Check your Grab-registered email

Tekan di sini untuk versi Bahasa Melayu

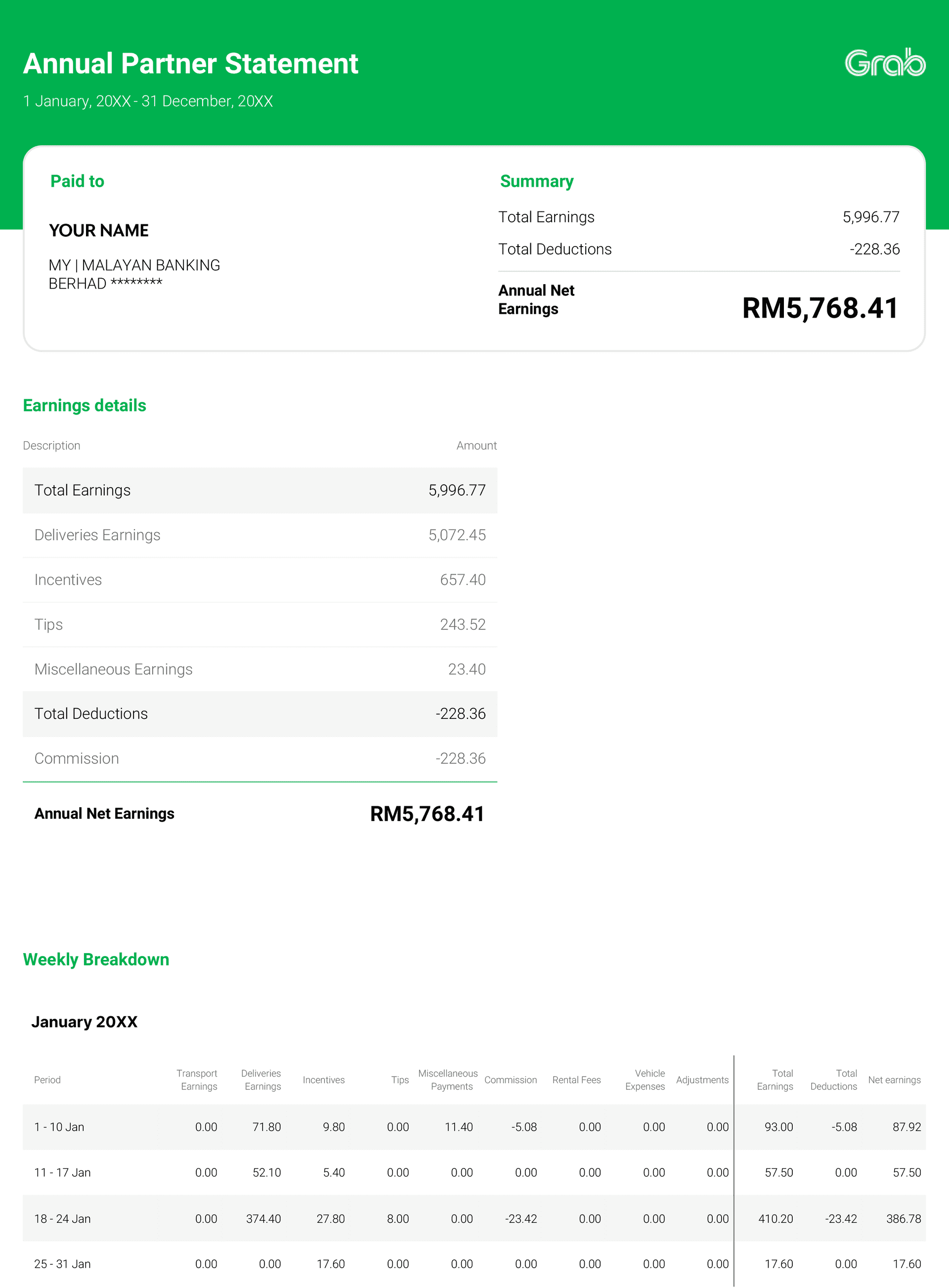

As reference for your income tax filing, we will send your Annual Partner Statement.

It will be available for you to view/download from your Grab-registered email. Here’s how it looks like:

What can I claim for my tax filing?

You can submit your Grab earnings for your income tax filing by putting in your annual net earnings amount in the income field of Form B (e-B) (Receive Income from Business/Knowledge or Expert Worker).

Here are some of expenses that you can claim as a Grab partner:

- Fuel costs

- Car repairs and maintenance

- Car loan interest

- Zakat

- Other allowances under business and individual income

How to read your Annual Statement

FAQs

How will I receive an Annual Partner Statement?

Your Annual Partner Statement will be sent to your registered email address with Grab.

What should I do if I did not receive my Annual Partner Statement?

Check your spam/junk mailbox if you do not see the Annual Partner Statement in your email inbox.

I am a part-time Grab Driver-Partner and I have already submitted tax filings in the previous years of assessment. Can I still declare my Grab earnings?

Yes, you just need to submit a letter in-person at the LHDN office with the net earnings you want to declare.

Kindly be reminded that all members of the Grab community are required to follow the Code of Conduct and Terms of Services.