Grab delivers cashless and seamless ride experience with GrabPay Credits

Grab today launched GrabPay Credits, which delivers a new cashless stored value option allowing top-ups via a variety of widely available local funding sources to its GrabPay in-app mobile payment solution. GrabPay Credits now allows everyone in Southeast Asia to […]

Grab today launched GrabPay Credits, which delivers a new cashless stored value option allowing top-ups via a variety of widely available local funding sources to its GrabPay in-app mobile payment solution. GrabPay Credits now allows everyone in Southeast Asia to experience the convenience of cashless payments for a more seamless ride experience by easily topping up their balance through local banks, ATMs and stores. Launching first in Indonesia and Singapore, GrabPay Credits will be available in all remaining countries across Southeast Asia, including the Philippines, in the coming weeks.

Southeast Asia is still a largely cash-based transaction economy. A large proportion of the region’s 620 million people remain unbanked, with the World Bank noting that only 27 percent have a bank account while only nine percent of adults have a credit card.[1] In line with Grab’s mission to make safe, affordable transportation accessible to everyone, the launch of its new proprietary method of cashless payment, GrabPay Credits, provides all consumers across the region with greater access to cashless payments for their mobility needs.

“We believe mastering cashless payments is critical to our mission of ‘driving Southeast Asia forward’ to improve people’s well-being and accelerate the move from cash to an increasingly cashless society. Grab wants to be the region’s leading payments platform and we believe we are uniquely well-positioned to do so, as we are one of the most frequently used mobile platforms with 1.5 million daily bookings. Since launching GrabPay in January 2016, the convenience of cashless rides has been winning over more consumers, as seen by our continuous double digit growth, month-on-month. Grab is built on providing accessibility and safety to everyone, which has spurred our interest in offering GrabPay Credits to allow everyone, everywhere, the convenience of going cashless for more seamless rides,” said Tan Hooi Ling, Co-founder of Grab.

By enabling GrabPay Credits in the Philippines, topping up will be available at thousands of top-up locations across the country via the following options:

- Local ATMs including BDO, Chinabank, RCBC, Landbank, PNB, Security Bank and UCPB

- Bank Transfers from BDO, BPI, Metrobank, Chinabank, Landbank, RCBC, Unionbank, UCPB, Eastwest, PNB, Security Bank, RuralNet Bank, Maybank and Sterling Bank of Asia

- Popular e-Money accounts including GCash and Dragonpay

- Credit and debit cards

- Bill Payment Centers like Bayad Center, ECPay, LBC, Cebuana Lhuillier, M Lhuillier, Savemore Bills Payment, SM Bills Payment and Robinsons

GrabPay Credits can be purchased at fixed denominations of Php 200, Php 500 and Php 1000 or a variable amount between Php 200 to Php 7,000. For safety and compliance reasons, GrabPay Credits may only be used for Grab rides from the country of purchase.

Brian Cu, Country Head of Grab Philippines, said, “GrabPay Credits now allows us to extend the safety and convenience of going cashless to more of our passengers and drivers. Passengers no longer have to trouble themselves with fumbling for cash or waiting for change at the end of every ride, making the rides as simple as a hop-in and hop-out. At the same time, drivers can reduce the cash they carry with them and not worry about having the right amount of change while focusing on providing the best ride experience to our passengers.”

With safety as its core, Grab implements global standards and practices to secure and maintain our low fraud rate in line with industry best practice rates. Grab’s proprietary risk and fraud detection system is also enhanced with sophisticated machine learning that progressively builds on the cumulative knowledge of transactions, its users and travel patterns to enable the largest mobile transaction volume on any Southeast Asian consumer platform.

“Through working with local banks, payment providers and merchants, Grab is building one of the region’s largest cashless payment solutions for people with limited access to the banking system. GrabPay now makes cashless payments available to almost everyone in Southeast Asia. We intend to continue building hyperlocal services region-wide, by Southeast Asians, for Southeast Asia,” added Tan.

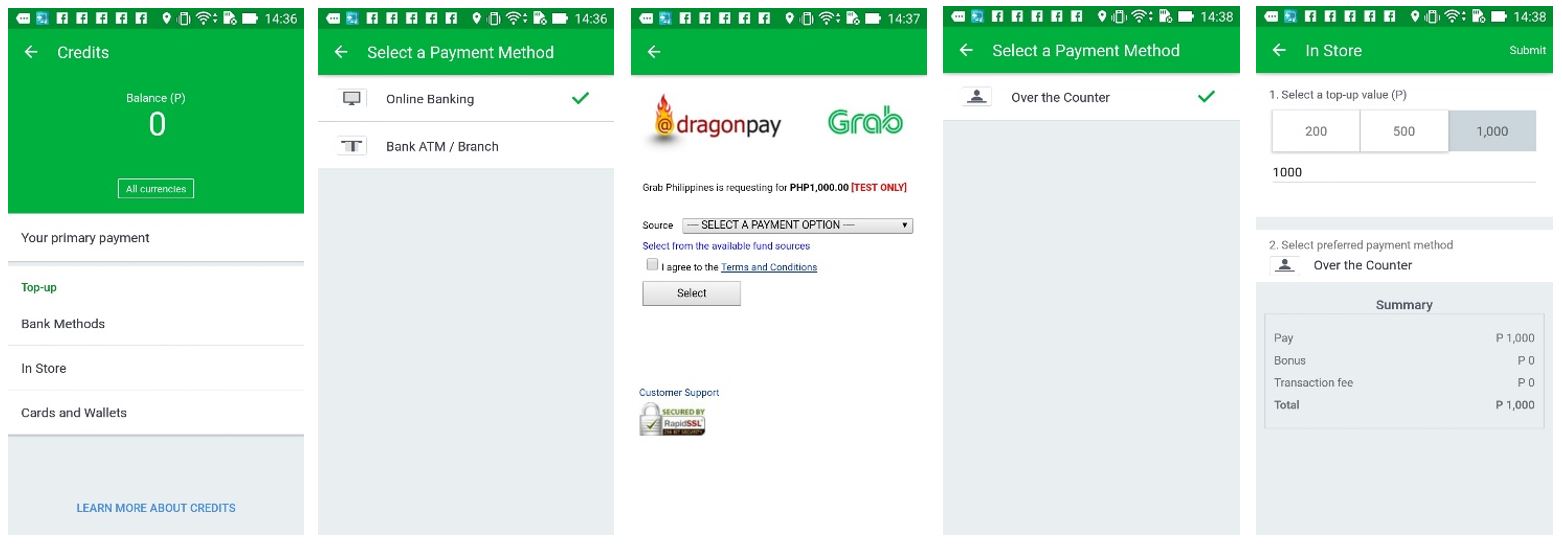

Passengers can top up and use GrabPay Credits as their payment method using the following steps:

- On the GrabPay menu, select “Top-up Credits”.

- On the Credits page, select the top-up value and the preferred payment method which will indicate the list of options available.

- Follow the instructions for the particular payment method selected.

- Once the top-up is successful, a pop-up screen will appear with details on the transaction.

- The Credits screen reflects the new total balance.

In addition to GrabPay Credits, passengers can now choose to pay in cash or make cashless payments for rides with credit and debit cards in the Philippines.

[1] The Global Findex Database 2014, Measuring Financial Inclusion around the World, the World Bank Group, URL.

Media Inquiries

Contact the Grab media teamFollow us on Grab social channels

Inside Grab

Explore Grab’s official blogEngineering Stories

Learn more about our technology developmentGrab Beta Launches GrabRewards to Make Rides Even More Rewarding

Grab today unveiled GrabRewards, Southeast Asia’s first regional loyalty programme for ride-hailing passengers, capping off a successful year for Southeast […]

Grab Launches In-app Instant Messaging Service GrabChat for Ride-hailing across Southeast Asia

Step 1: After making a booking, the GrabChat icon will appear on screen. Step 2: Click the […]