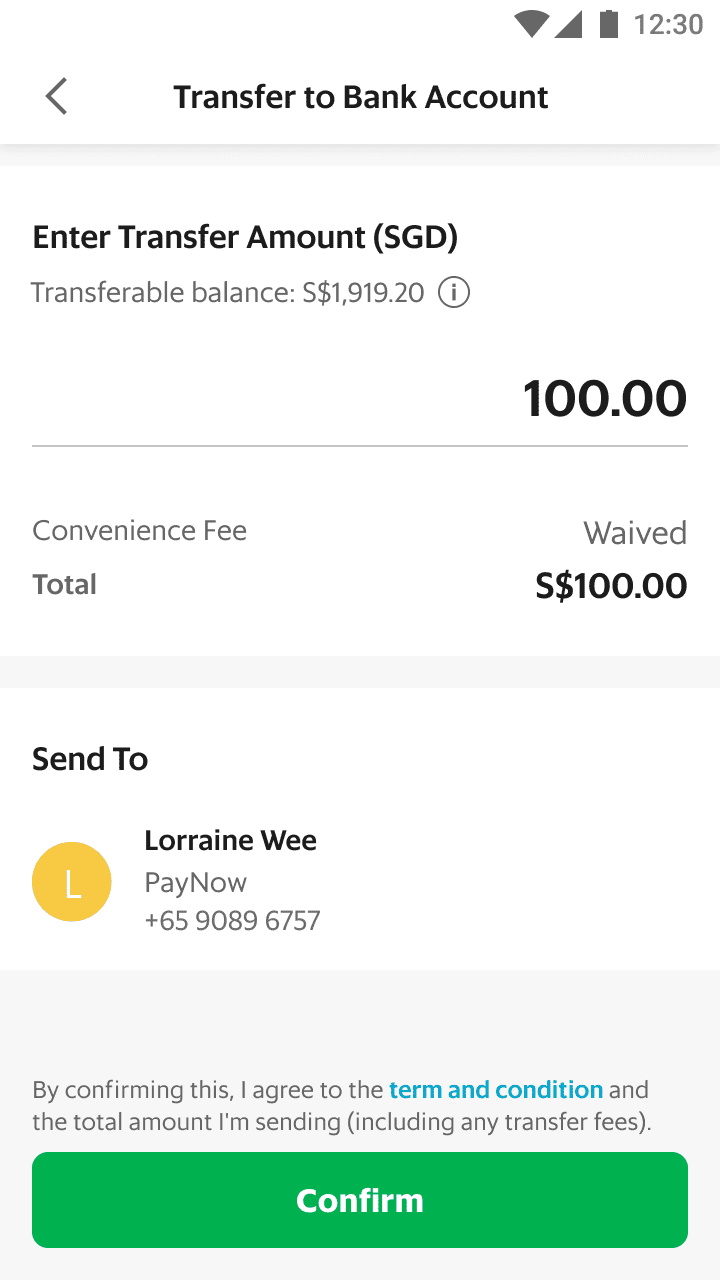

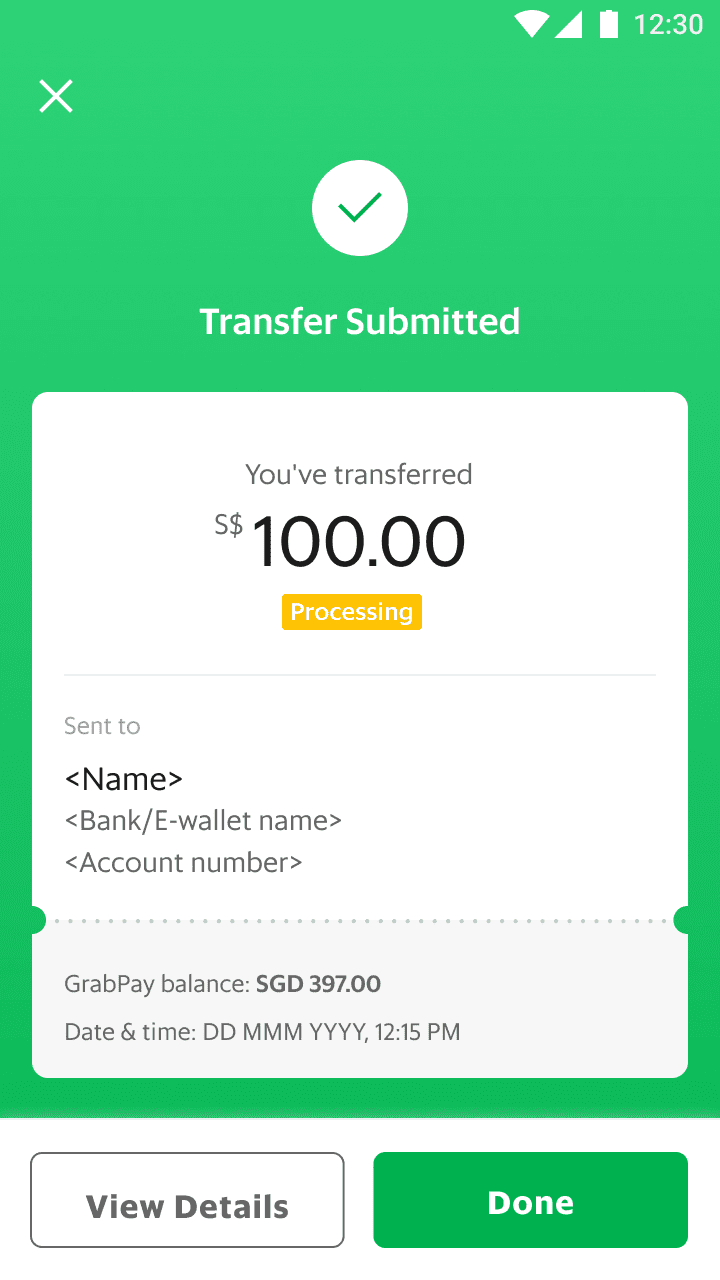

Transfer to your own PayNow account

-

Access the 'Transfer' feature, and you'll see your PayNow linked account.

-

Enter and confirm the amount to transfer. Minimum top-up amount is S$10.

-

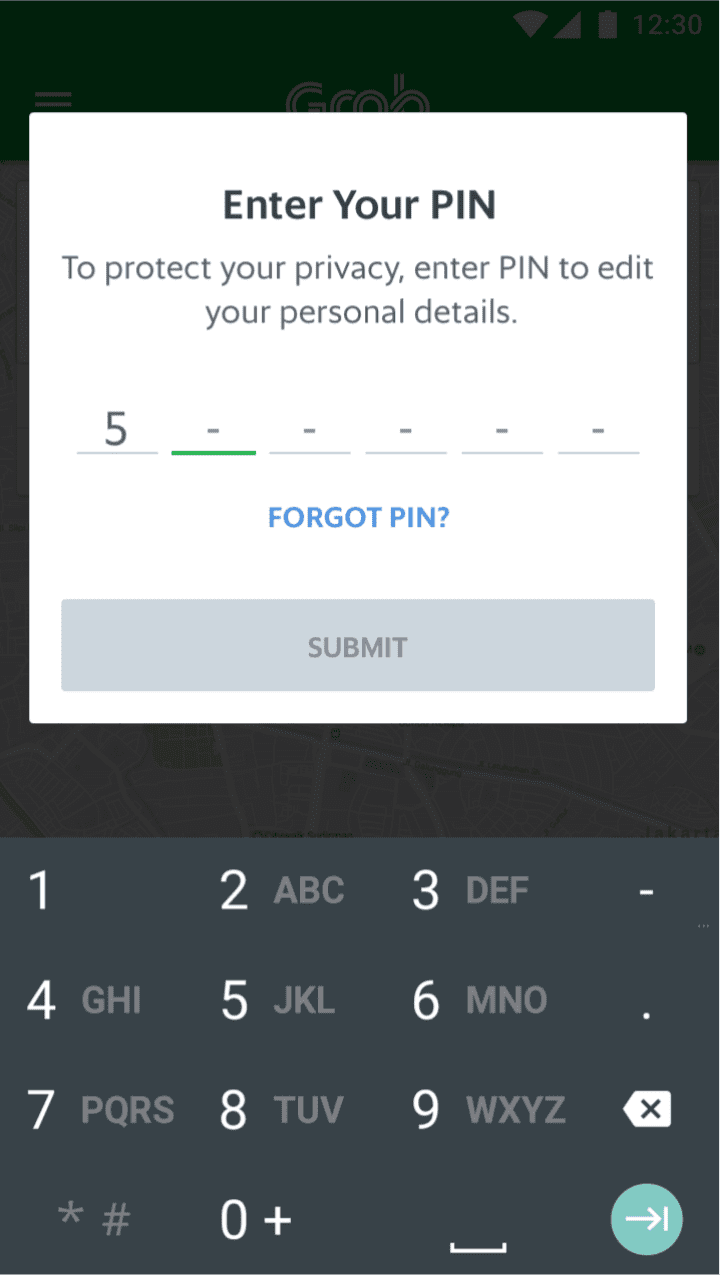

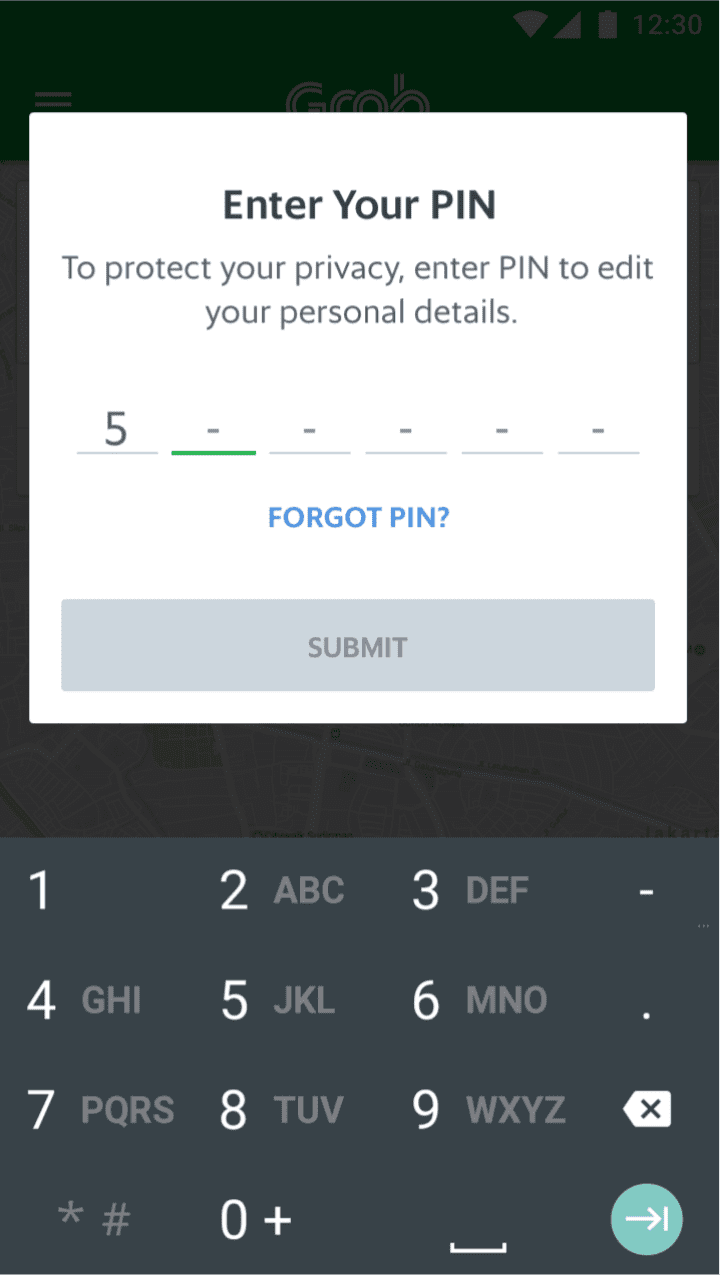

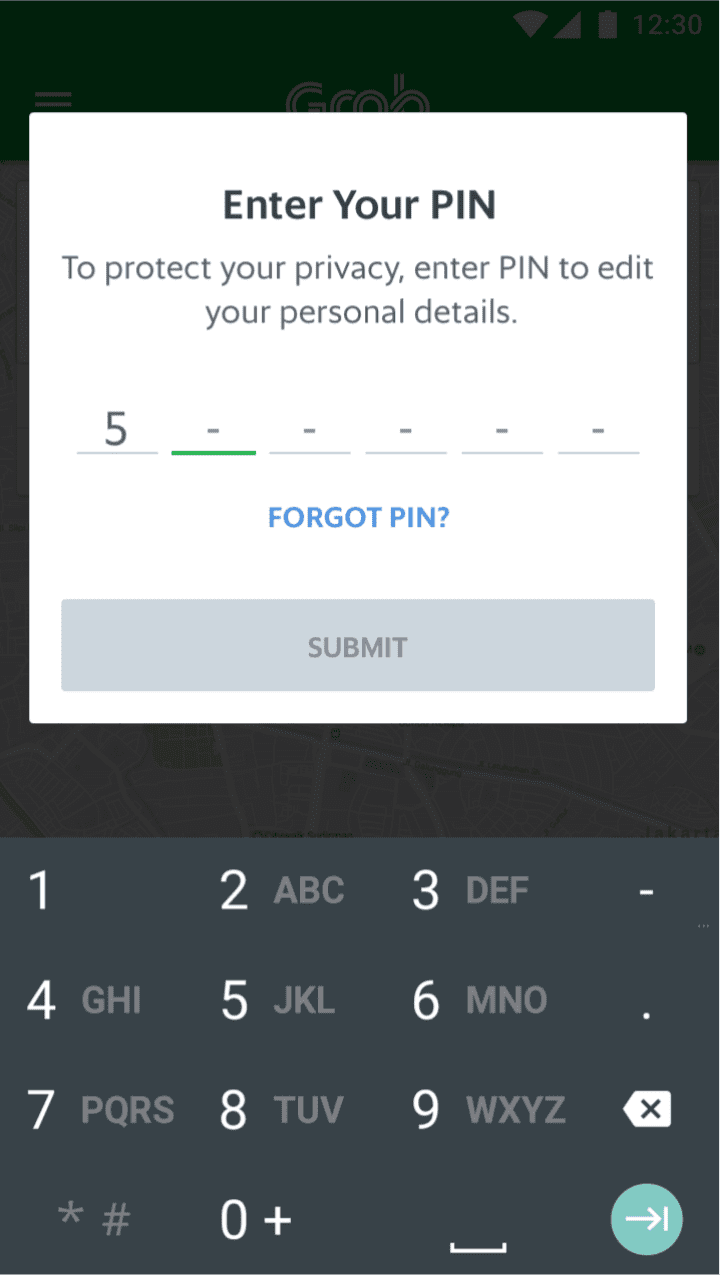

Enter your GrabPIN to confirm the transfer.

-

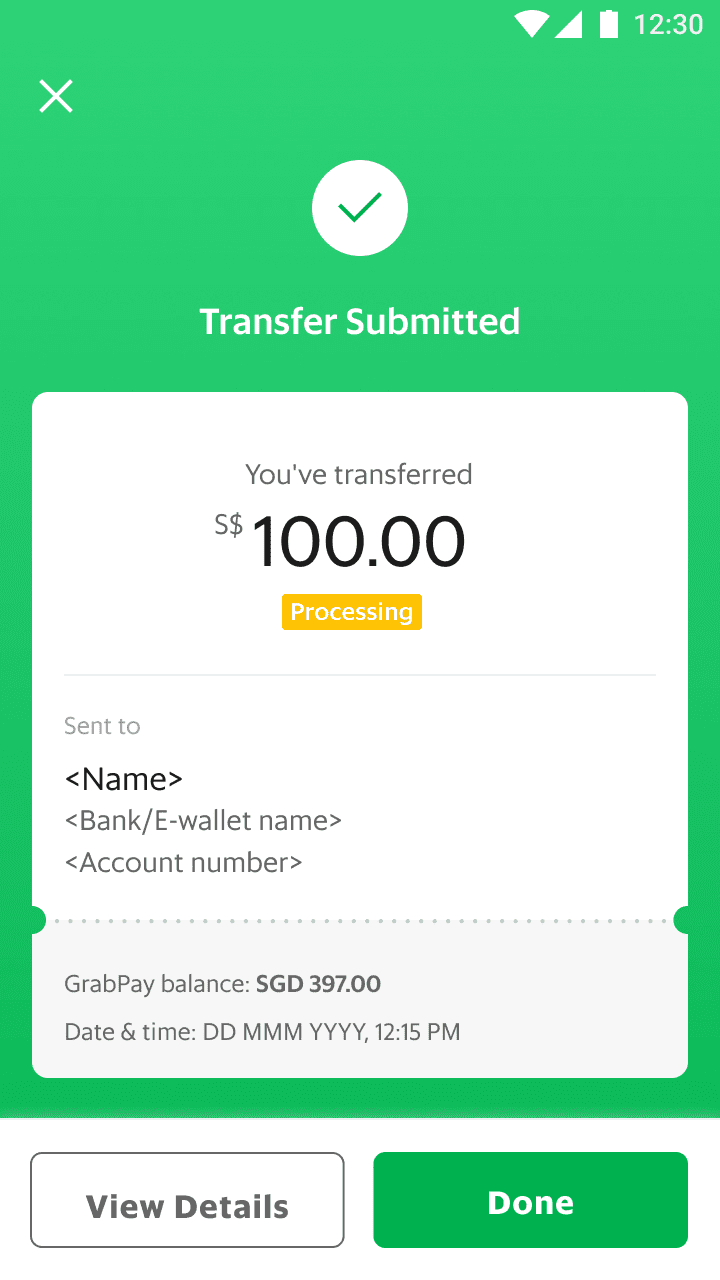

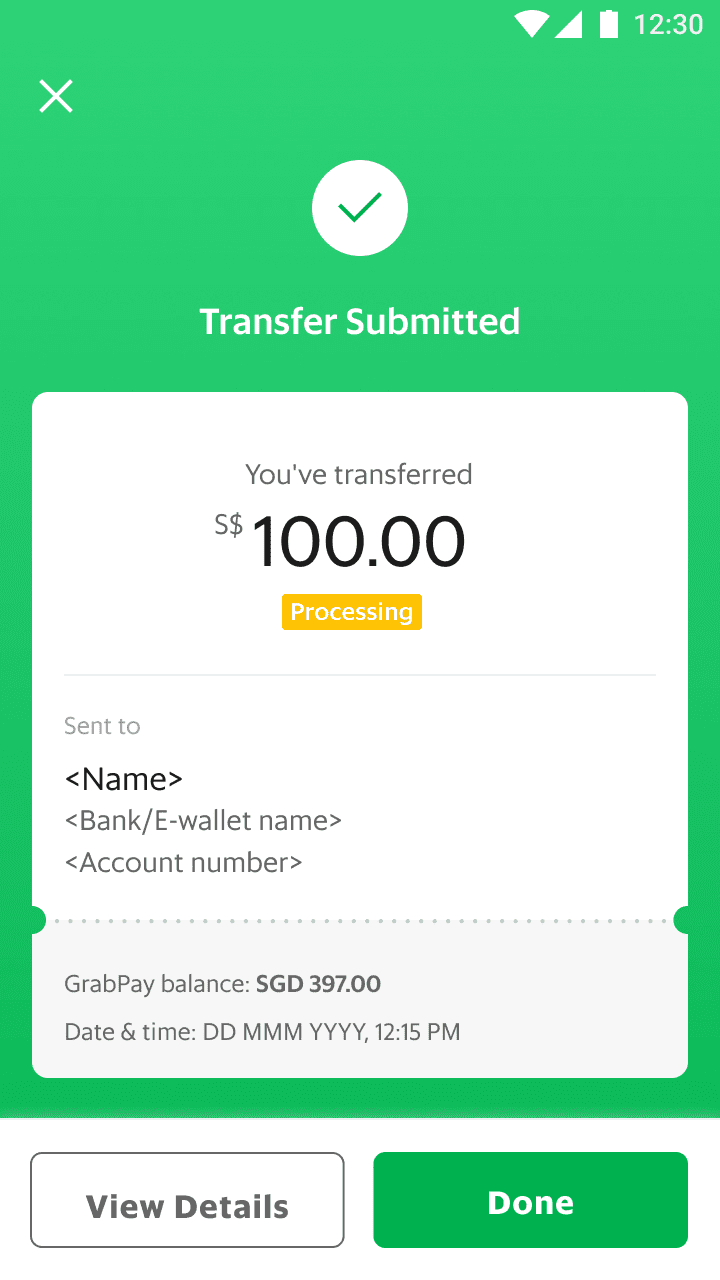

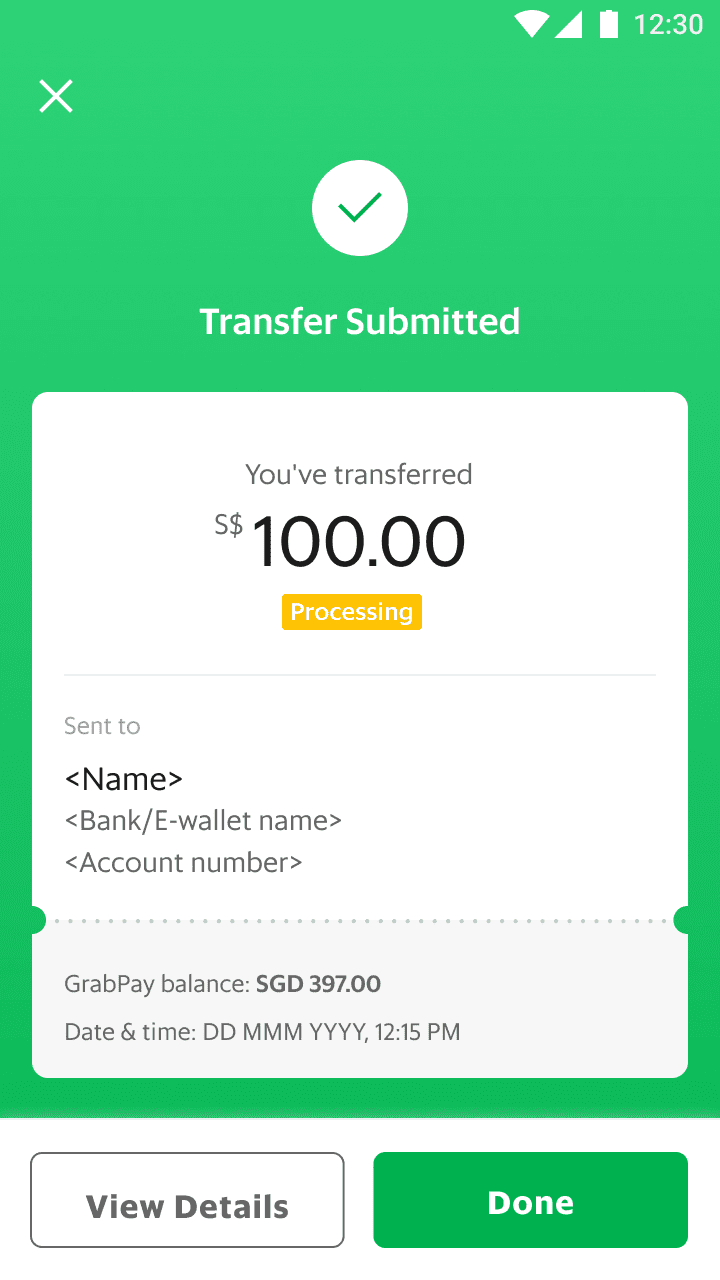

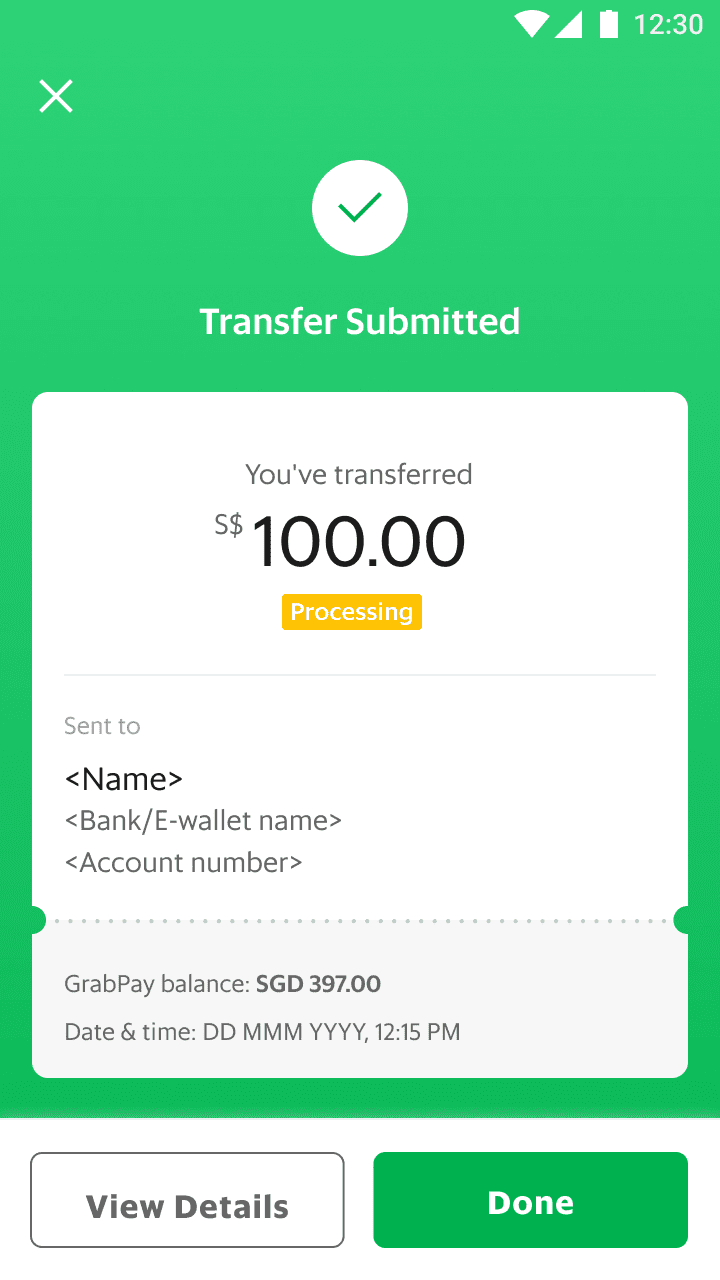

All done! Your funds have been transferred from your GrabPay Wallet to your PayNow account instantly.

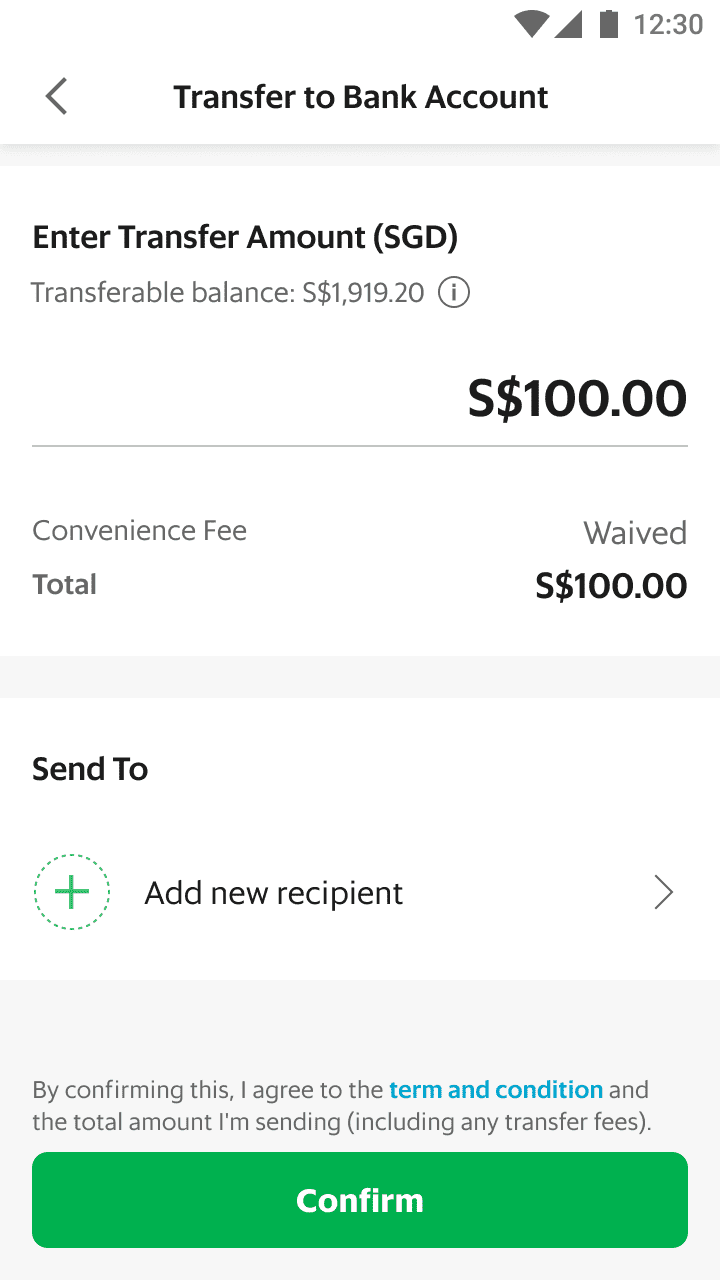

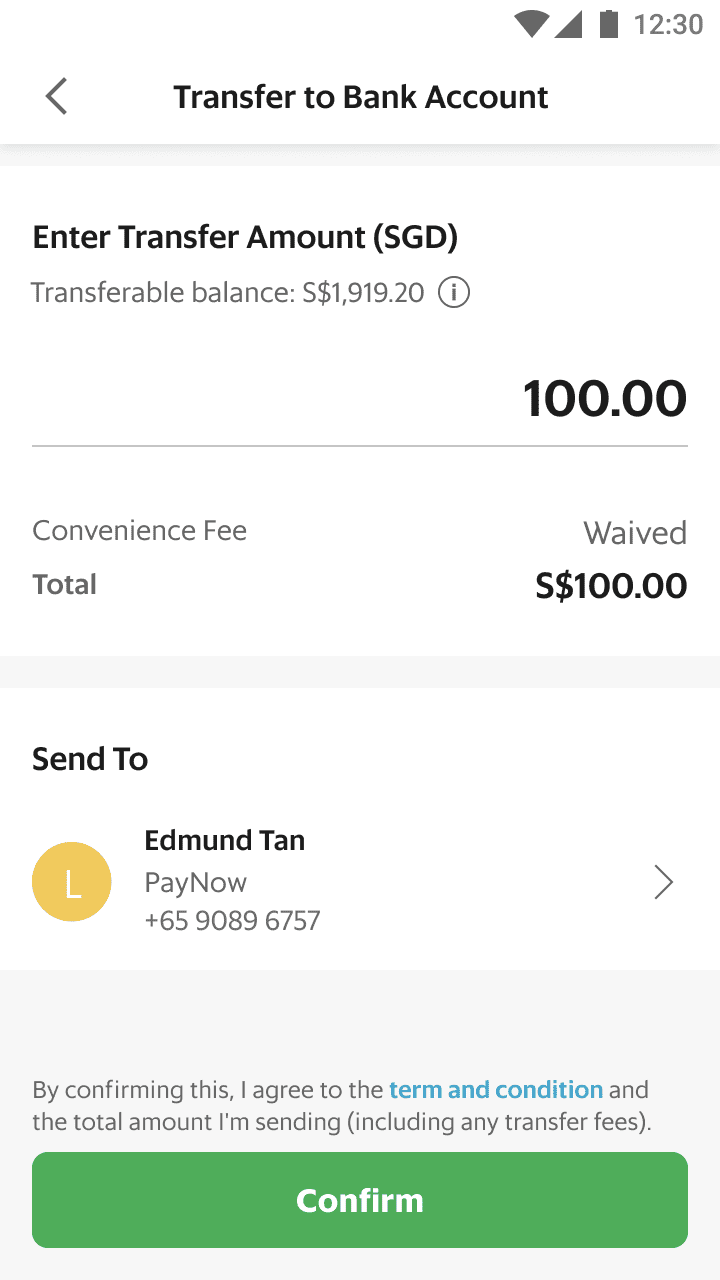

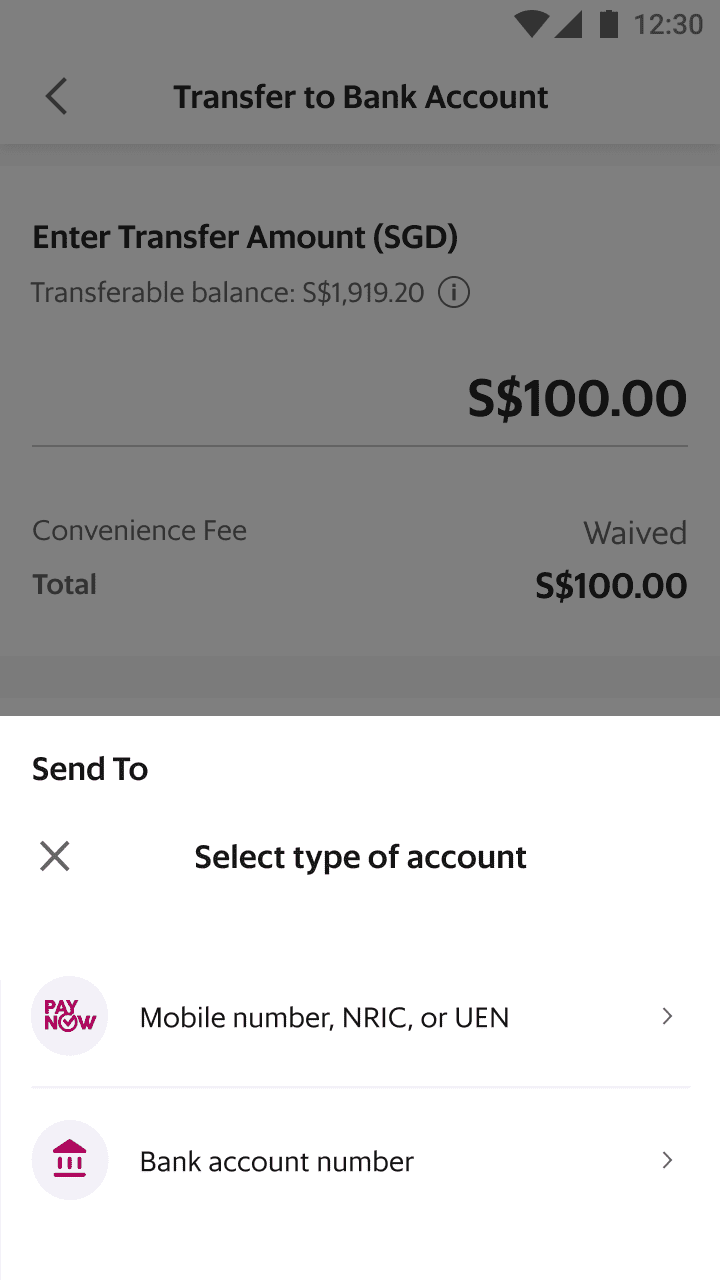

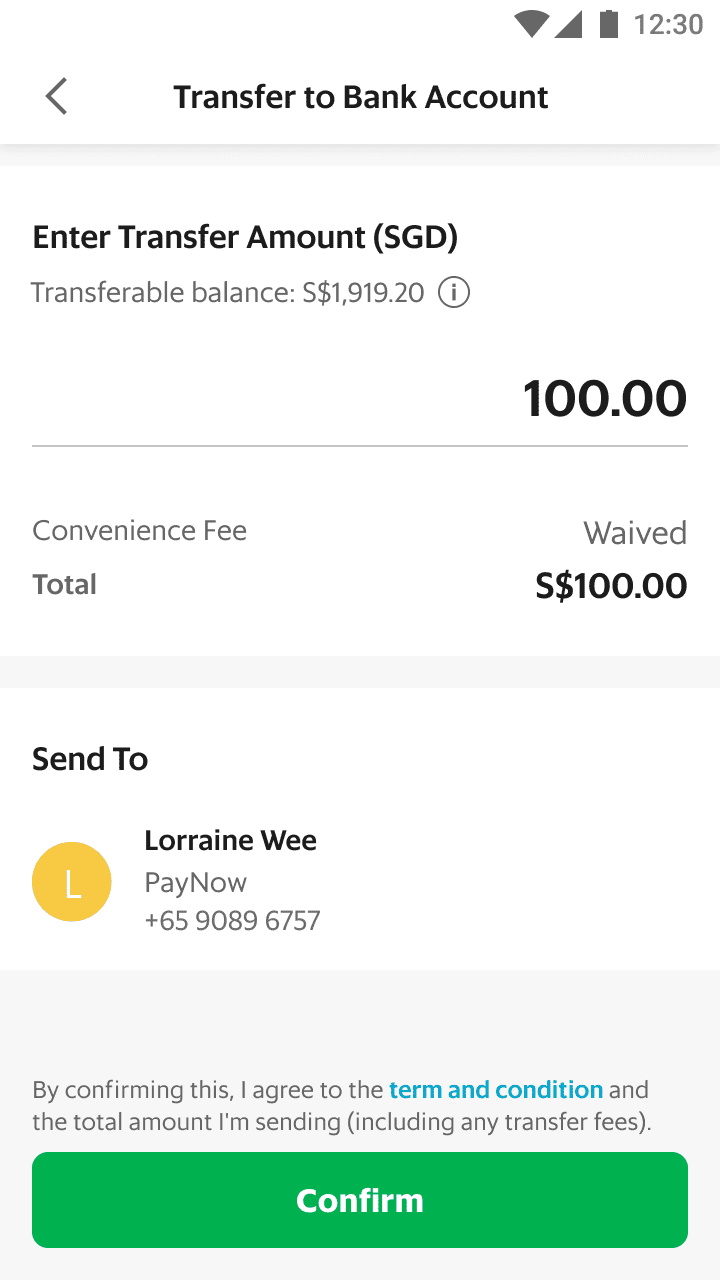

Transfer to another bank account via PayNow

-

Access the 'Transfer' feature, and tap on 'Bank account'.

-

Tap on 'Add New Recipient'.

-

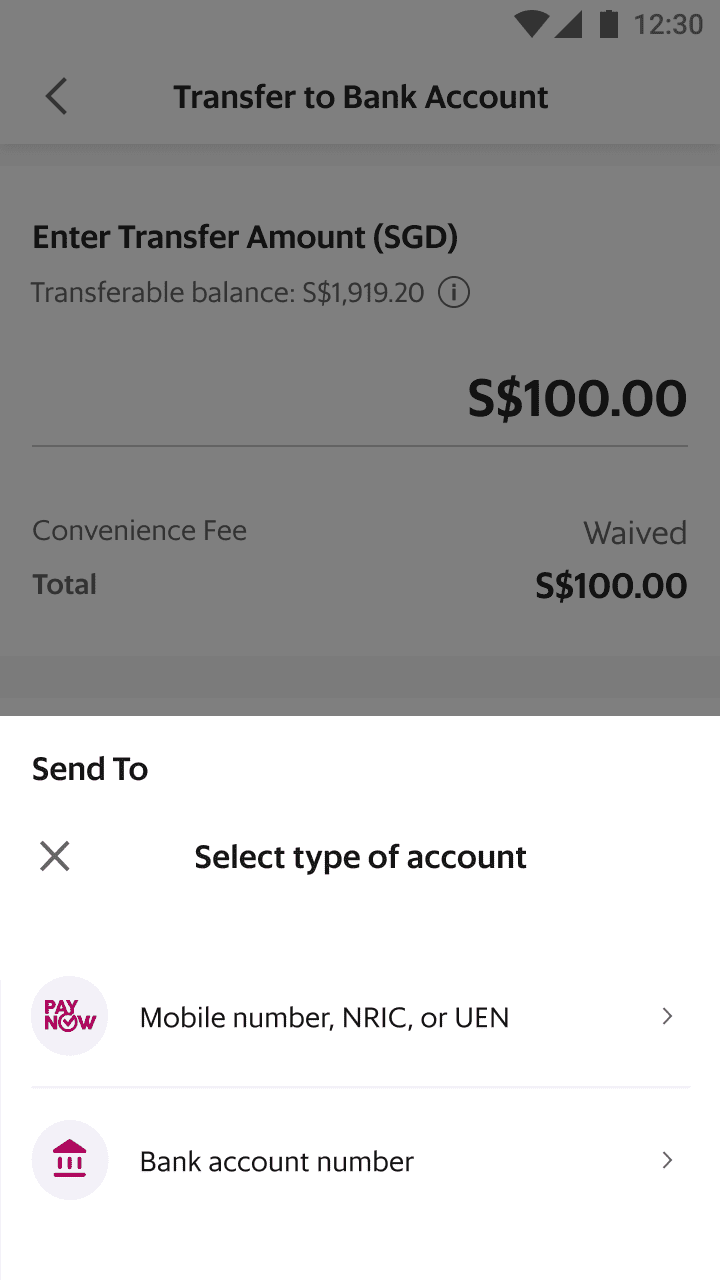

Select the PayNow option of, 'Mobile number, NRIC, or UEN'.

-

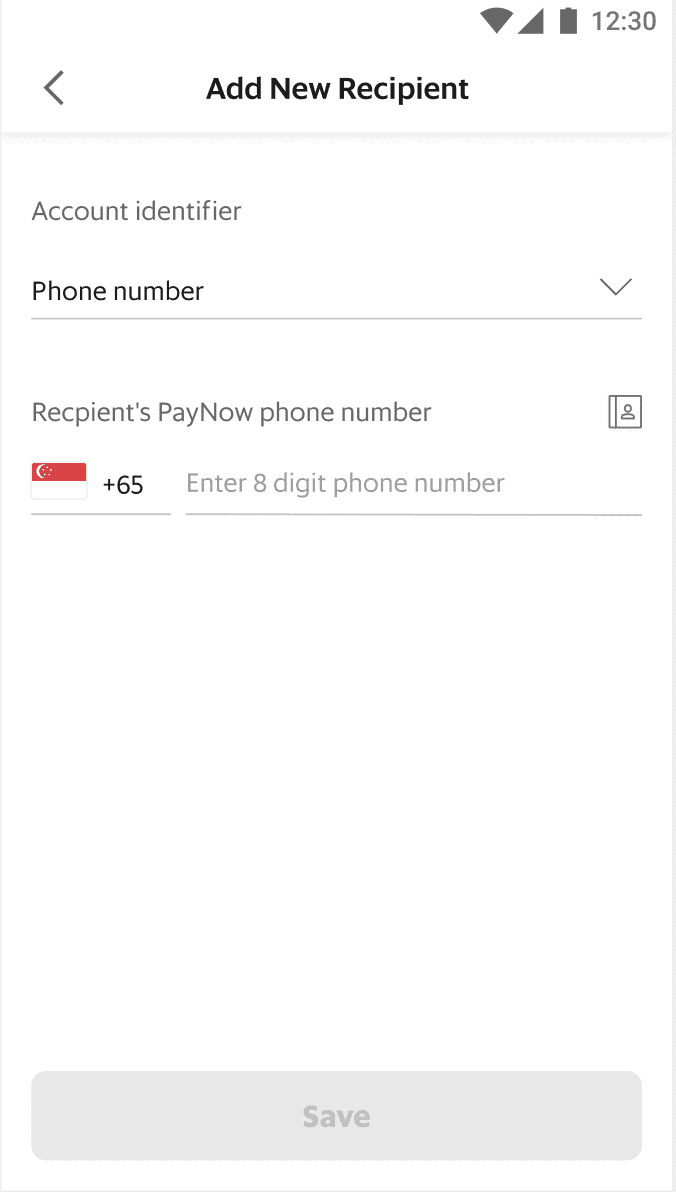

Mobile number is the default account identifier, but you can change it to NRIC or UEN in the drop down menu.

-

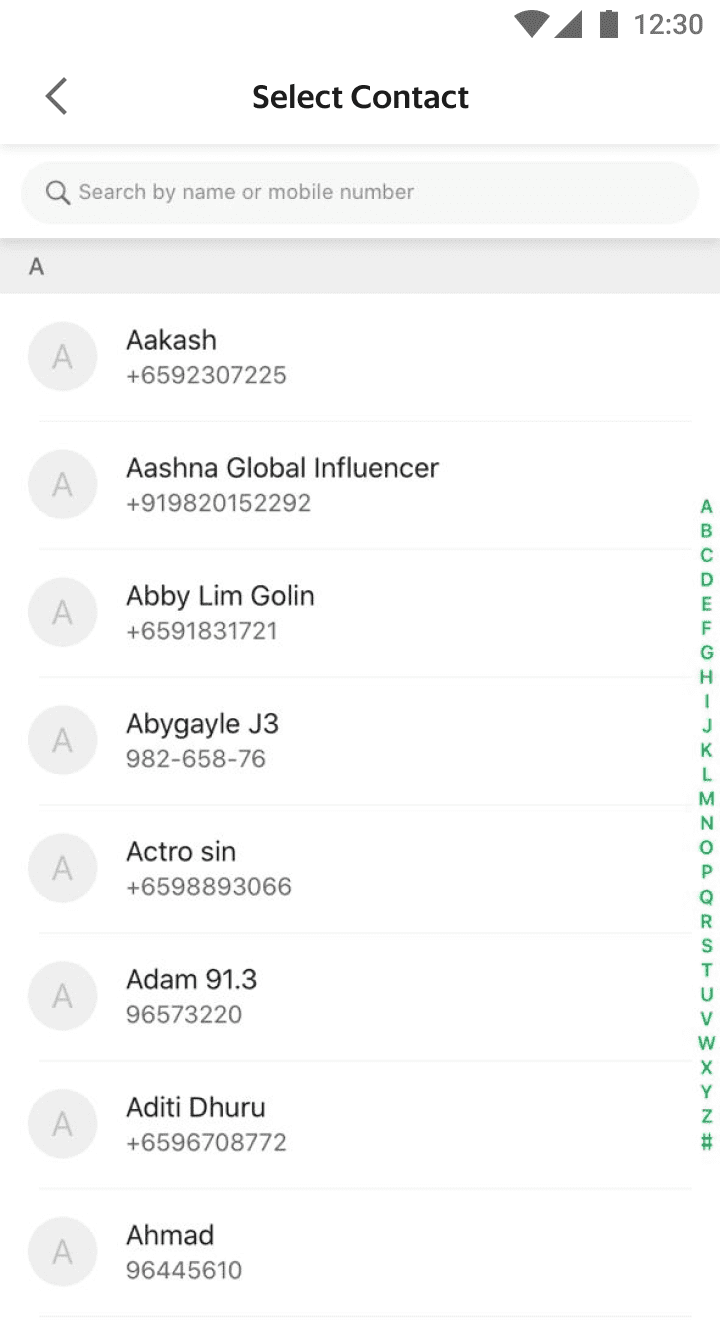

To save the recipient - enter the mobile number or select from your contact list in your phone.

(Note: Permission is required from you to allow the Grab app to access your contact list.) -

Enter and confirm the amount to transfer. Minimum amount is S$10.

-

Enter your GrabPIN to confirm the transfer.

-

All done! The funds have been transferred from your GrabPay Wallet to the PayNow recipient.

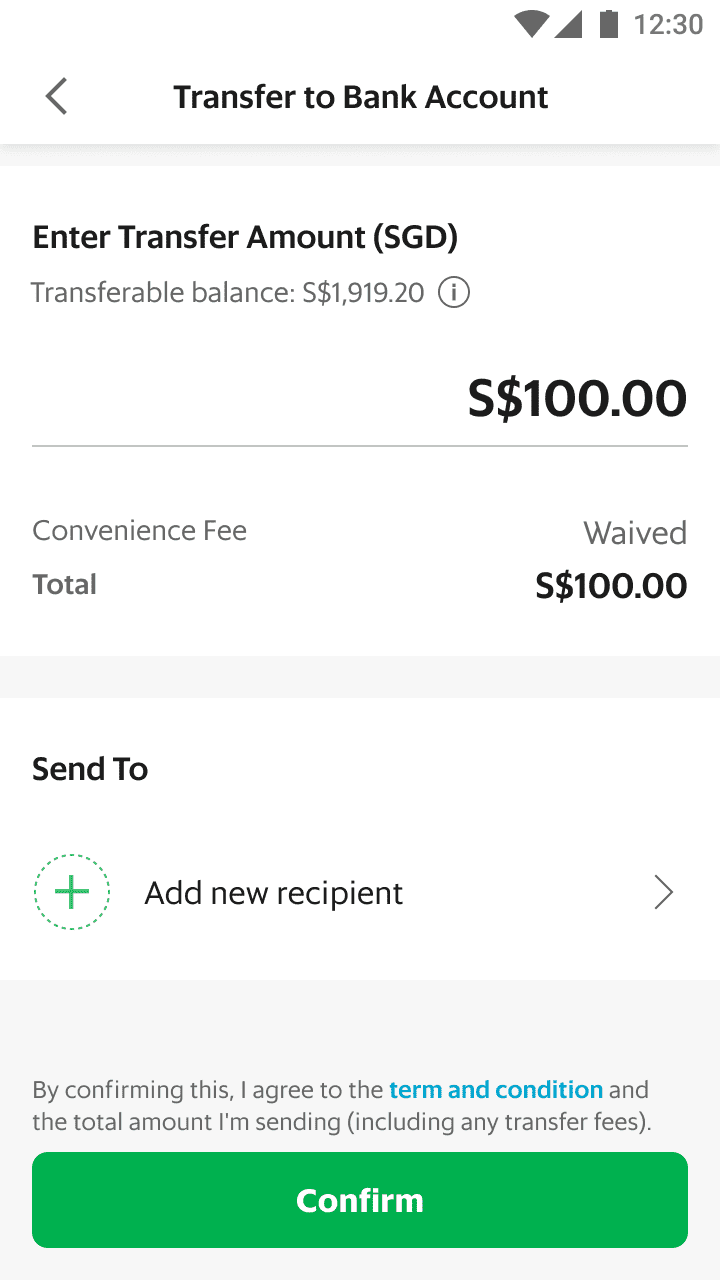

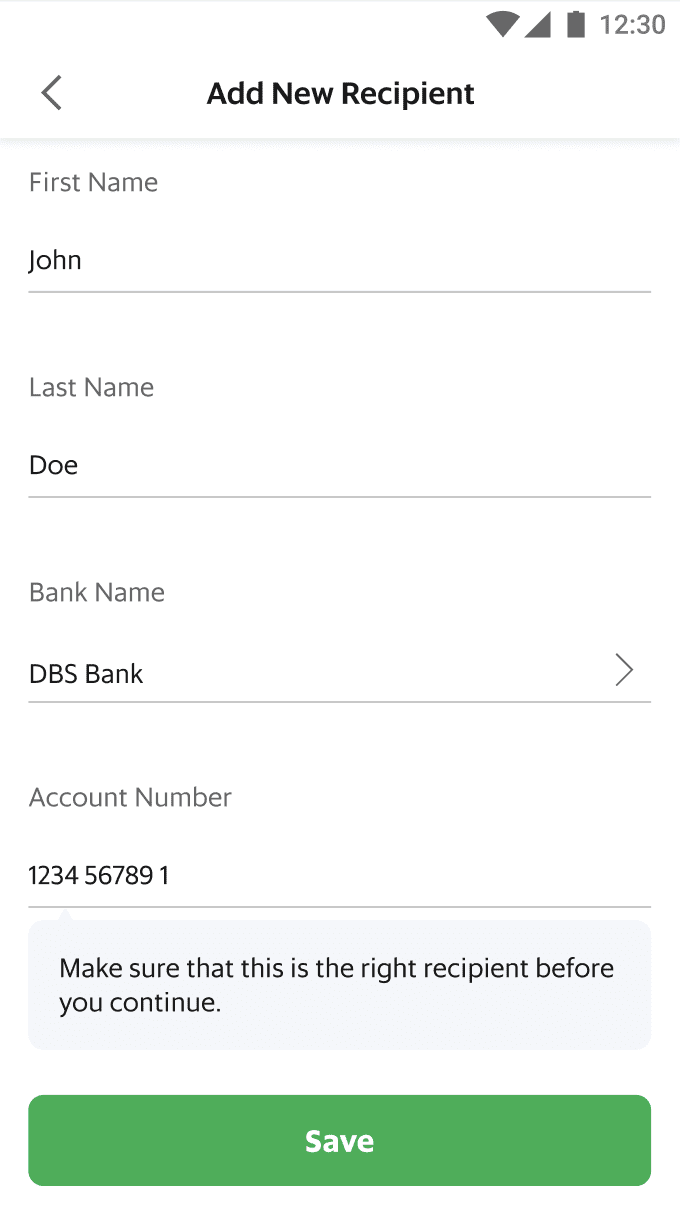

Transfer to another account via bank account details

-

Access the 'Transfer' feature, and tap on 'Bank account'.

-

Tap on 'Add New Recipient'.

-

Select the 'Bank account number' option.

-

Fill up all of the recipient's details, including full name and bank account number.

-

Enter and confirm the amount to transfer. Minimum amount is S$10.

-

Enter your GrabPIN to confirm the transfer.

-

All done! The funds have been transferred from your GrabPay Wallet to the bank account recipient.

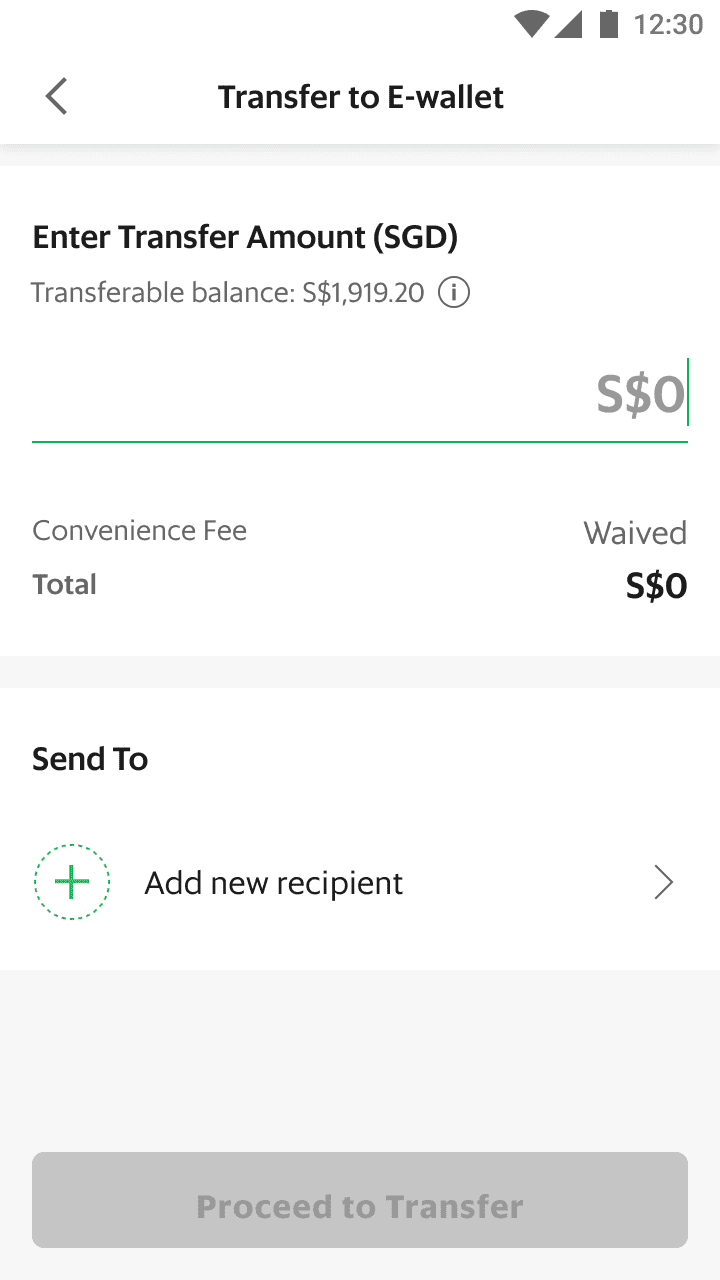

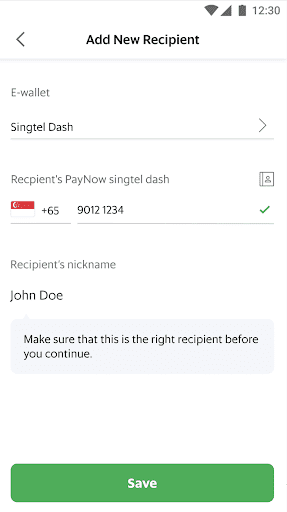

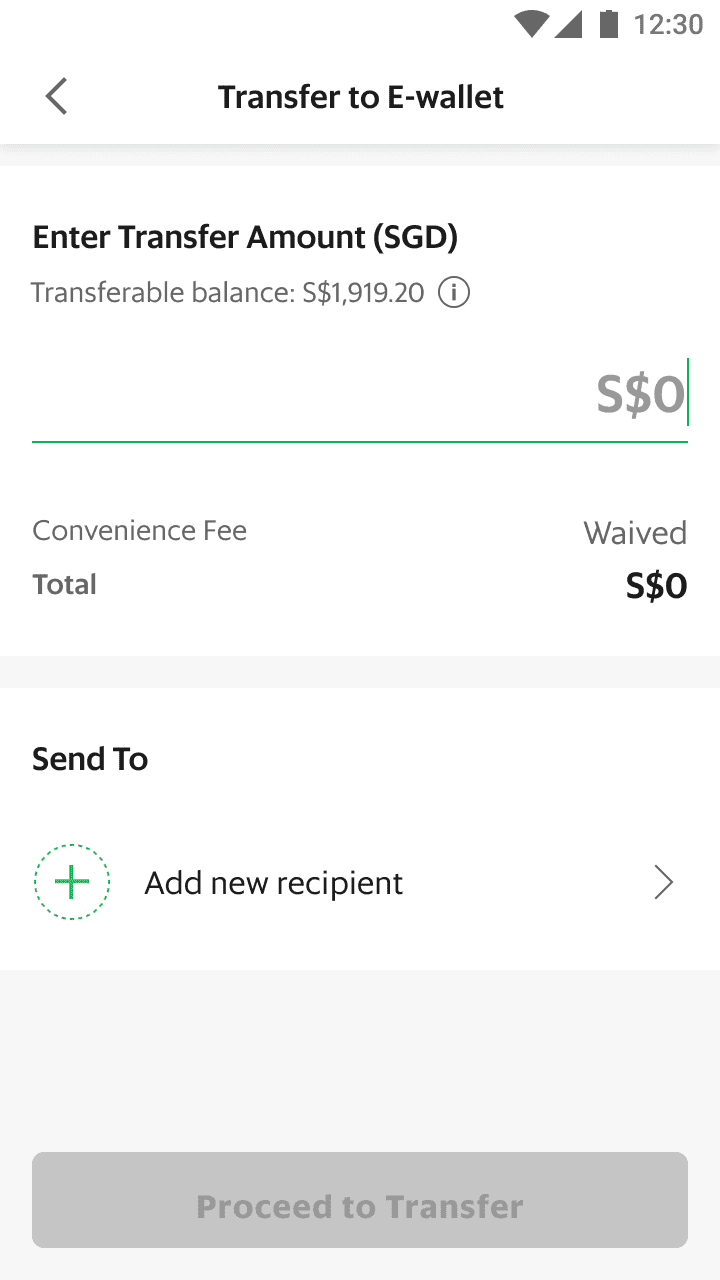

Transfer to another e-wallet (for Singtel Dash and Liquid Pay)

-

Access the 'Transfer' feature, and tap on 'Another e-wallet'.

-

Tap on 'Add New Recipient'.

-

Select the recipient's e-wallet.

-

Key in or select the recipient's mobile number from your phone contacts. You'll see the nickname associated with the mobile number.

-

Enter and confirm the amount to be transferred to the recipient.

-

Enter your GrabPIN to confirm the transfer.

-

All done! The funds have been transferred from your GrabPay Wallet to the e-wallet recipient.

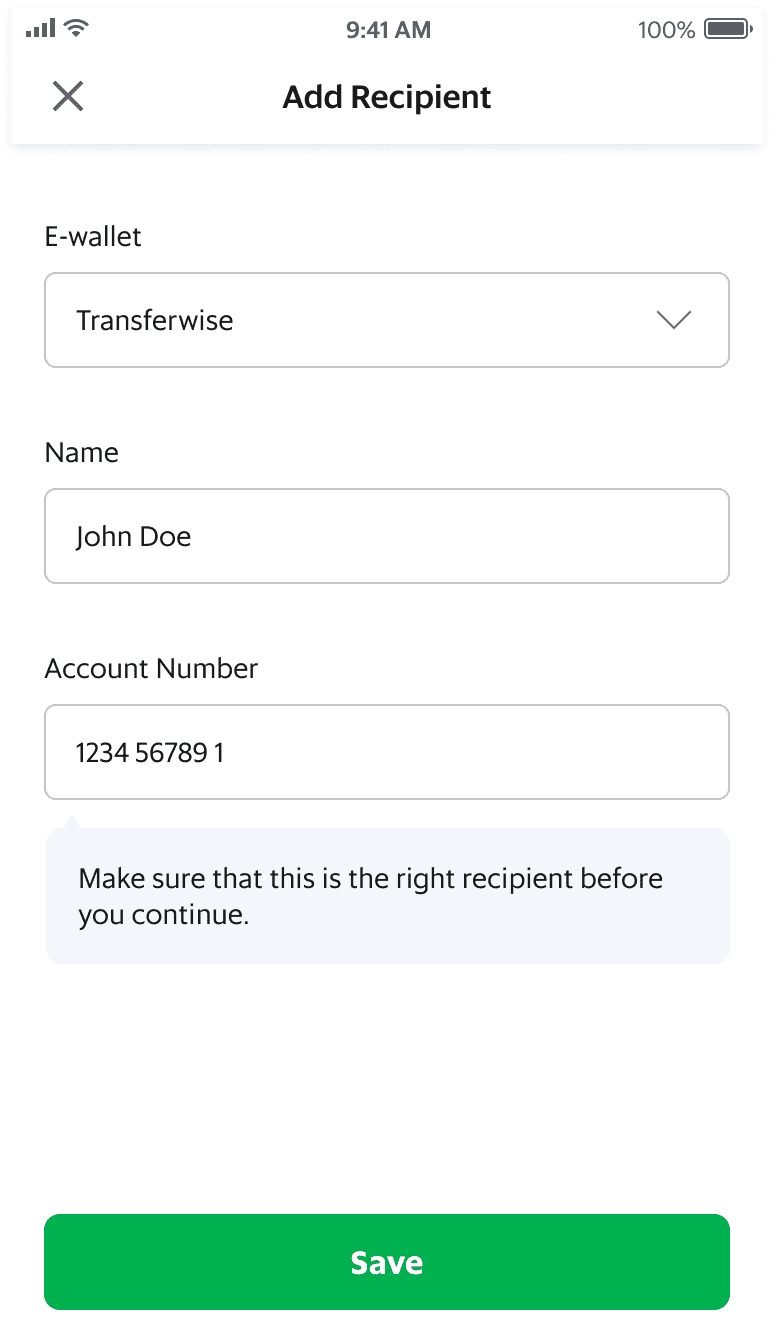

Transfer to another e-wallet (for TransferWise and MatchMove)

-

Access the 'Transfer' feature, and tap on 'Another e-wallet'.

-

Tap on 'Add New Recipient'.

-

Select the recipient's e-wallet.

-

Key in the recipient's name and e-wallet number.

-

Enter and confirm the amount to be transferred to the recipient.

-

Enter your GrabPIN to confirm the transfer.

-

All done! The funds have been transferred from your GrabPay Wallet to the e-wallet recipient.

Your GrabPay Wallet will have 2 different types of balances:![]()

There is no minimum transfer amount. The maximum transfer amount per transaction is S$5,000, which is the same as your GrabPay Wallet spending limit.

You can make up to two transfers to bank accounts or e-wallets per day

Transfers to your own PayNow account (i.e. the bank account linked to your Grab mobile number) will not be counted towards your annual spend limit.

However, transfers to other accounts or e-wallets will count towards your annual spend limit of S$30,000

You can transfer funds to any bank account that is part of the FAST bank transfer network in Singapore. The following banks are supported:

1) DBS Bank/POSB

2) OCBC Bank

3) United Overseas Bank

4) Standard Chartered Bank

5) CIMB Bank

6) Citibank NA

7) Citibank Singapore Ltd

8) ANZ Bank

9) Deutsche Bank

10) HL Bank

11) The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch (HSBC)

12) HSBC Bank (Singapore) Limited

13) ICICI Bank Limited Singapore

14) Industrial and Commercial Bank of China Limited

15) Maybank Singapore Ltd

16) Malayan Banking Berhad

17) Mizuho Bank

18) Bank of China

19) RHB Bank

20) BNP Paribas

21) Sumitomo Mitsui Banking Corporation

22) The Bank of Tokyo Mitsubishi UFJ

23) Sing Investments & Finance Ltd

No. You can only transfer funds from your transferable balance to a local Singapore bank account.

Funds transfer to a bank account involves introducing funds back into Singapore’s banking system, and is hence subject to stringent anti-money laundering measures. Thus, we are required by MAS to identify users performing transfers outside the GrabPay Wallet ecosystem.

By knowing the identity behind each GrabPay Wallet user, we are able to create a secure payments platform for everyone that can mitigate the risks of fraud, identity theft, money laundering, and other illicit activities. As such, only users who have verified their profile and have setup their Grab PIN will be eligible to use the “Transfer” feature.

Users who have not verified their profile can do so instantly using SingPass/MyInfo on the Grab app.

Forward Together

3 Media Close,

Singapore 138498