Grab Launches Peer-to-Peer Fund Transfer in GrabPay Mobile Wallet in the Philippines

#GiveGrab on Christmas day! New in-app feature enables Filipinos to share a gift of cashless rides to one another

Manila, Philippines – Grab, the leading on-demand transportation and mobile payments platform in Southeast Asia, today launched its new peer-to-peer (P2P) fund transfer feature.

No need for something shiny, slimy and other strange Kris Kringle gifts. This holiday season, Grab has something hassle-free for its passengers. Grab enables passengers to send GrabPay Credits to one another, making way for instant, simple and secure gift-giving. Grab passengers can now share the gift of cashless rides – and rewards that come in every ride booking – even without a debit or credit card.

“Despite the availability of multiple payment channels, Philippines is still predominantly driven by cash transactions. The fear of overspending hinders Filipinos from going cashless. As a result, they miss out on a lot of benefits and perks that add more value to every transaction,” said Jason Thompson, Head of GrabPay.

“Most Filipinos still do not have credit and debit cards. We’re very happy to have launched GrabPay Credits to serve more Filipino passengers. Now with Peer-to-peer fund transfer available, we hope to encourage more passengers to expand the use of GrabPay as a mobile wallet. This holiday season, we also hope to open them up to exclusive offers and benefits from GrabRewards,” added Thompson.

Grab also introduced a new six-digit GrabPay PIN as a second factor authentication (2FA) to make its GrabPay mobile wallet more secure. Consumers with more than Php 1000 worth of credits in their GrabPay account are required to activate the PIN. The Grab app will automatically prompt users to input their pin number when it detects any unusual activities, such as the app being used in a different country.

Peer-to-peer fund transfer with GrabPay

GrabPay Credits is a cashless stored value option offered within the Grab app. With the instant fund transfer feature, consumers can transfer money immediately to another person. Benefits include:

- Immediacy: Fund transfer is instant on Grab. Users can expect to receive payment within seconds.

- Simplicity: A phone number and a Grab app are all that’s needed to make a transfer. There’s no need to memorize and key in a long string of bank account numbers, branch code and other details.

- Security: Users who prefer not to share their mobile numbers with others can still receive funds through their unique QR code within the Grab app.

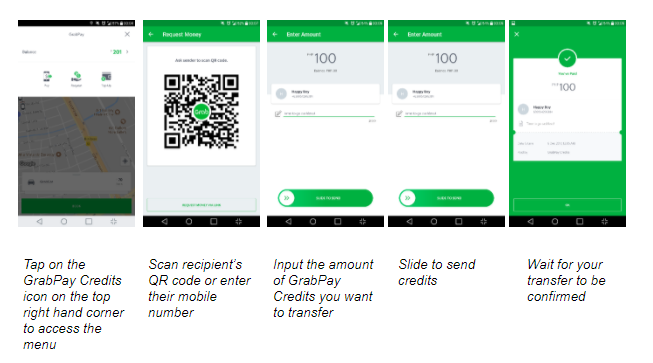

To send credits:

- Scan the recipient’s QR code if within proximity. All Grab users have a unique QR code that can be found within the Grab app.

- To transfer funds remotely, search for your contact in your phone address book, or key in mobile phone details of the recipients. Funds will be transferred as long as the user is on Grab.

To receive credits:

- If nearby, open the Grab app, launch the QR code and let the sender scan it. Otherwise, a notification will be sent to the recipient following a successful transfer, whether it’s via a QR code or a mobile number.

Media Inquiries

Contact the Grab media teamFollow us on Grab social channels

Inside Grab

Explore Grab’s official blogEngineering Stories

Learn more about our technology developmentGrab Beta Launches GrabRewards to Make Rides Even More Rewarding

Grab today unveiled GrabRewards, Southeast Asia’s first regional loyalty programme for ride-hailing passengers, capping off a successful year for Southeast […]

Grab Launches In-app Instant Messaging Service GrabChat for Ride-hailing across Southeast Asia

Step 1: After making a booking, the GrabChat icon will appear on screen. Step 2: Click the […]