Fulfil Your Zakat. Make an Impact Today

Tekan di sini untuk terjemahan Bahasa Melayu

As part of our mission to be the everyday app, we’ve partnered with various zakat agencies to introduce Zakat Deduction Programme!

With this programme, Muslim partners can easily contribute zakat on your earnings with Grab. Just opt in to the programme and deduction will begin the following month.

Zakat Agencies & Their Benefits:

Kuala Lumpur/ Selangor

- Pusat Pungutan Zakat MAIWP (PPZ): Skim Kafalah Muzakki-Khairat Kematian

- Lembaga Zakat Selangor (LZS): Siddik-Bantuan Pendidikan

Pahang

Pulau Pinang

Perak

Kedah

Melaka

- Zakat Melaka: Agihan Zakat

Sabah

Do I Need to Contribute Zakat?

Yes, if your yearly income exceeds the Nisab amount, you are required to contribute zakat.

If your income is below the Nisab, contributing is optional but always encouraged.

Your Zakat, Your Choice?

Giving options to the DAX on their contribution to Zakat:

1. Fixed Deductions:

- 2.5% deducted from your net monthly income (standard zakat rate)

2. Flexible Contribution: NEW!

- Introducing a new option to encourage drivers and delivery partners earning below RM2,500 per month to participate in the “Flexible Zakat Contribution Programme”.

- Contribute any amount you choose (minimum RM10)

- This programme is only available for LZS, PPZ, PKZP, and MUIS. All Zakat contributions are voluntary and subject to the terms and conditions.

Disclaimer:

- If you already opt-in for 2.5% zakat deduction every month, you are not eligible for this programme (to avoid double deductions).

- Registration is on a monthly basis. If you do not register, it will be considered as not interested.

- Registration is based on the city where you reside.

- Minimum contribution is only RM10, on a voluntary basis.

- Deductions will be made on the 28th of each month if your cash wallet balance is sufficient, and the payment will be transferred to the zakat agency in the first week of the following month.

- This programme is only available for LZS, PPZ, PKZP, and MUIS. All zakat contributions are voluntary and subject to the terms and conditions.

Already on the 2.5% monthly deduction?

You won’t be eligible for the flexible option, this helps avoid double deductions.

Great! Ready to Sign Up for the Zakat Deduction Programme?

Step 1: Opt-In

Step 2: Confirmation

You will be notified if your opt-in is successful by the 5th of the following month.

Step 3: Zakat Deduction Begins

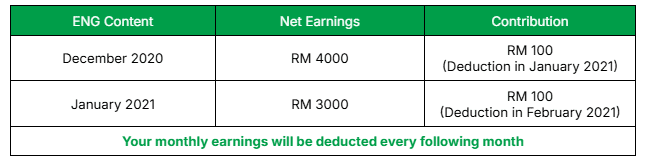

We will deduct 2.5% or the flexible amount you requested from your net earnings in your cash wallet in the following month.

For Penang & Kedah, the minimum contribution is RM10 or 2.5% (whichever higher)

Flexible Deduction Option

Deductions will be made on the 28th of each month if your cash wallet balance is sufficient, and the payment will be transferred to the zakat agency in the first week of the following month.

Example: If you sign up in November 2019, your net earnings in December 2020 will be eligible for zakat contribution. It will then be deducted in January 2021.

FAQ

I haven’t registered for zakat before. What should I do?

No worries! Once you opt-in to the Zakat Deduction Programme, you’ll automatically be registered for Zakat Pendapatan.

My account is registered in Kuantan (Pahang) but I drive in Kuala Lumpur. Where will my contributions be directed to?

You’re encouraged to make zakat contributions to the zakat agency in the city where you work. However, if your registered Grab city is Pahang, your zakat contribution will be directed to Pusat Kutipan Zakat Pahang (PKZP).

If you wish to change it to Pusat Pungutan Zakat MAIWP (PPZ), you need to fill up this form.

I am based outside of the cities listed but still want to contribute. What can I do?

Great Spirit! You can contribute directly at your nearest zakat agency. We’re also working on expanding this programme to more locations. Stay tuned!

I’ve already been paying zakat through another agency. What now?

If your zakat contributions are linked to your new IC number, we’ll sync your Grab earnings to that account.

Used a different ID (e.g., old IC, Police ID)? Simply provide those details in the opt-in form so we can merge your contributions correctly.

Can I opt out from this programme?

Yes, you can opt out anytime by filling the form here but please note that the current month’s contribution will still be carried out.

Example: If you opt out on 16 March 2020, we will still deduct 2.5% of your March’s net earnings in April 2020. Deduction for zakat contributions will only stop in May 2020.

If you would like to contribute more than 2.5% of your monthly earnings, you can also do it via the relevant links provided above.

How do I calculate my net earnings?

Net earnings = Total fares collected minus Grab’s commission (if any).

When is the deadline to opt in to the programme?

You must opt-in before the end of the month to start contributing the following month.

The deduction from your earnings will start in the following month.

Example: Opt in by 28 November, we’ll deduct your December earnings in January.

Is there an age limit for this programme?

There is no age limit to make a contribution. As long as you’re Muslim Grab partner, you’re eligible to participate regardless of age.

Where does this contribution go?

Your zakat is sent directly to your selected zakat agency every month.

What happens if I’m banned/terminated or don’t have enough balance?

If this happens, deductions will automatically stop the following month, and you’ll be opted out of the programme.

Kindly be reminded that all members of the Grab community are required to follow the Code of Conduct and Terms of Services.