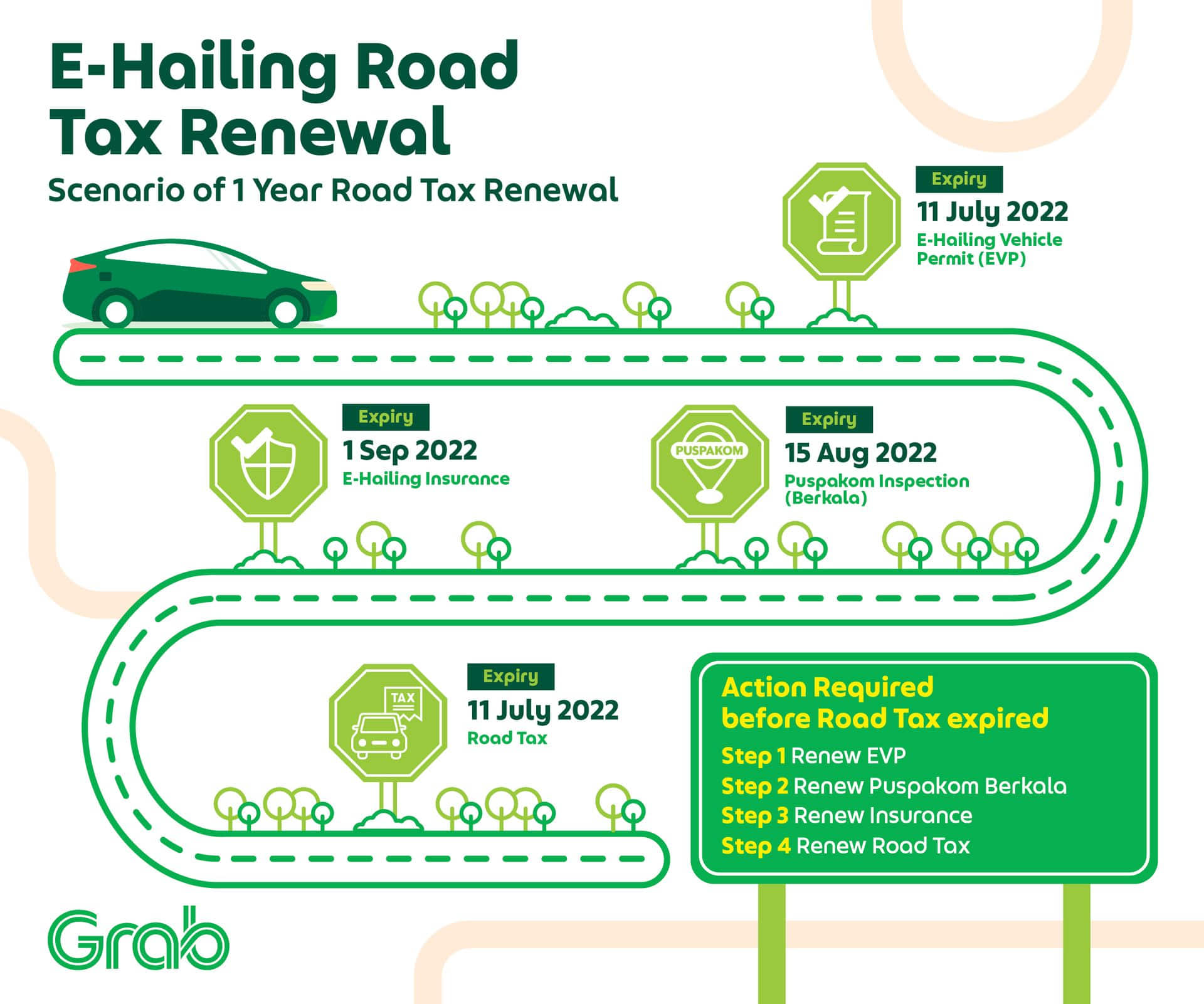

E-Hailing Road Tax Renewal

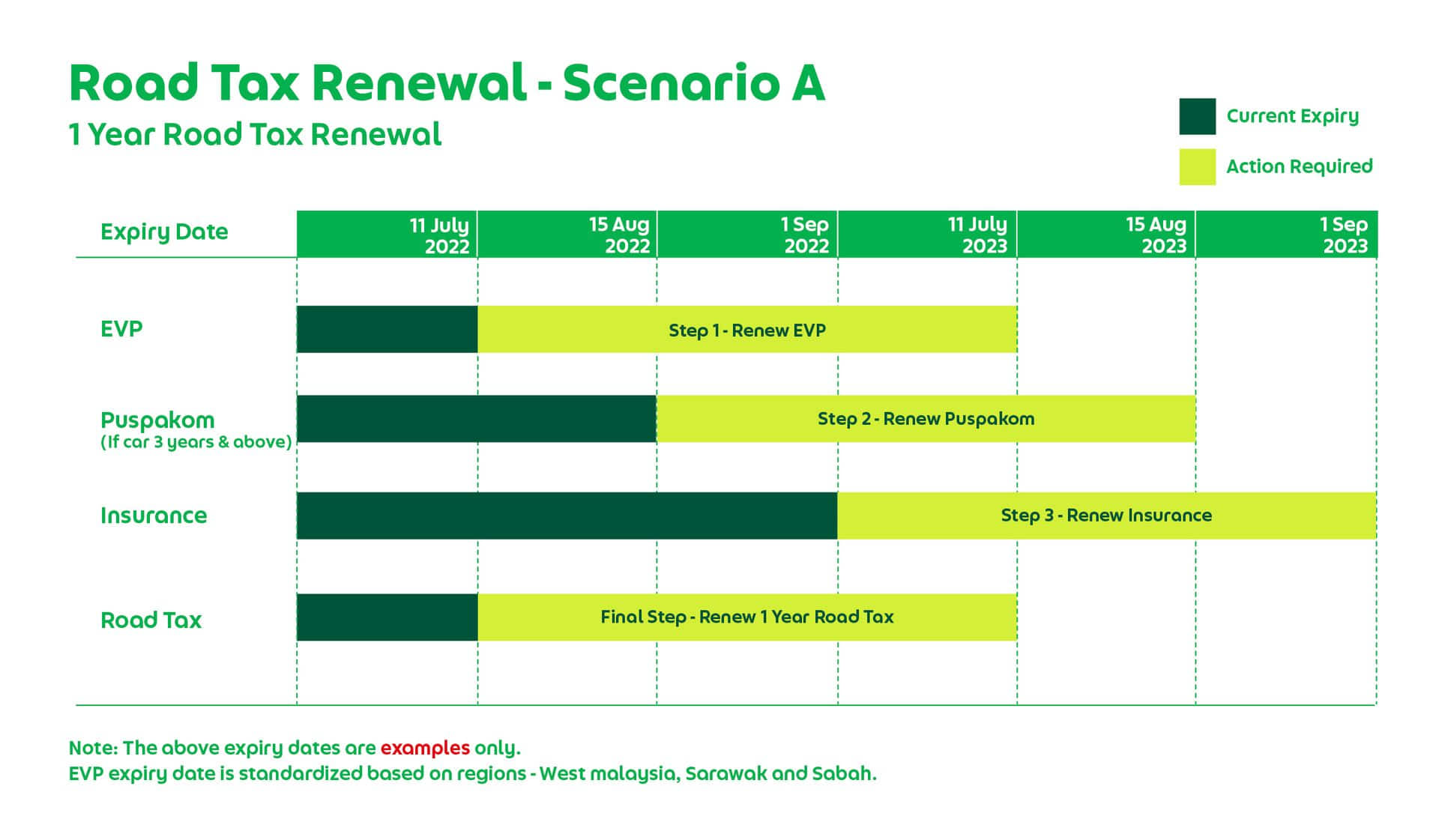

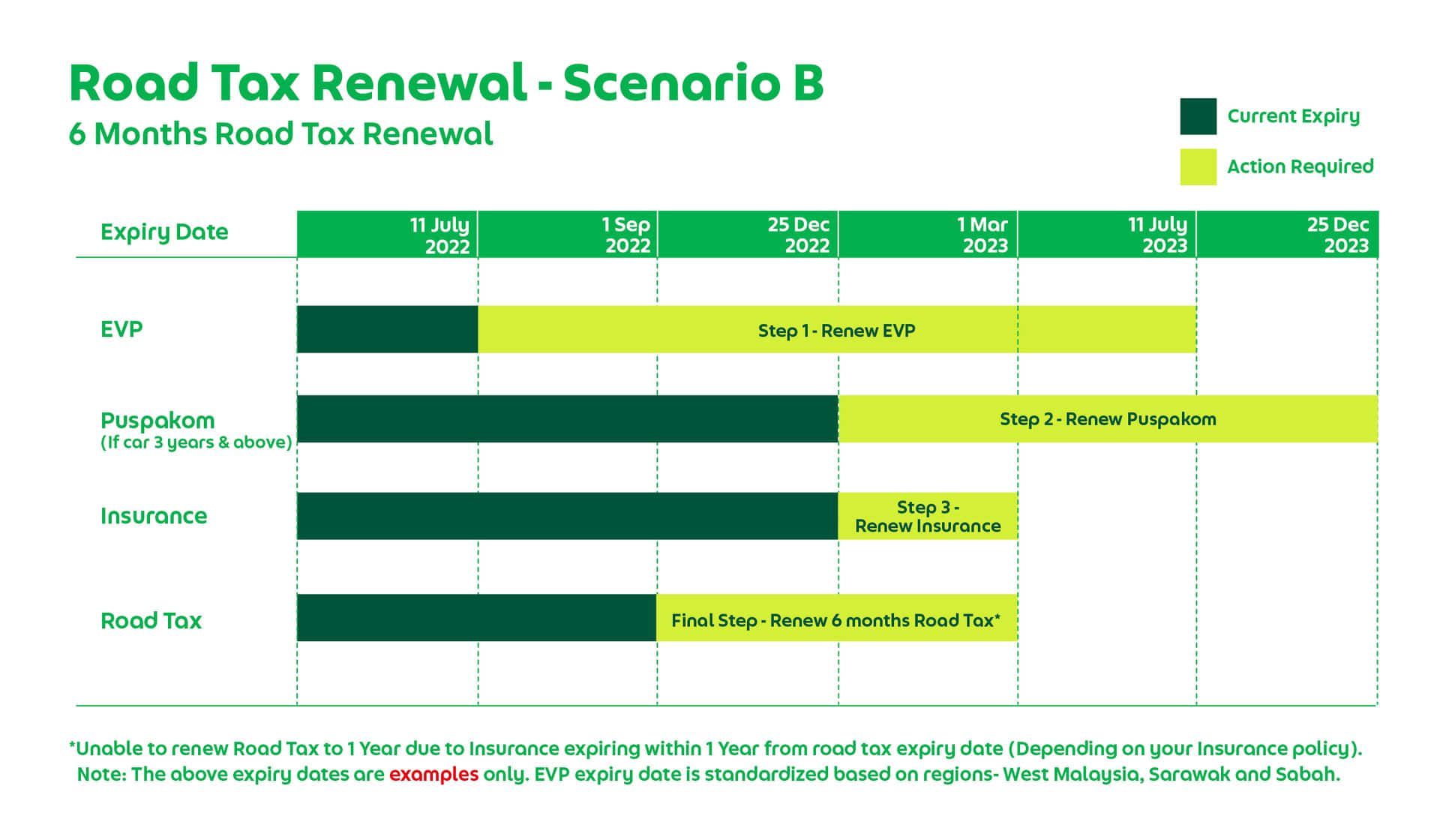

Note: The expiry dates stated above are examples for reference only.

Dear driver-partners, thank you for your feedback and we are here to provide clarity on the E-Hailing Road Tax Renewal.

According to E-Hailing Regulations, the road tax’s renewal period (6 months or 1 year) for E-Hailing driver-partners depends on the nearest expiry date of your documents below.

- E-Hailing Insurance

- E-hailing Vehicle Permit (EVP)

- Puspakom Berkala (for vehicles of 3 years and above)

Below are a few questions asked by our driver-partners:

What are the steps for E-Hailing Road Tax Renewal?

Step 1 – Renew EVP*

Step 2 – Renew Puspakom Berkala**

Step 3 – Renew Insurance

Final Step – Renew Road Tax

*If your EVP is expiring this year

**If your vehicle is 3 years old or above this year

What is Puspakom vehicle inspection (Berkala E-Hailing)?

Puspakom vehicle inspection (Berkala E-Hailing) is a requirement from the Ministry of Transport for vehicles 3 years old and above.

The check is conducted by Puspakom to certify that your vehicle is fit to operate as an E-Hailing vehicle. Guide to make an appointment here.

What if your EVP is expiring in the same year?

Kindly submit your car grant via your Grab Driver App under the Documents tab.

Once your car grant is verified by us, we will renew EVP on your behalf and the approval by the authorities will take:

Peninsular Malaysia – APAD : 5 working days

Sabah – LPKP : 2 months

Sarawak – LPKP : 1 month

Is the E-hailing Vehicle Permit (EVP) expiry date standardized based on regions?

Yes, it is standardized by West Malaysia, Sarawak and Sabah. No action is required on your end.

We’ve prepared two different scenarios below. Please take note that the expiry dates mentioned below are examples only.

Scenario A – 1 Year Road Tax Renewal

Scenario B – 6 Months Road Tax Renewal

Note: If you are unable to renew or extend the expiry date of the documents above to a 1 year period, please proceed to renew your road tax with 6 month’s payment. Your road tax will be renewed to the nearest expiry date of documents above.