Hi Merchant-Partners!

We just want touch base with some important info regarding the amended BIR Revenue Regulation 2-98 (under Revenue Regulations No. 16, 2023). You might be wondering what exactly is this regulation? This focuses on the withholding tax on gross remittances made by e-marketplace operators and digital financial services providers (DFSPs), such as GrabFood and/or GrabMart, to sellers/merchants.

According to the revenue regulation, starting April 15, 2024,

- Credit withholding tax (CWT) of 1% on one-half of the gross remittances made by e-marketplace operators and DFSPs to sellers/merchants for goods and services paid through the platform/facility. (ex: P5 for P1,000 to be remitted)

- All online merchants must be BIR-registered on or before joining an e-marketplace platform.

- E-marketplace platforms shall require from their sellers/merchants the submission of their BIR-issued Certificate of Registration (CoR) / BIR Form 2303 and Sworn Declaration, if applicable

- Mobile payment service/e-wallet used for customer payments must be for the account of the seller/merchant’s BIR-registered trade name (e.g. Customer pays to a restaurant’s BIR-registered GCash account instead of the owner’s GCash number)

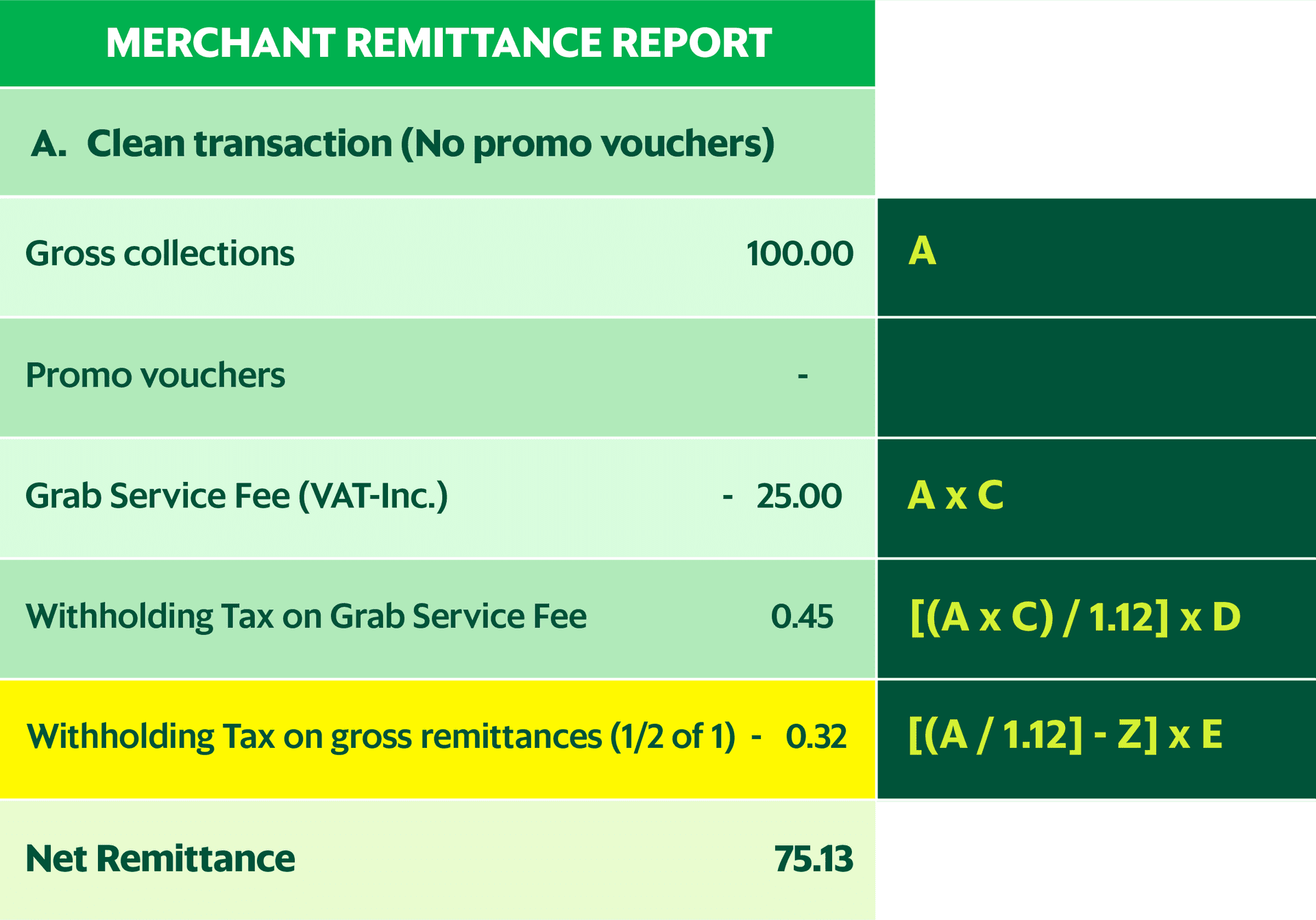

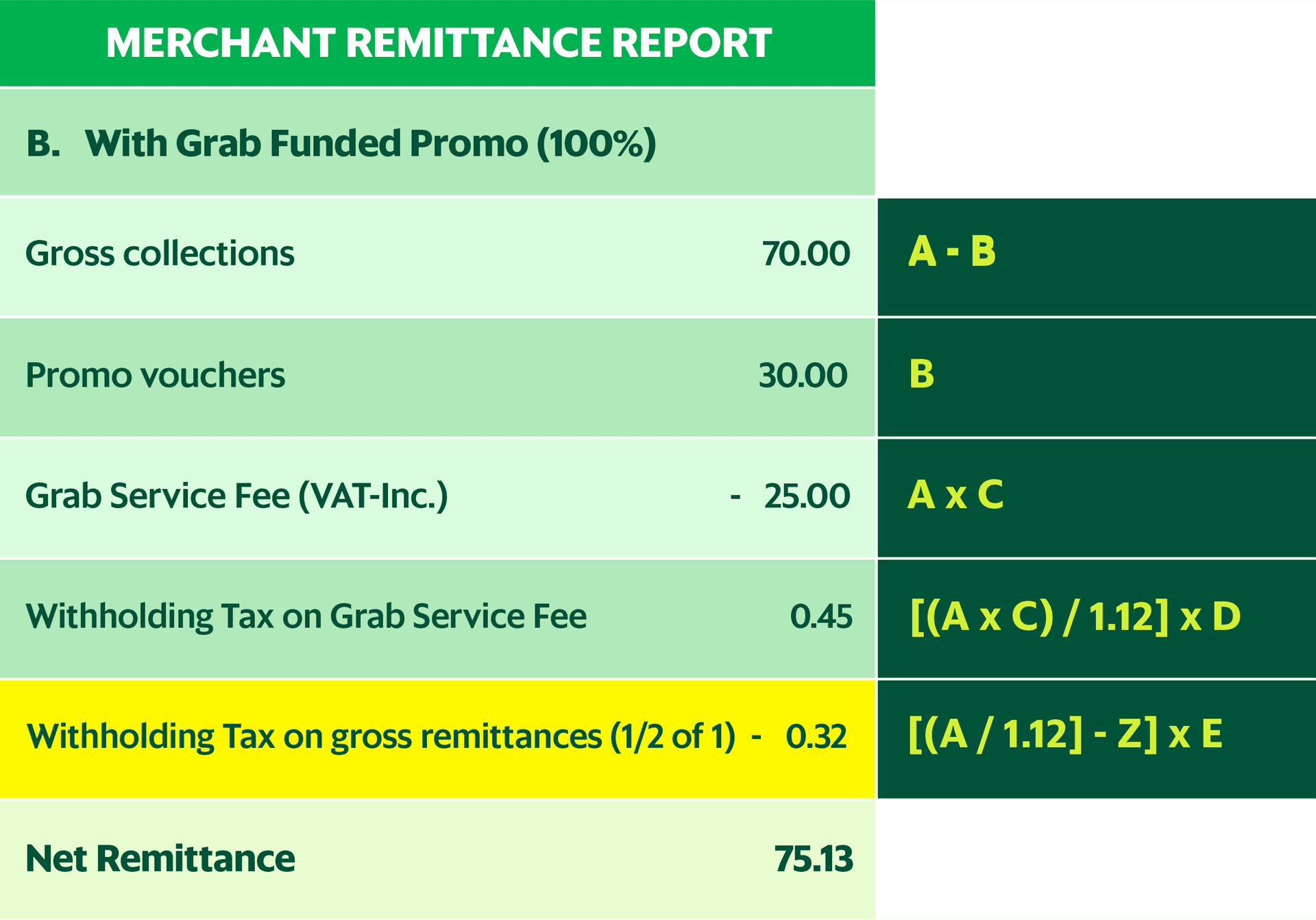

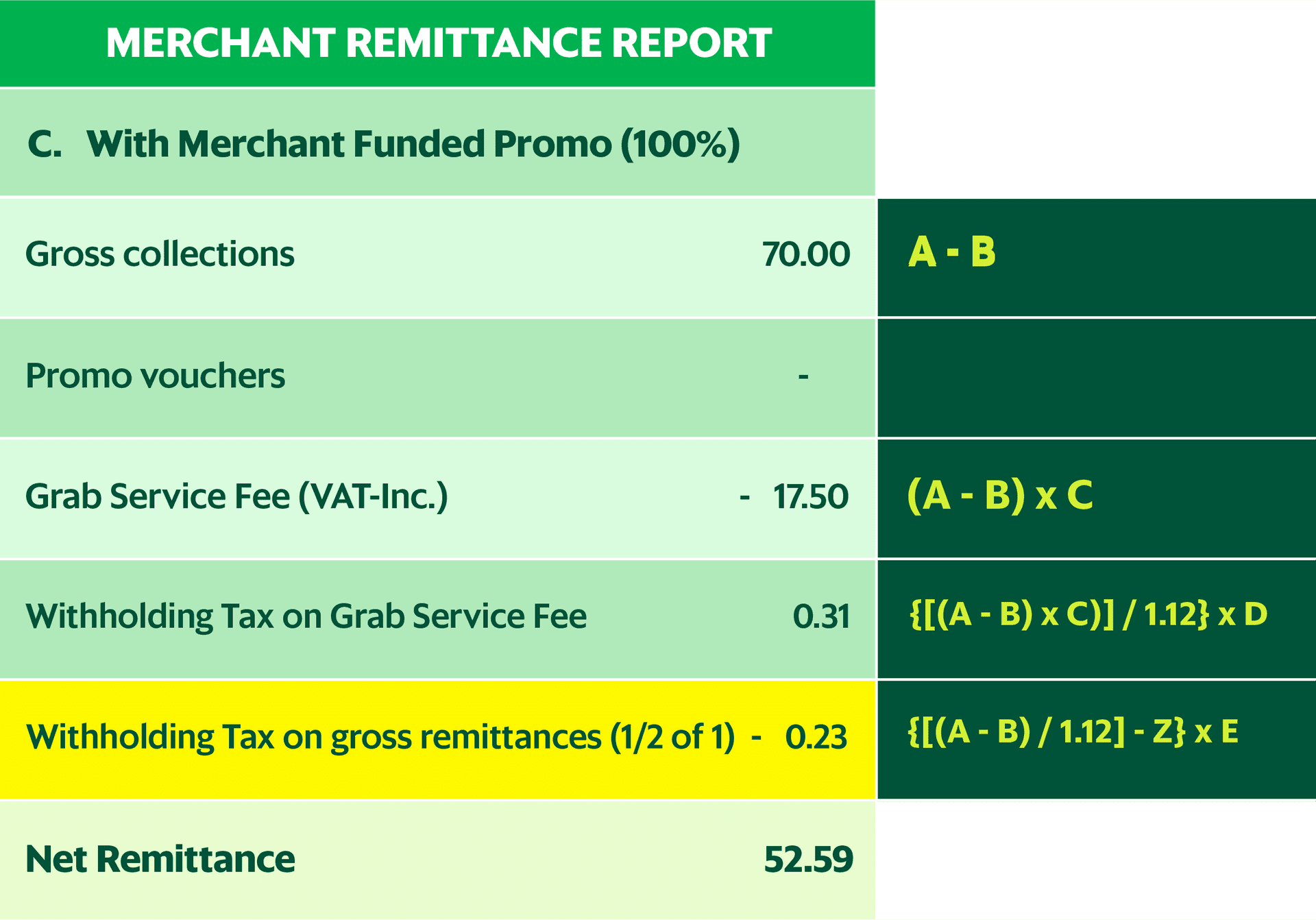

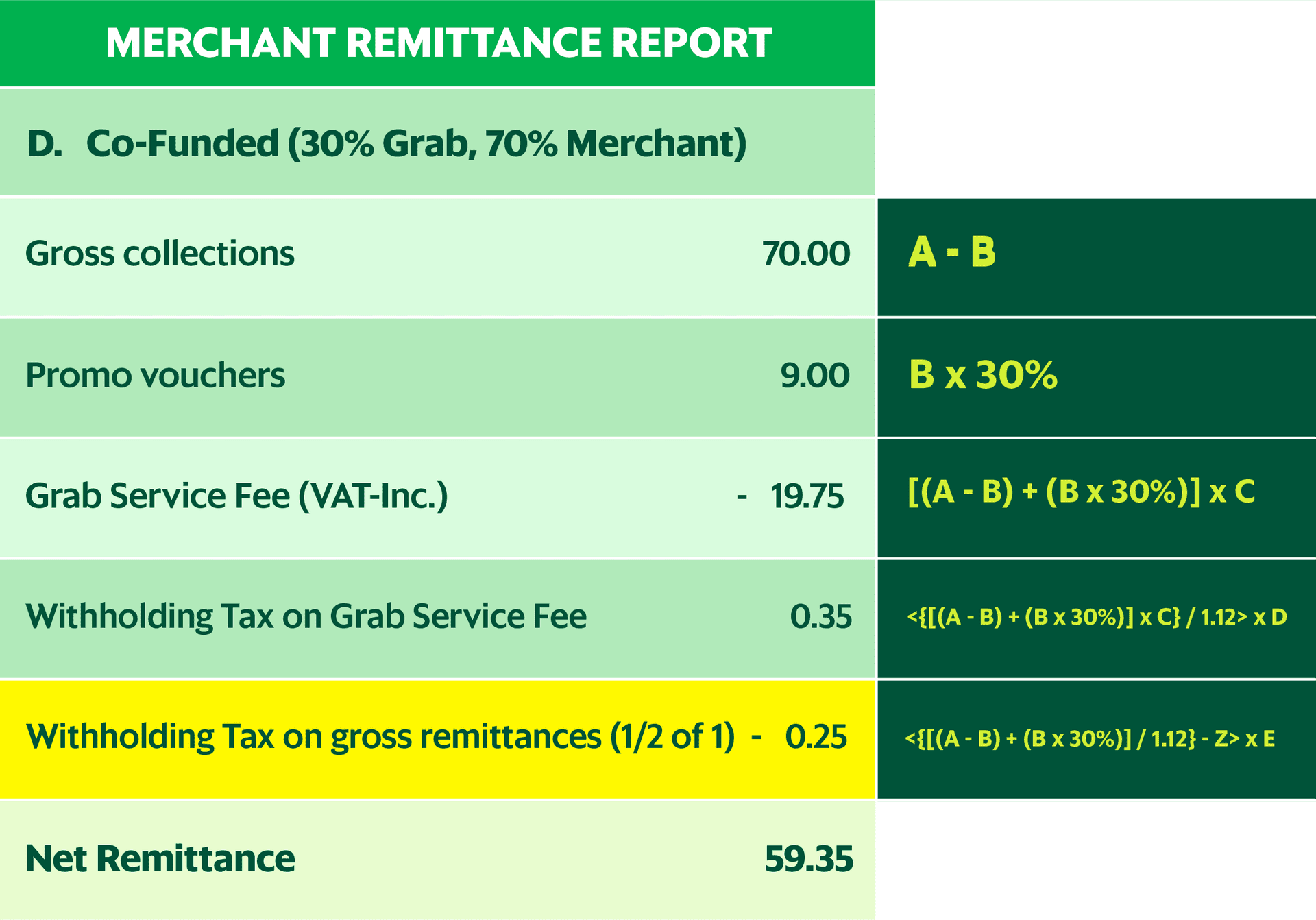

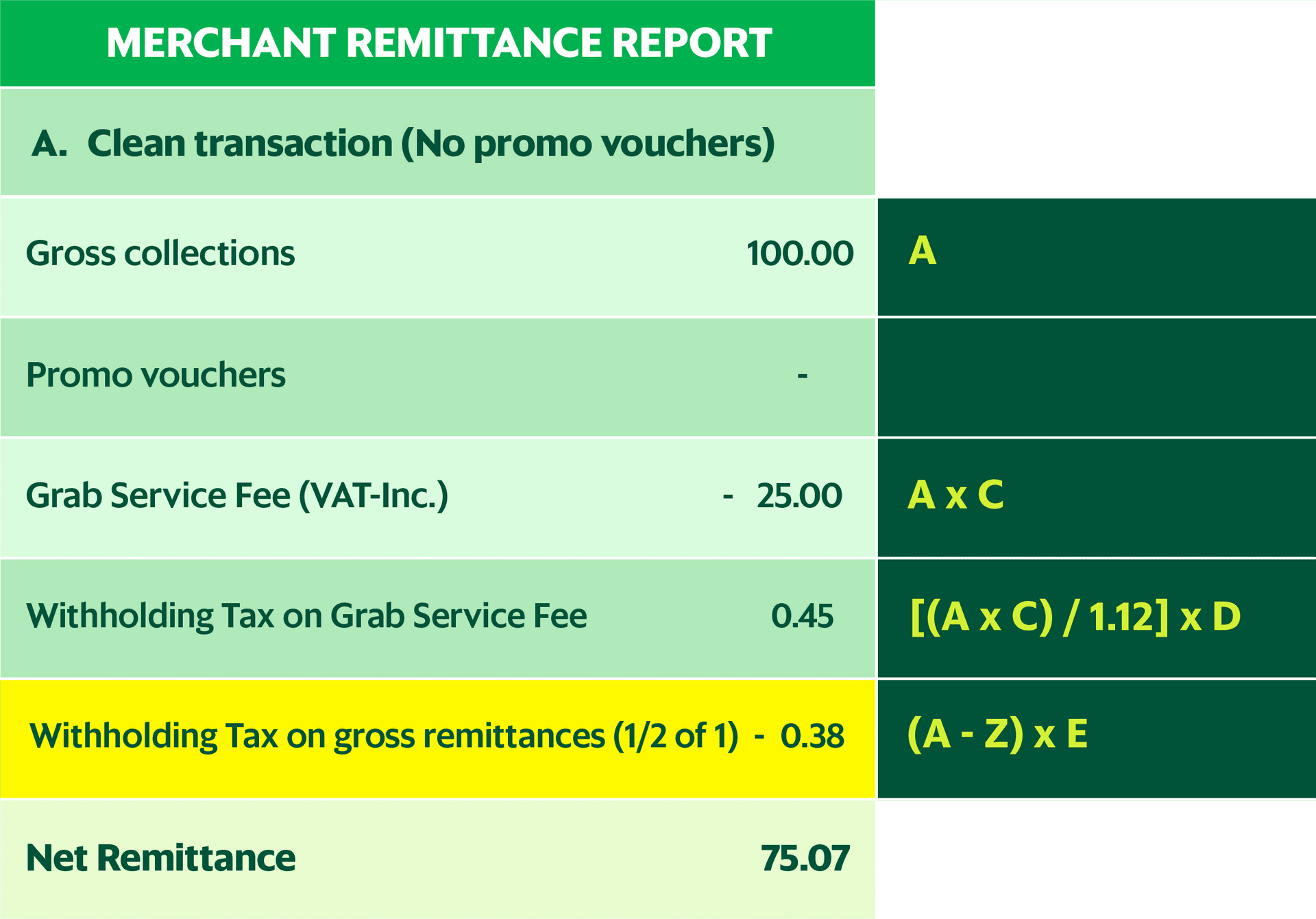

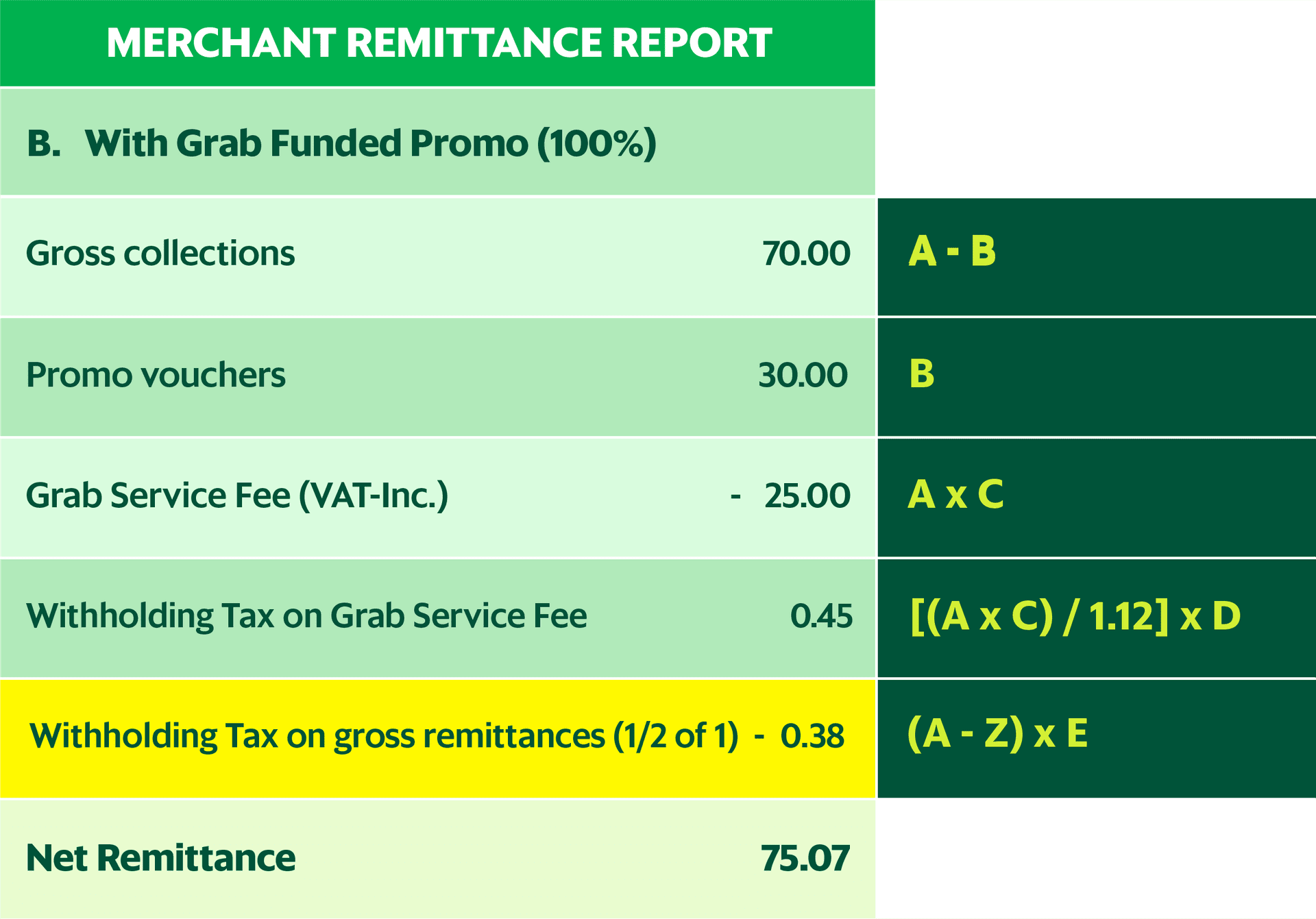

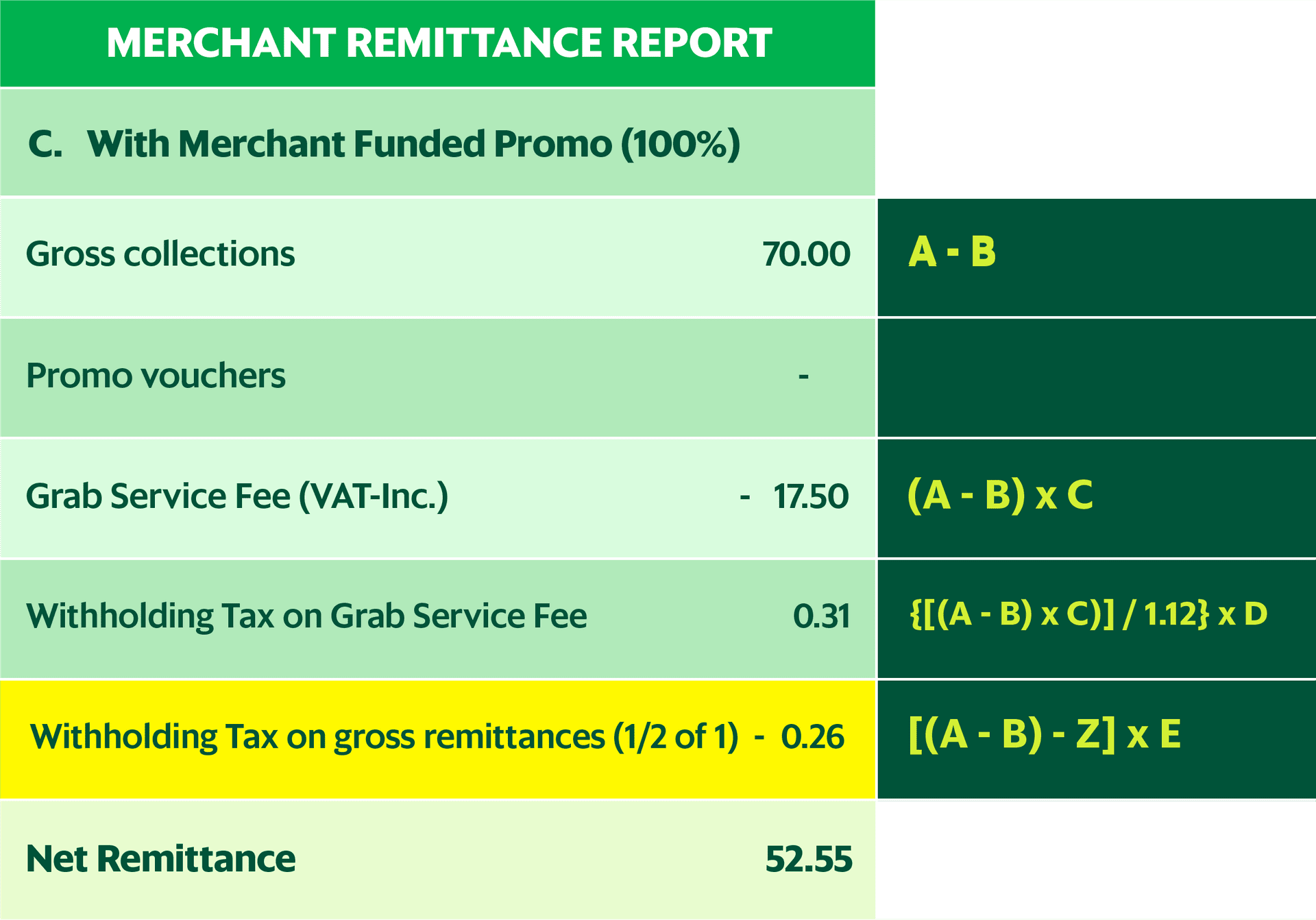

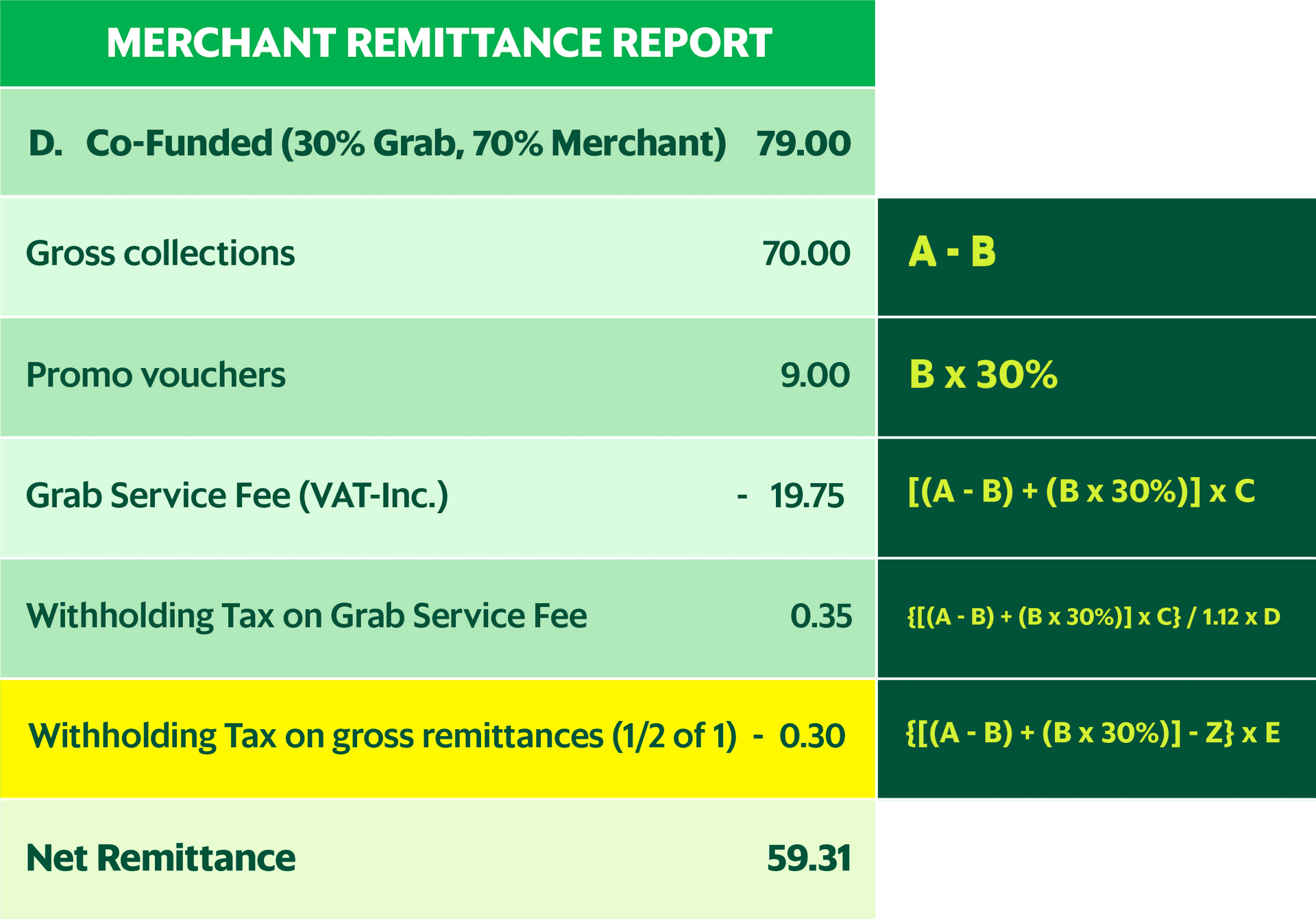

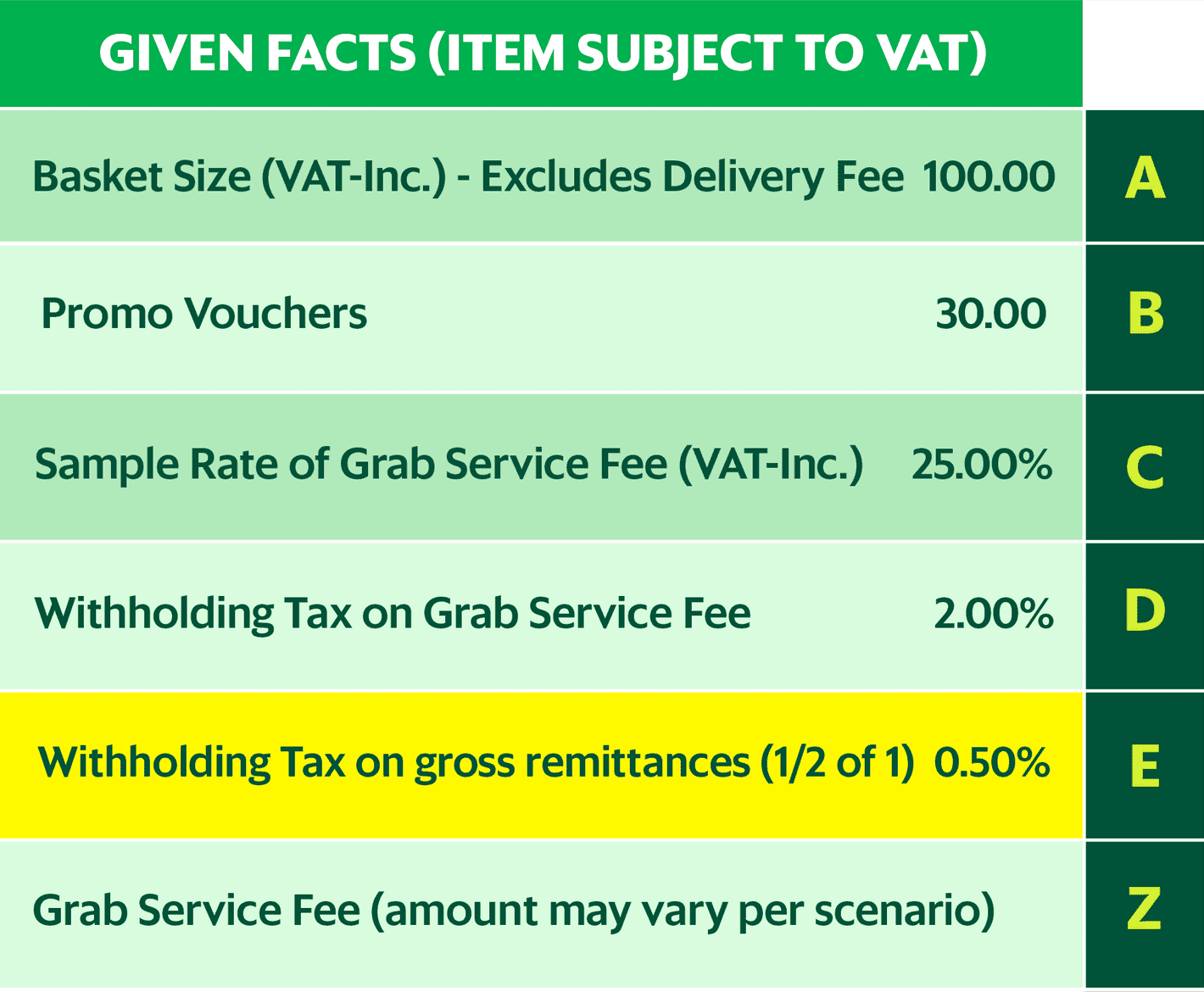

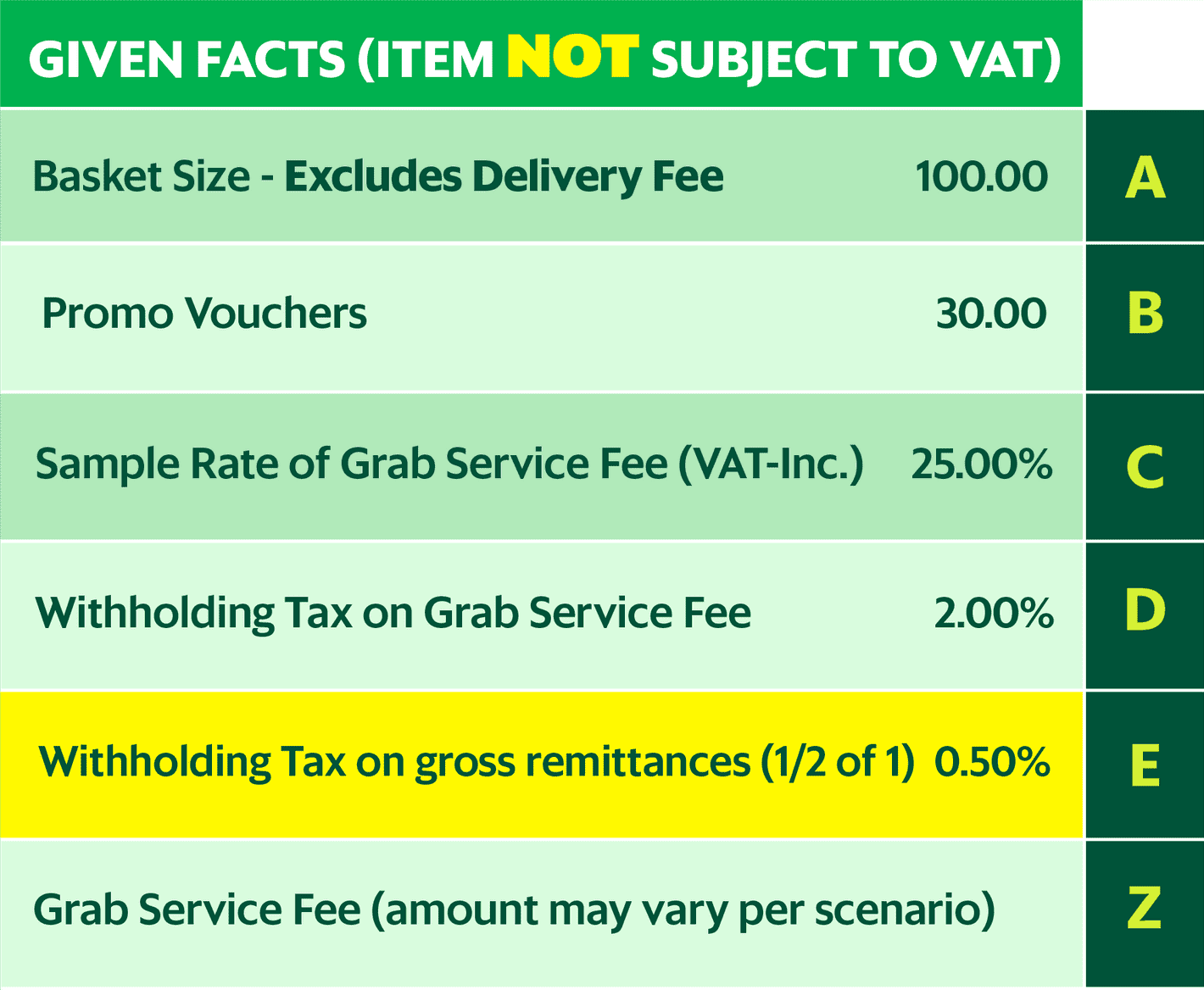

Here are the sample computations that you can follow. We split the examples for VAT in and VAT ex. Understanding these computations is key to ensure that you fully understood the regulation.

These given facts are your reference for the sample computations for VAT Inc. computation.

These given facts are your reference for the sample computations for non-VAT computation.

IMMEDIATE ACTION REQUIRED FROM MERCHANTS

To ensure compliance of merchants with the revised regulation, please submit the following requirements:

- Copy of Certificate of Registration (COR) of business with the BIR

- Submit a BIR-issued Certificate of Registration (CoR) / BIR Form 2303 and Sworn Declaration, if total annual gross remittances does not exceed P500,000 (VAT ex) by March 15, 2024. based on legal entities.

Additionally, it is advisable to consult with your tax advisors to assess the impact of these changes on your operations and to determine the appropriate adjustments needed.

For further details and clarification, we encourage you to refer to the amended BIR Revenue Regulation 2-98 or seek guidance from the Bureau of Internal Revenue (BIR).

EXEMPTION & CLARIFICATIONS

Your business is exempted if you fall under the following categories:

- Merchants who are duly exempted from or subject to a lower income tax rate

Gross remittances of P500,000 shall consist of the total amount of remittances received by an online merchant from ALL e-marketplace operators and DFSPs

- If e-marketplace has monitored and determined that gross remittances in its platform has exceeded P500K any time of the year, the prescribed withholding tax shall be automatically deducted and imposed on subsequent remittances.

“Gross remittance” excludes: discounts, shipping fee, VAT, and fee for using e-marketplace platform

WHAT ARE GRAB’S RESPONSIBILITIES?

Our team is dedicated to helping you through the process and ensure that all the required documents from your end will be submitted successfully.

Here are the responsibilities mandated by the Revenue Regulation that we are required to fulfill.

- Ensure all merchants are BIR-registered by requiring submission of COR

- Require merchants who are duly exempt from or subject to lower income tax rate to submit necessary certification/s as proof of entitlement

- Require merchants to submit BIR-received SD. If they fail to submit, withholding tax shall be automatically deducted

- Monitor the gross payments of buyers and deduct the withholding tax before remitting the same to the merchant

- Provide merchants the Certificate of Creditable Tax Withheld at Source (BIR Form No. 2307) within the prescribed period or upon request by merchant

HOW TO SUBMIT THE REQUIREMENTS?

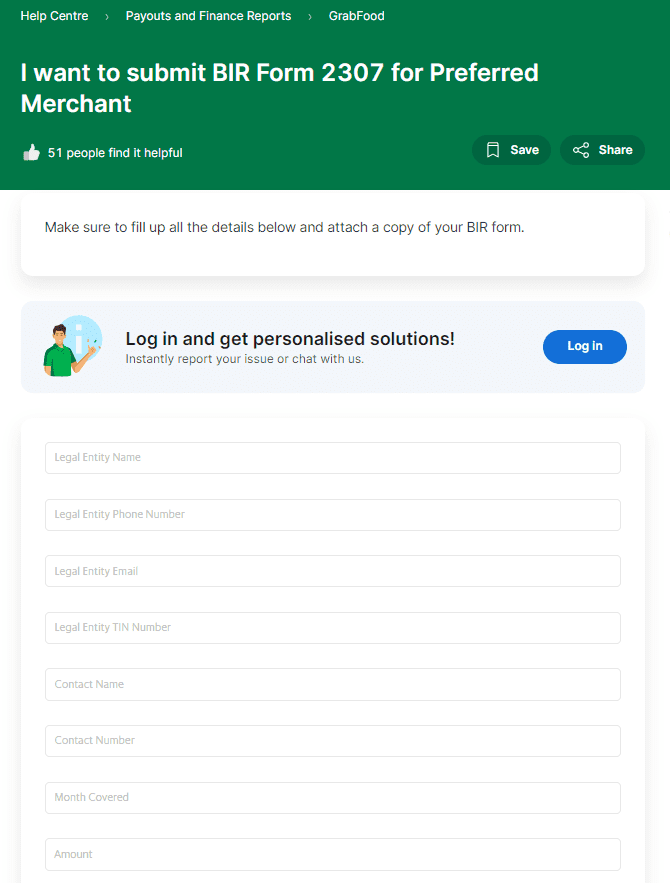

Here’s the step-by-step guide on how you can easily submit the requirements that are requested:

STEP 1: Click here to submit your requirements. Kindly fill out the form with your required information.

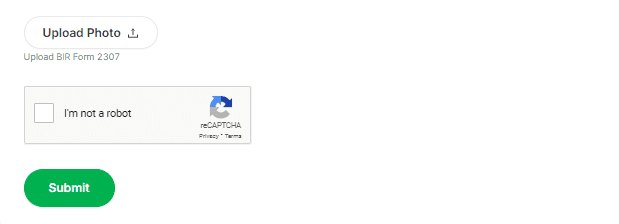

STEP 2: Upload your documents (make sure to name your documents as Certificate of Registration (COR) , BIR Form 2303, and Sworn Declaration). Click “Submit”.

Please expect your respective Account Managers to contact you to explain further. If you do not have assigned Account Manager, kindly visit our Merchant Help Center for Grab-specific inquiries or concerns.

Kindly wait for further announcement regarding the new process of the BIR 2307 release.

IS YOUR BUSINESS NOT YET BIR REGISTERED?

Learn how to register your business to BIR.

To increase transparency and clarity, we will start displaying our rates as VAT-ex in future contracts. As such, a Grab Account Manager may reach out to you to discuss changes with your contract upon expiry.

WHEN TO RECEIVE THE BIR FORM 2307?

At Grab, we are currently implementing a manual process for withholding tax deductions, which will occur bi-weekly.

For example, for the period of April 15 to 30, the computation of withholding tax will be followed by the availability of BIR form 2307.

This form will be made available 20 days after the end of the quarter, in accordance with BIR standards. Please note that during this transition period, we will issue the form on July 20th.

IMPORTANT REMINDER

Upon the implementation of the Manual Payment Adjustment on BIR Withholding Tax, you may raise disputes within 7 days upon manual payment adjustment deduction.

Dispute requests beyond 7 days will not be accepted.