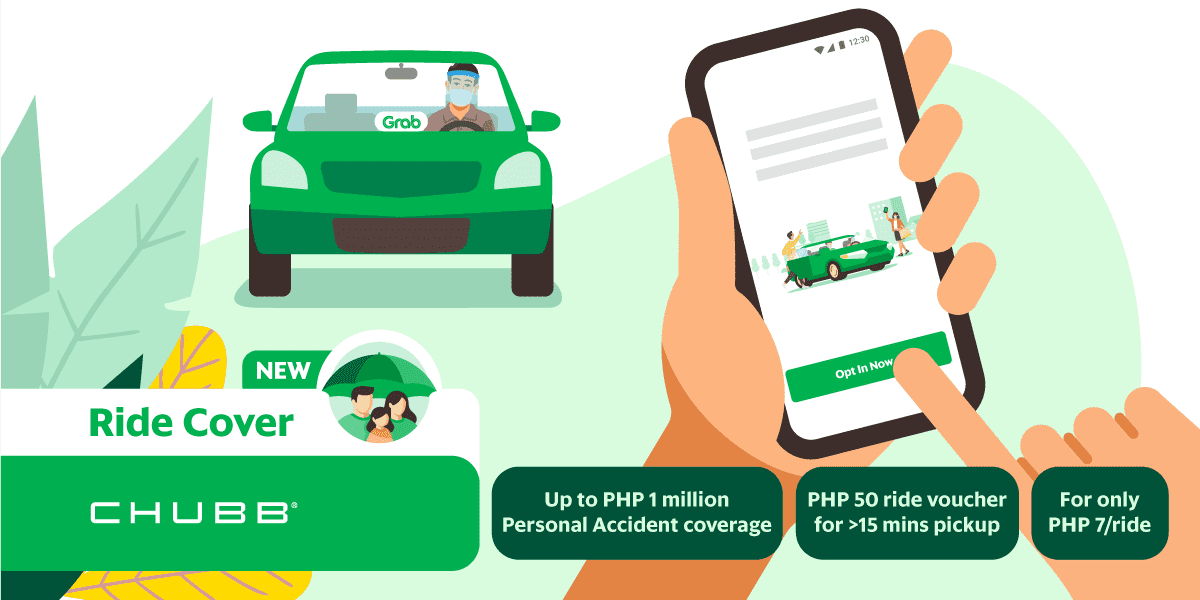

With Ride Cover, you’ll be eligible for a Delay Voucher of PHP 50 if your Grab driver arrives 15 minutes late after the estimated time of arrival. Perfect for when things like unexpected traffic jams happen. Furthermore, you will also be entitled to a free Personal Accident Insurance with a maximum benefit of PHP 1,000,000 on top of Grab’s existing coverage.

How Ride Cover works

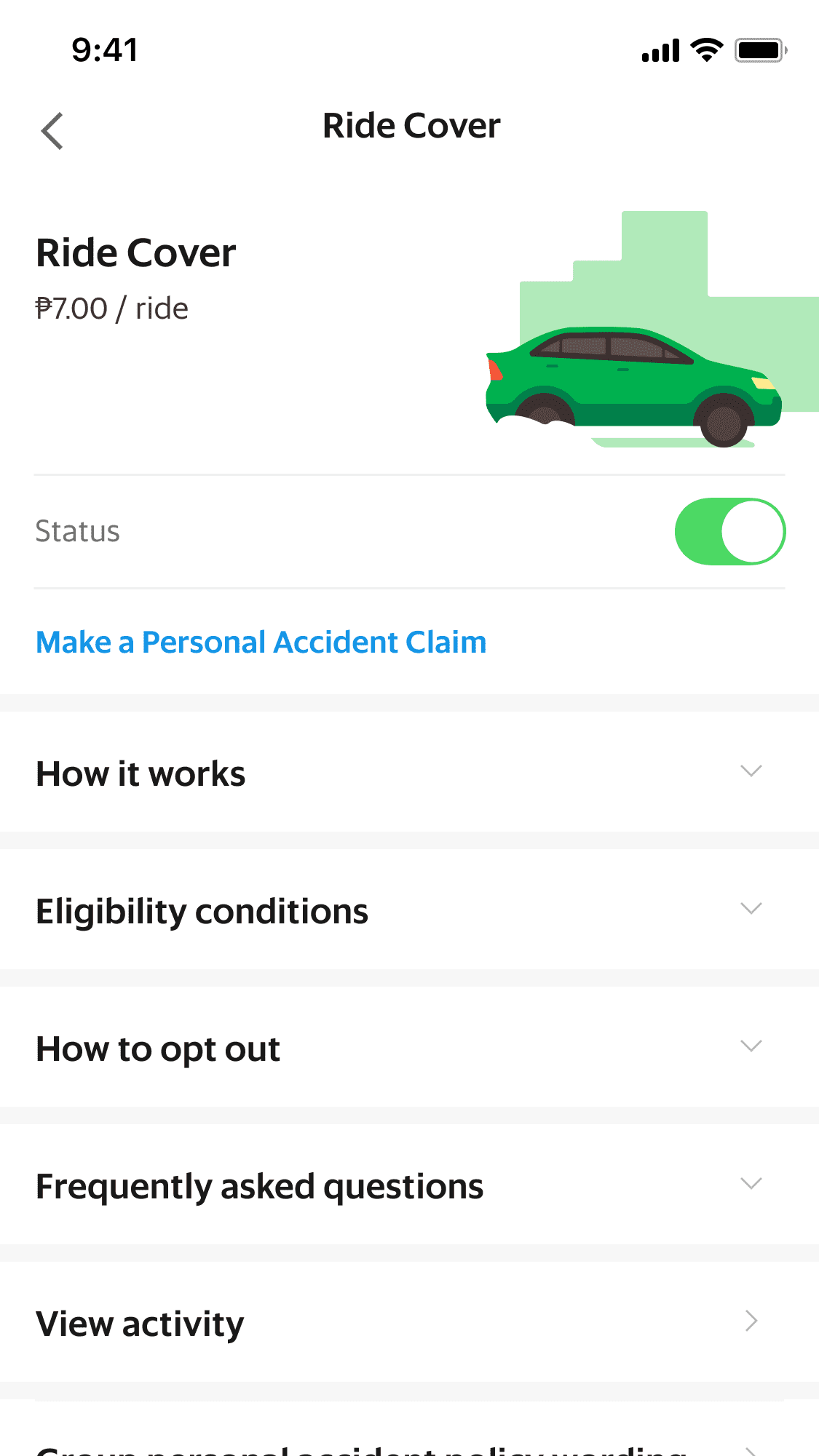

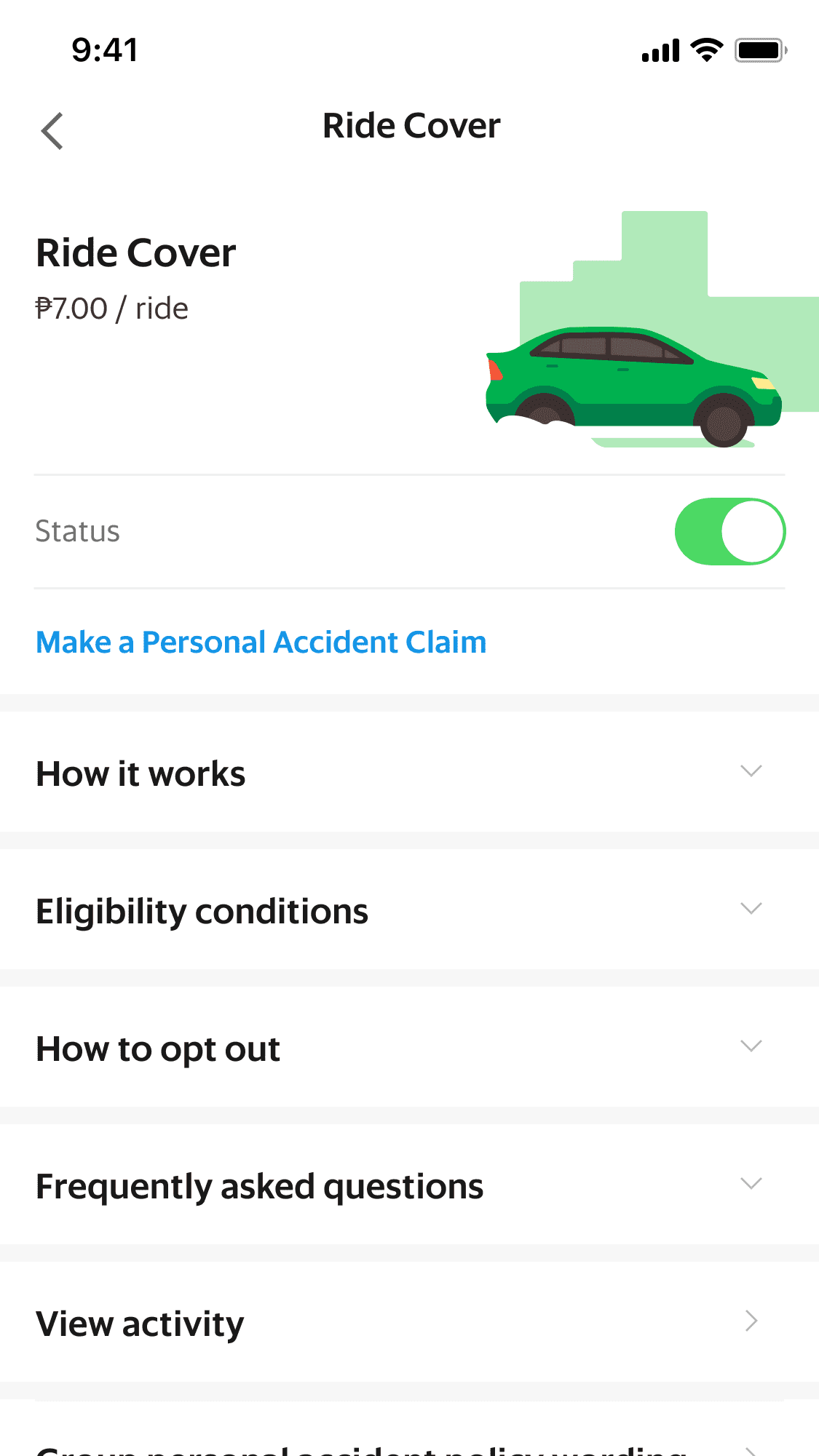

Simply opt in to Ride Cover for PHP 7 per trip.

Upon opt in, PHP 7 will be added to subsequent eligible fares.

In the event of an unforeseen accident, easily re-trace your ride in-app to file a claim.

| You’ll be compensated if | You’ll receive |

|---|---|

| Your pickup is delayed by more than 15 minutes after the estimated arrival time | A PHP 50 Grab Ride voucher will be added to 'My Rewards' once your eligible journey has been completed; your voucher will be valid for 6 months |

| You get into an accident during your eligible car ride in Philippines | A claim of up to PHP 1,000,000 for death or permanent disability, on top of Grab's existing coverage |

Extra protection made extra convenient

Enhanced protection

Get free personal accident coverage of up to PHP 1,000,000

Protection when needed

One time opt in via the Insurance tile

Affordable peace of mind

Get covered for only PHP 7 per ride

How To Opt In

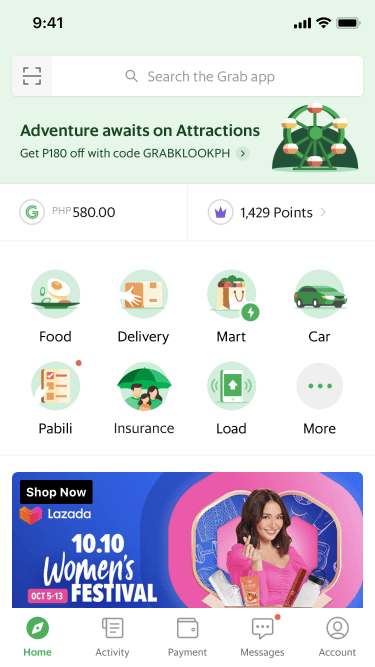

You can first opt in to Ride Cover when you book a ride. Subsequently, Ride Cover can be accessed through 'insurance' in your Grab App hompage

-

Open your Grab App and tap on 'Insurance' in your homepage screen

-

Tap on 'View' Ride Cover

-

Simply toggle to opt in, and you are done!

FAQs

Get answers to your questions at our Help Center.

The Ride Cover Program is not an insurance product. It is an enhanced service provided to you by Grab. The Personal Accident Cover is a group policy arranged and sponsored by MyTaxi.PH, Inc. as the policyholder. The Personal Accident Cover’s group policy is underwritten by Insurance Company of North America (a Chubb Company).

Forward Together

Level 27F/28F Exquadra Tower,

Lot 1A Exchange Road corner Jade Street,

Ortigas Center, Pasig City, Philippines