Financial scams are on the rise, but there are 6 things you can do to make it much harder for thieves:

1

Never share your One Time Password (OTP)

Your One Time Password (OTP) is the first line of defense against potential fraudsters. Do not share your One Time Password (OTP) with anyone under any circumstances.

Most banks and payment companies have the ability to send you alerts when you make a purchase, pay or withdraw money using their payment platform. Please subscribe to these instant alerts — it can be annoying at times, but its important.

2

Never share your Password

Do not give your Password to anyone and don’t write it down anywhere. If you must write them down, store your list in a secure and private place.

Be vigilant when you shop online at public places to ensure you are not accidentally revealing your password to anyone.

3

Never share your Reset password link

Your reset password link is a powerful tool for fraudsters who have secured your email ID through nefarious means like phishing or vishing. Please ensure the security questions for your account are strong and consistent. A strong password is useless if a fraudster can answer all your security questions after a quick trip to your social media accounts.

Change your passwords and PINs regularly to make it harder for any fraudster to access your information.

Remember:

- No-one should be asking for your password

A reputable company will never ask for your password or bank PIN, either over the phone or by email. If they need you to reset your password, they’ll send you a link to a secure page on their official site, which will allow you to do it safely. You also shouldn’t have to give any individual person your password or PIN number.

- Fraudsters often use threats

In order to try to spur the victim into action, scammers may include threats in their calls. For example, they could say that your bank account will be permanently deleted if you don’t reset your password through a link that they’ve provided.

- If the deal seems too good to be true, it is indeed

Be cautious when you come across promotional offers that sound too good to be true. Fraudsters will claim to be from a real company with fake offers, or that you won a lucky draw.

4

Don’t make financial transactions on open public networks

Most public hotspots in public areas like airports, hotels and restaurants lower their security standards so it becomes easier for guests and travellers to access and use these networks. That makes it easier for fraudsters to eavesdrop on these unsecured Wi-Fi networks and try to intercept your information.

5

Set strong and unique passwords for every account

Great password security is one of the easiest ways to protect your account. Use strong passwords and PINs that contain both numbers, letters and symbols.

Create a unique password for every account. That way, one data breach won’t put all your accounts at risk.

6

Use apps wisely

If you use mobile apps on your smartphone to access your financial accounts, be sure to password-protect your device.

Be wary of free apps because it might be accompanied by spyware. Every time you download apps or files from an unknown source, you risk loading malicious programs on your phone. Only download legitimate and credible apps from the Google Play Store and Apple Store.

Your security and privacy is our priority.

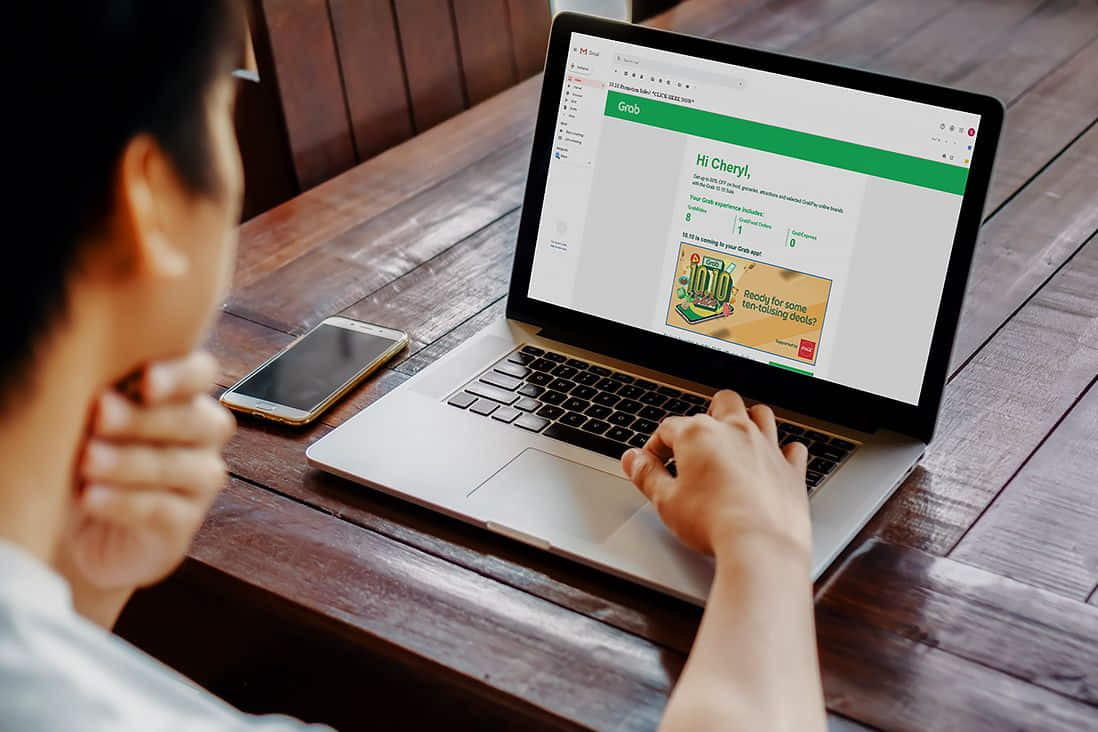

Activate GrabPay, a safe way to pay and keep your money.

Read other articles.

Learn about phishing and legitimate communications

Grab will never ask for your password or OTP over calls, sms or email.

Why is verifying your account and setting up GrabPIN important

GrabPIN and biometrics adds an additional layer of authentication to access your funds

Forward Together

Level 27F/28F Exquadra Tower,

Lot 1A Exchange Road corner Jade Street,

Ortigas Center, Pasig City, Philippines

GPay Network PH Inc. (GrabPay) is regulated by the Bangko Sentral ng Pilipinas.