Grab delivers a cashless and seamless ride experience to everyone with GrabPay Credits

Grab today launched GrabPay Credits, which delivers a new cashless stored value option allowing top-ups via a variety of widely available local funding sources to its GrabPay in-app mobile payment solution.

- Enables everyone to enjoy greater convenience with cashless payments

- Encourages move towards a cashless society and improves safety by reducing dependence on physical cash

- Supports Grab’s vision to be the region’s leading payments platform

Jakarta, 29 November 2016 – Grab today launched GrabPay Credits, which delivers a new cashless stored value option allowing top-ups via a variety of widely available local funding sources to its GrabPay in-app mobile payment solution. GrabPay Credits now allows everyone in Southeast Asia to experience the convenience of cashless payments for a more seamless ride experience by easily topping up their balance through local banks, ATMs and stores. Launching first in Indonesia and Singapore, GrabPay Credits will be available in all remaining countries across Southeast Asia in the coming weeks.

Southeast Asia is still a largely cash-based transaction economy. A large proportion of the region’s 620 million people remain unbanked, with the World Bank noting that only 27 percent have a bank account while only nine percent of adults have a credit card.[1] In line with Grab’s mission to make safe, affordable transportation accessible to everyone, the launch of its new proprietary method of cashless payment GrabPay Credits provides all consumers across the region with greater access to cashless payments for their mobility needs.

“We believe mastering cashless payments is critical to our mission of ‘driving Southeast Asia forward’ to improve people’s well-being and accelerate the move to an increasingly cashless society. Grab wants to be the region’s leading payments platform and we believe we are uniquely well positioned to do so, as we are one of the most frequently used mobile platforms with up to 1.5 million daily bookings. Since launching GrabPay in January 2016, the convenience of cashless rides has been winning over more customers, as seen by our continuous double digit growth, month-on-month. Grab is built on providing accessibility and safety to everyone, which has spurred our interest in offering GrabPay Credits to allow everyone, everywhere, the convenience of going cashless for more seamless rides,” said Tan Hooi Ling, Co-founder of Grab.

With GrabPay Credits in Indonesia, customers can top-up online or at thousands of top-up locations via the following options:

- Local ATM networks including ATM Alto, ATM Bersama, ATM Prima, BCA, BNI, BRI, CIMB Niaga, PermataBank

- Online bank transfers from BCA, BNI, BRI, CIMB Niaga, Permata Bank

- Popular e-Money accounts including Doku Wallet

- Convenience stores including Alfamart, Dan+Dan and Lawson

- Credit and debit cards including Visa and MasterCard

GrabPay Credits can be purchased at fixed denominations of IDR50,000, IDR100,000 and IDR200,000 or a variable amount between IDR50,000 to IDR999,999. For safety and compliance reasons, GrabPay Credits may only be used for Grab rides from the country of purchase.

Ridzki Kramadibrata, Managing Director, Grab Indonesia said, “GrabPay Credits now allows us to extend the safety and convenience of going cashless to more of our passengers and drivers. Passengers no longer have to trouble themselves with fumbling for cash or waiting for change at the end of every ride, making the rides as simple as a hop-in and hop-out. At the same time, drivers can reduce the cash they carry with them and not worry about having the right amount of change while focusing on providing the best ride experience to our passengers.”

With safety as its core, Grab implements global standards and practices to secure and maintain our low fraud rate in line with industry best practice rates. Grab’s proprietary risk and fraud detection system is also enhanced with sophisticated machine learning that progressively builds on the cumulative knowledge of transactions, its users and travel patterns to enable the largest mobile transaction volume on any Southeast Asian consumer platform.

“Through working with local banks, payment providers and merchants, Grab is building one of the region’s largest cashless payment solutions for people with limited access to the banking system. GrabPay now makes cashless payments available to almost everyone in Southeast Asia. We intend to continue building hyperlocal services region-wide, by Southeast Asians, for Southeast Asia,” added Ridzki.

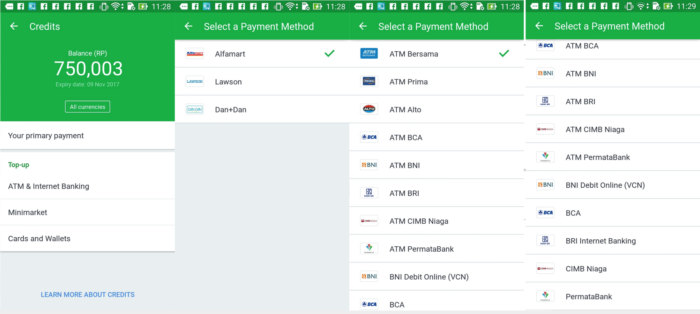

Figure 1: Selecting a Payment Method to Top-up GrabPay Credits

Passengers can top up and use GrabPay Credits as their payment method using the following steps:

- On the GrabPay menu, select “Top-up Credits”.

- On the Credits page, select the top-up value and the preferred payment method which will indicate the list of options available.

- Follow the instructions for the particular payment method selected.

- Once the top-up is successful, a pop-up screen will appear with details on the transaction.

- The Credits screen reflects the new total balance.

In addition to GrabPay Credits, passengers can now choose to pay in cash or make cashless payments for rides with credit and debit cards, Doku Wallet in Indonesia, AliPay in Thailand and Singapore, Android Pay in Singapore.

###

About Grab

Grab is Southeast Asia’s leading ride-hailing platform. Grab solves critical transportation challenges to make transport freedom a reality for 620 million people in Southeast Asia. Grab began as a taxi-hailing app in 2012, but has expanded its core product platform to include private cars and motorbikes. Grab is focused on pioneering new commuting alternatives for drivers and passengers with an emphasis on convenience, safety and reliability. As part of its innovative culture, Grab is testing new services such as social carpooling, as well as last mile and food deliveries. Grab currently offers services in Singapore, Indonesia, Philippines, Malaysia, Thailand and Vietnam. For more information, please visit: http://www.grab.com.

For high-res images of GrabPay Credits, please visit this link

For more information, please contact:

Ekhel Chandra Wijaya Dewi Nuraini

PR Manager for GrabTaxi & GrabCar PR Manager for GrabBike & GrabExpress

ekhel.liu@grab.com dewi.nuraini@grab.com

[1] The Global Findex Database 2014, Measuring Financial Inclusion around the World, the World Bank Group, URL.

Media Inquiries

Contact the Grab media teamFollow us on Grab social channels

Inside Grab

Explore Grab’s official blogEngineering Stories

Learn more about our technology developmentGrab Beta Launches GrabRewards to Make Rides Even More Rewarding

Grab today unveiled GrabRewards, Southeast Asia’s first regional loyalty programme for ride-hailing passengers, capping off a successful year for Southeast Asia’s leading ride-hailing company.

Grab Launches In-app Instant Messaging Service GrabChat for Ride-hailing across Southeast Asia

Grab today announced the availability of GrabChat, an instant messaging platform built within the app, across all its locations in Southeast Asia to provide a more seamless and speedier pickup to drivers and passengers.