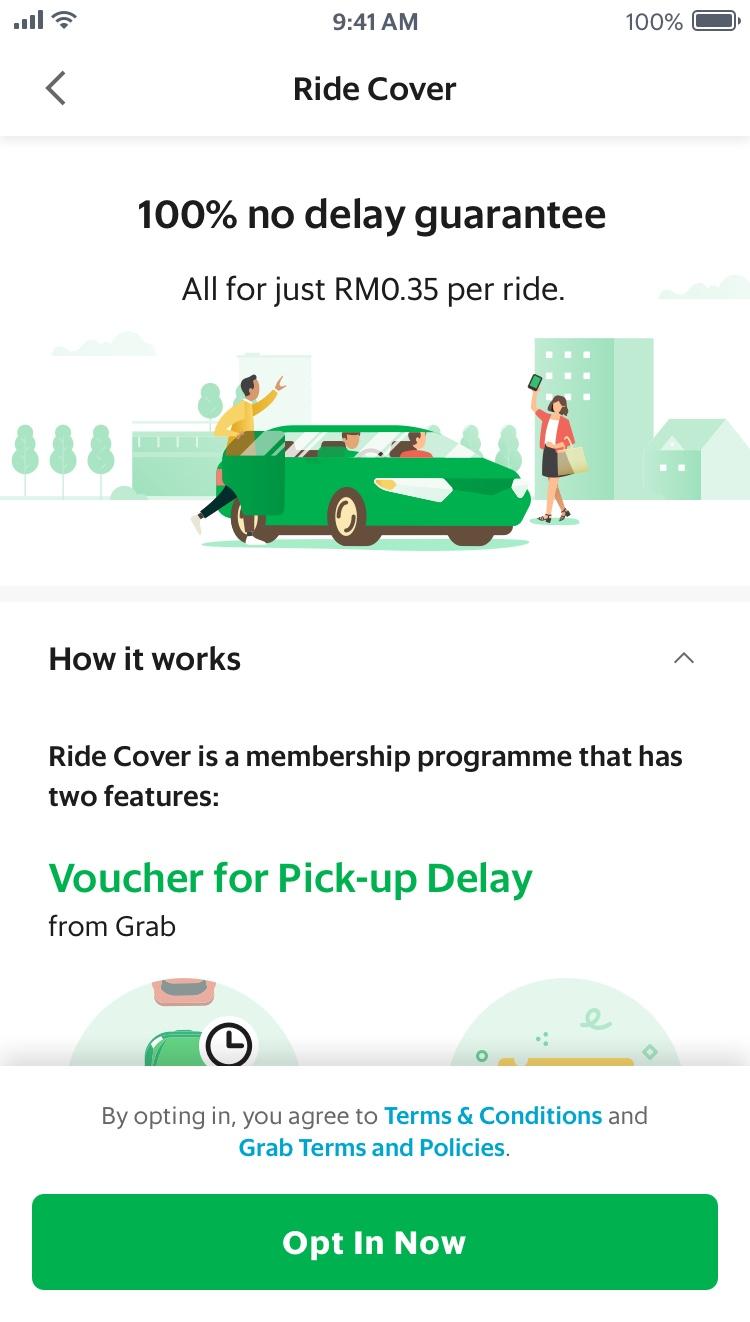

With Ride Cover, you’ll enjoy our 100% No Delay Guarantee: if your pickup doesn’t arrive within 15 minutes after the estimated arrival time, you’ll get an RM5 Grab Ride voucher. Plus, you can also get up to RM100,000 free personal accident coverage in the event of your death or permanent disability on top of your basic coverage for you and any immediate family members sharing the ride. All for just RM0.30/ride.

*The Personal Accident coverage of Ride Cover is underwritten by Chubb Insurance Malaysia Berhad, registration number 197001000564 (9827-A).

How Ride Cover works

Simply opt in to Ride Cover for RM0.30 per trip.

In the event of an unforeseen accident, easily re-trace your ride in-app to file a claim.

| You’ll be compensated if | You’ll receive |

|---|---|

| You get into an accident during your eligible Grab ride in Malaysia | A claim of up to RM100,000 for death or permanent disability, and up to RM2,000 for medical expenses, on top of your basic coverage |

| Your pickup is delayed more than 15 minutes after the estimated arrival time | A RM5 Grab ride voucher once your eligible journey has been completed; your voucher will be valid for six months |

For more information on Grab's existing coverage, click here.

Extra protection made extra convenient

Enhanced protection

Get extra personal accident coverage of up to RM100,000

Protection when you need it

One time opt in any time via the Insurance tile

Affordable peace of mind

Get covered for RM0.30 per ride

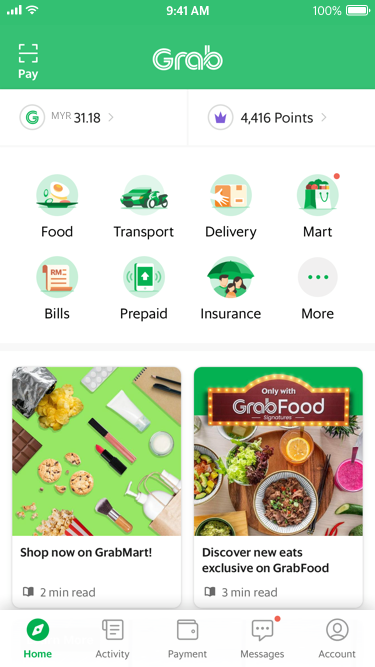

How To Opt In

-

Open your Grab App, tap on 'Insurance' in the homepage screen

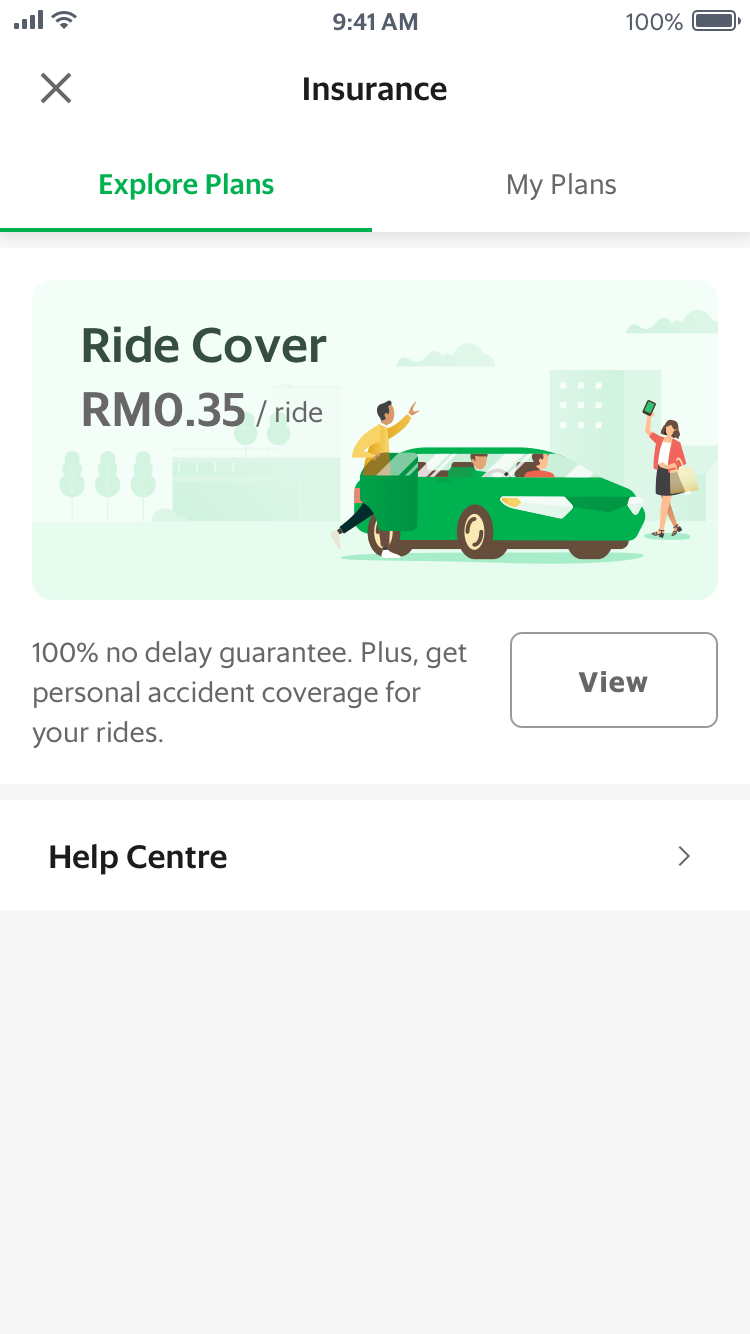

-

Tap on ‘View’ (Ride Cover)

-

Tap on ‘Opt In Now'

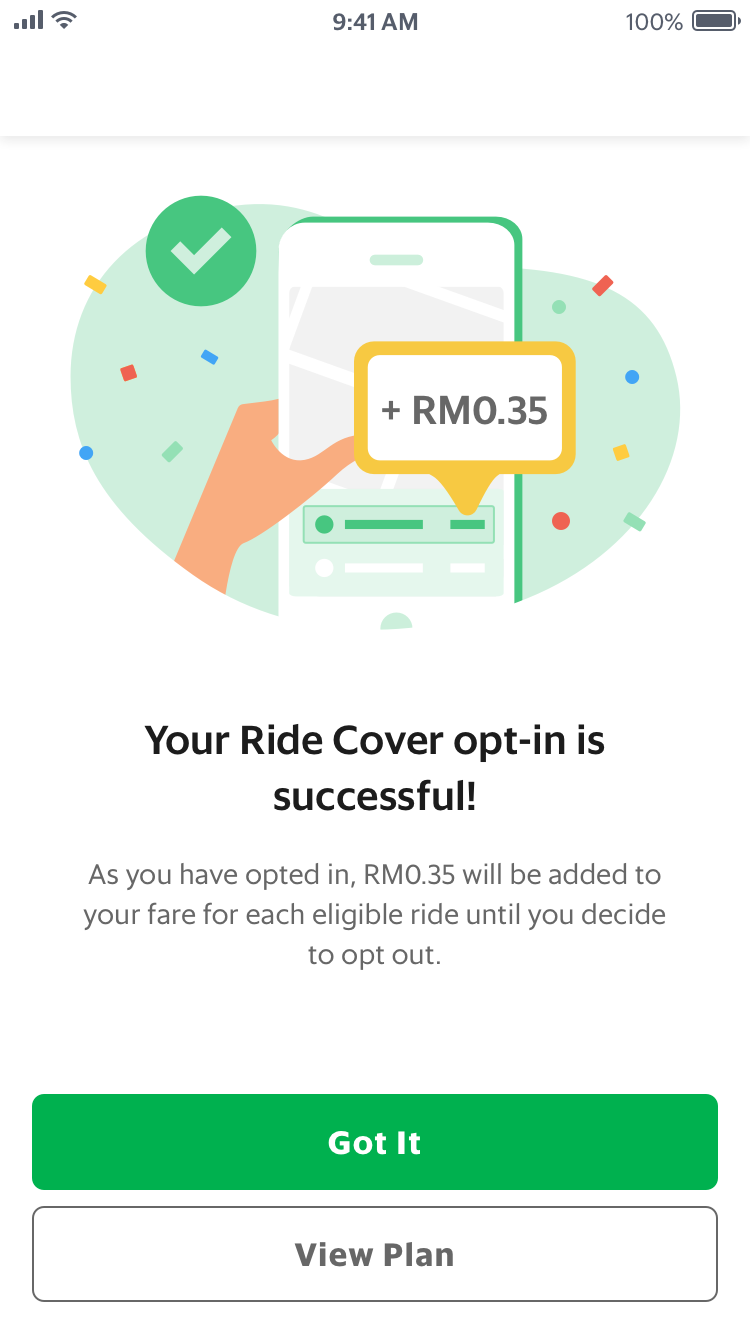

-

Tap on 'Got it' and you're done!

FAQs

If your pick-up is delayed for more than 15 minutes after the given estimated arrival time, we will send you an inbox message to let you know that you qualify to receive the RM5 Grab ride voucher. You will only receive the voucher if you continue with that ride.

If the fee was not charged, that ride is not eligible for Ride Cover and the pick-up delay benefit does not apply.

If you have previously opted in to Ride Cover, you can opt out any time before booking a ride.

If you’re viewing this from your mobile device,

- Simply click here to be directed straight to the page.

- Next, tap on the green toggle under Status to switch it off and select the Opt Out option to confirm.

If you’re viewing this from other devices,

Scan the QR code below

or

- Open your Grab app and click on the More icon.

- Select the Insurance tile under the Finance tab.

- Navigate to the My Plans tab and click on Ride Cover.

- Tap on the green toggle under Status to switch it off.

- Select the Opt Out option to confirm.

Any pre-existing conditions are not included. A pre-existing condition means any condition for which a doctor has been consulted or for which treatment or medication has been prescribed; or a condition, the manifestation or symptoms of which a reasonable person in the circumstances would be expected to be aware of at or before the relevant Grab ride commencing. Please refer to policy wording for the complete list of exclusions.

You can submit your claim directly to Chubb Insurance Malaysia Berhad by email to GrabInquiries.My@chubb.com or call in at +603-2058 3181.

The claims assessment will take 7 – 10 working days to process.

Do note that you can make a Personal Accident claim immediately after an accident with the supporting documents as below:

- All reports that have been made with or obtained from the police, a carrier or other authorities about the accident, loss or damage; and

- Any other documentary evidence required by Chubb.

For delayed pick-up, If you qualify for a payout (the pick-up was delayed for more than 15 minutes and you completed your ride), you will receive an inbox message informing you that you have received the RM5 Grab ride voucher from us. You can find this voucher under the “My Rewards” tab in GrabRewards. There is no need to submit a claim for this.

Terma dan Syarat Ride Cover/ Ride Cover Terms and Condition

Ride Cover adalah program pilihan di bawah GrabCar (“Program Ride Cover”) yang disediakan untuk anda oleh GrabCar Sdn Bhd dan / atau MyTeksi Sdn Bhd (“Grab”) di mana anda akan diberikan voucher penangguhan pengambilan sebanyak RM5.00 (untuk Pelan Asas) atau RM10.00 (untuk Pelan Tambahan) (dirujuk secara kolektif sebagai “Baucar Kelewatan”) berdasarkan peristiwa-peristiwa berikut

Pemandu Grab anda tiba lebih dari 15 minit selepas Anggaran Masa Ketibaan awal ditunjukkan melalui Aplikasi Grab, dengan syarat Perjalanan Perlindungan Ride selesai; atau

Perjalanan Perlindungan Ride anda dibatalkan oleh anda atau Pemandu Grab anda selepas lebih dari 15 minit berlalu dari Anggaran Masa Ketibaan awal yang ditunjukkan melalui Aplikasi Grab dengan syarat (i) langganan Ride Cover anda aktif semasa anda menempah Perjalanan Perlindungan Ride, (ii) anda tidak membatalkan Perjalanan Perlindungan Ride 15 minitsebelum Anggaran Masa Ketibaan awal, dan (iii) Pemandu Grab tidak membatalkan Perjalanan Perlindungan Ride 15 minit sebelum Anggaran Masa Ketibaan awal.

Ride Cover is an optional programme under GrabCar (“Ride Cover Programme”) made available to you by GrabCar Sdn Bhd and/or MyTeksi Sdn Bhd (“Grab”) which enables a pick-up delay voucher of RM5.00 (for the Basic Plan) or RM10.00 (for the Plus Plan) (collectively referred to as “Delay Voucher”) based on the following events:

Your Grab Driver arrives more than 15 minutes after the initial Estimated Arrival Time shown via Grab Application, provided that the Ride Cover Journey is completed; or

Your Ride Cover Journey is canceled by you or your Grab Driver after more than 15 minutes have passed from the initial Estimated Arrival Time shown via the Grab Application provided that (i) your Ride Cover subscription was active when you booked the Ride Cover Journey, (ii) you do not cancel the Ride Cover Journey 15 minutes prior to the initial Estimated Arrival Time, and (iii) the Grab Driver does not cancel the Ride Cover Journey 15 minutes prior to the initial Estimated Arrival Time.

Dengan memilih opt-in Program Ride Cover, anda juga berhak mendapat perlindungan Kemalangan Diri secara percuma di bawah Polisi Insurans Kumpulan Perlindungan Kemalangan Diri Grab (“Polisi Kumpulan”) yang ditaja oleh Grab dan ditaja jamin oleh Chubb Insurance Malaysia Berhad (“Chubb”). Sila rujuk kepada Polisi Kumpulan yang boleh didapati di Aplikasi Grab.

By opting into the Ride Cover Programme, you will also be entitled to a free Personal Accident cover under the Grab Personal Accident Cover Group Insurance Policy (“Group Policy”) sponsored by Grab and underwritten by Chubb Insurance Malaysia Berhad (“Chubb”). Please refer to the Group Policy that is made available on Grab App.

Setelah anda memilih untuk mengikut serta program ini, bayaran Ride Cover sebanyak RM0.30 atau RM1 (berdasarkan pelan anda yang dipilih) untuk setiap perjalanan Grab akan dikenakan sehingga anda memilih untuk berhenti mengikut serta program ini [Grab app> Insurance> Ride Cover]. Program Ride Cover akan diaktifkan secara automatik untuk perjalanan anda yang seterusnya yang layak dan bayaran Ride Cover akan dikenakan secara automatik pada setiap perjalanan Grab anda yang dilayaki.

Upon your opt-in, a Ride Cover fee of RM0.30 or RM1 (depending on your chosen plan) will be charged for each eligible Grab ride until you opt-out via [Grab app > Insurance > Ride Cover]. The Ride Cover Programme will automatically be activated for your subsequent eligible rides and the Ride Cover fee will automatically be charged to each of your eligible Grab rides.

Grab bersetuju untuk mengkreditkan akaun Grab anda dengan Baucar Kelewatan RM5.00 /RM10.00 (berdasarkan pelan anda yang dipilih), jika rakan pemandu Grab anda tiba sekurang-kurangnya lima belas (15) minit selepas Anggaran Masa Ketibaan.

Grab undertakes to credit your Grab account with a RM5.00 or RM10.00 Delay Voucher (depending on your chosen plan), if your Grab driver-partner arrives at least fifteen (15) minutes after the Estimated Arrival Time.

Apabila anda memilih untuk berhenti mengikut serta Program Ride Cover, atau tidak memenuhi kriteria kelayakan di bawah Program Ride Cover, hak untuk Baucar Kelewatan dan perlindungan di bawah Polisi Kumpulan akan dihentikan dengan segera dan automatik. Harap maklum bahawa Baucar Kelewatan tidak akan dikeluarkan sekiranya Grab App mengalami kegagalan sistemik.

Upon your opt-out of the Ride Cover Programme or non-fulfilment of the eligibility criteria under the Ride Cover Programme, the entitlement to the Delay Voucher and the coverage under the Group Policy shall cease immediately and automatically. Please take note that the Delay Voucher will not be issued should the Grab App encounter a systemic failure.

Baucar Kelewatan adalah sah selama 6 bulan dari tarikh pengeluaran dan tidak boleh dijual atau ditukar dengan wang tunai.

The Delay Voucher is strictly valid for a period of 6 months from the date of issuance and cannot be sold or be exchanged for cash.

Setakat yang dibenarkan oleh undang-undang, Grab tidak akan bertanggungjawab atas tuntutan, sama ada kerugian atau kerosakan langsung atau tidak langsung yang ditanggung oleh anda yang timbul daripada pilihan untuk ikut serta dan / atau tidak ikut serta dalam Program Ride Cover ini.

To the fullest extent permitted by law, Grab shall not be liable for any claim, whether direct or indirect loss or damage whatsoever incurred by you arising from your opt-in and/or opt-out to this Ride Cover Programme.

Program Ride Cover dan / atau Baucar Kelewatan boleh ditarik atau dihentikan oleh Grab pada bila-bila masa tanpa pemberitahuan terlebih dahulu kepada anda.

The Ride Cover Programme and/or the Delay Voucher may be withdrawn or terminated by Grab at any time without prior notice to you.

Dengan memilih opt-in, anda dengan ini memberikan persetujuan kepada Chubb dan Grab dan / atau syarikat sekutunya, termasuk penyedia perkhidmatan pihak ketiga mereka untuk mengumpulkan, menggunakan dan mendedahkan maklumat anda untuk diproses dan untuk tujuan yang dijelaskan dalam Polisi Privasi Chubb dan Polisi Privasi Grab.

By opting in, you hereby give consent to Chubb and Grab and/or its affiliates, including their third party service providers to collect, use and disclose your information for processing and for the purposes described in Chubb’s Privacy Policy and Grab’s Privacy Policy.

Dengan memilih opt-in, anda dengan ini mengakui dan menyetujui syarat dan ketentuan Program Ride Cover dan Syarat dan Terma Grab yang berkenaan.

By opting in, you hereby acknowledge and agree to the terms and conditions of the Ride Cover Programme and the applicable Grab Terms and Policies.

Nota Penting / Important Notes

Program Ride Cover bukan produk insurans. Ini adalah perkhidmatan yang dipertingkatkan yang diberikan kepada anda oleh Grab. Polisi Kumpulan ditaja jamin oleh Chubb Insurance Malaysia Berhad dan ditaja oleh GrabCar Sdn Bhd dan / atau MyTeksi Sdn Bhd sebagai pemegang polisi.

The Ride Cover Programme is not an insurance product. It is an enhanced service provided to you by Grab. The Group Policy is underwritten by Chubb Insurance Malaysia Berhad and sponsored by GrabCar Sdn Bhd and/or MyTeksi Sdn Bhd as the policyholder.

Got a question?

For personal accident policy enquiries, please contact Chubb Customer Service at +603 2058 3181 (Mondays to Fridays, 9.00am – 5.00pm, excluding public holidays).

Chubb is the world’s largest publicly traded property and casualty insurer. Chubb’s operation in Malaysia (Chubb Insurance Malaysia Berhad) provides a comprehensive range of general insurance solutions for individuals, families and businesses, both large and small through a multitude of distribution channels. With a strong underwriting culture, the company offers responsive service and market leadership built on financial strength. Chubb in Malaysia has a network of 23 branches and more than 2,600 Independent Distribution Partners (Agents).

More information can be found at www.chubb.com/my.

The Personal Accident Coverage of Ride Cover is underwritten by Chubb Insurance Malaysia Berhad (a general insurer licensed under the Financial Services Act and regulated by Bank Negara Malaysia), and is distributed by GrabInsure Agency (M) Sdn. Bhd., a registered agent of Chubb Insurance Malaysia Berhad

Forward Together

G-02 Ground Floor, Block A,

Axis Business Campus,

No 13A & 13B Jalan 225,

Section 51A, Petaling Jaya,

46100 Selangor.

Business Registration:

MyTeksi Sdn. Bhd. - 201101025619

GrabCar Sdn. Bhd. - 201401013360