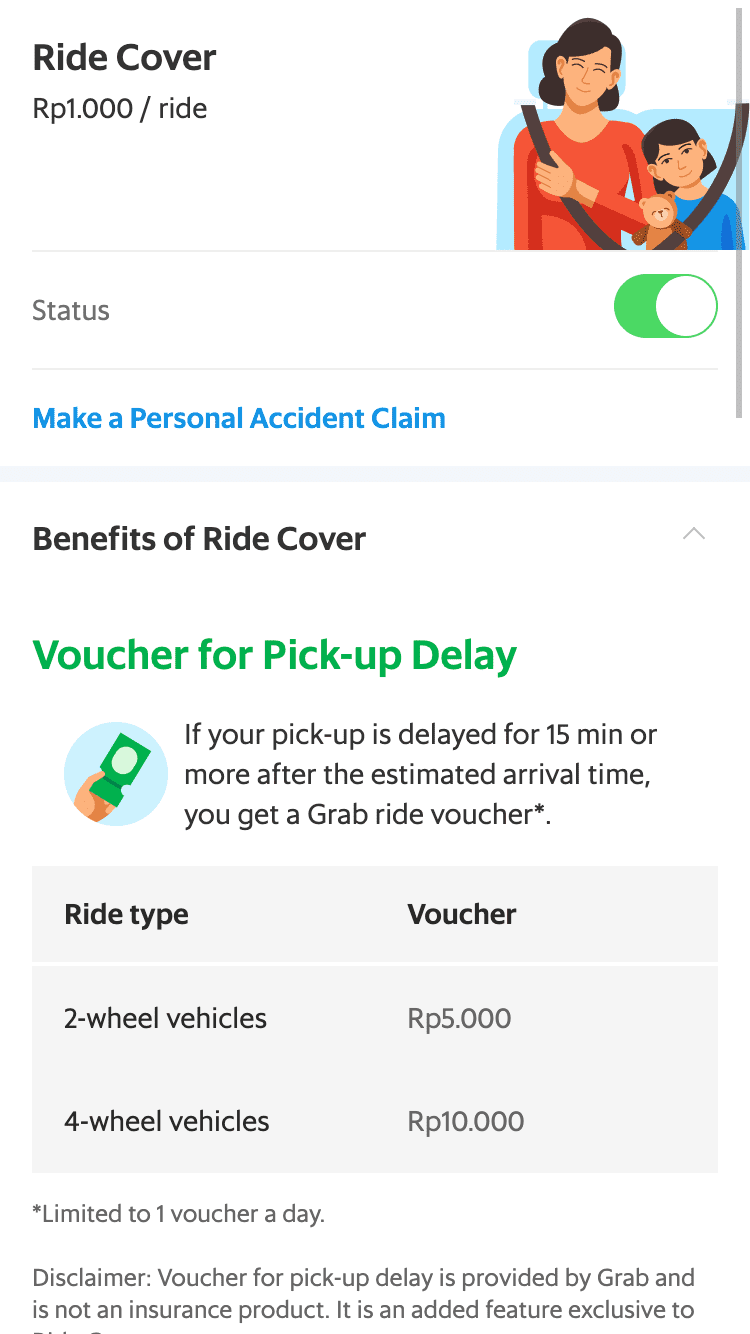

With Ride Cover, you’ll be eligible for a Delay Voucher if your Grab driver arrives 15 minutes after the estimated time of arrival. You’ll get a Rp10.000 ride voucher for pickup delays on all GrabCar rides, and a Rp5.000 ride voucher for GrabBike delays.

Plus, you will also enjoy free Personal Accident Insurance with benefits up to Rp350.000.000 on top of Grab’s existing coverage.

How Ride Cover works

Simply opt in to Ride Cover for Rp1.000 per trip. Upon opt in, Rp1.000 will be added to subsequent eligible fares.

In the event of an unforeseen accident, easily re-trace your ride in-app to file a claim.

| You’ll be compensated if | You’ll receive |

|---|---|

| Your pickup is delayed more than 15 minutes after the estimated arrival time | GrabCar passengers: You will receive an Rp10.000 ride voucher applicable to all Grab rides.

GrabBike passengers: You will receive an Rp5.000 ride voucher applicable to all Grab rides. The voucher will be added to "My Rewards" once your eligible journey has been completed; your voucher will be valid for six months |

| You get into an accident during your eligible Grab ride | A claim of up to Rp350.000.000 for death or permanent disability, on top of Grab's existing coverage* |

* Based on Grab's personal accident protection package for eligible trips, GrabCar passengers & GrabBike passengers get insurance for death and permanent disability due to accidents of up to IDR 50,000,000.

Extra protection made extra convenient

Enhanced protection

Get extra personal accident coverage of up to Rp350.000.000

Protection when you need it

One time opt in via the Grab app

Affordable peace of mind

Get covered for only Rp1.000 per ride

How To Opt In

You can first opt in to Ride Cover when you book a ride. Subsequently, Ride Cover can be accessed through the insurance tile.

-

Open your Grab App, tap on ‘Insurance’ in the homepage screen

-

Tap on ‘View’ (Ride Cover)

-

Simply toggle to opt in, and you're done!

Frequently Asked Questions (FAQ)

Got a question?

You can contact Grab customer support at:

Hotline: +62 21 8064 8767 (24/7 hotline)

You can also visit our Help Centre for more information.

Chubb has three insurance operations in Indonesia: general insurance, life insurance and sharia general insurance. Its general insurance operation (PT Chubb General Insurance Indonesia) provides a comprehensive range of general insurance solutions for individuals, families and businesses, both large and small. With strategically located offices, the company offers its products and services through a multitude of distribution channels, including banks, multi-finance companies, brokers and independent distribution partners. Its general insurance offerings are complemented by an array of sharia general insurance products via its subsidiary company, PT Asuransi Chubb Syariah Indonesia (Chubb Syariah), and life insurance products via its sister company, PT Chubb Life Insurance Indonesia (Chubb Life).

More information can be found at www.chubb.com/id.

The Personal Accident Insurance (“Insurance Product”) is undertaken by PT Grab Teknologi Indonesia as master policyholders of the Insurance Product. The Insurance Product is underwritten by PT Chubb General Insurance Indonesia. Please note that PT Chubb General Insurance Indonesia and PT Grab Teknologi Indonesia may agree to make changes to the Insurance Product from time to time without prior notice to you.

PT Chubb General Insurance Indonesia is registered and supervised by Otoritas Jasa Keuangan.